ZCash ($ZEC) holders have started unshielding coins. The $ZEC vaults are emptying out, potentially signaling an exit from privacy assets.

The previous trend of shielding $ZEC tokens in high-privacy vaults reversed in the past weeks. Around 4.86M $ZEC remain shielded, but some of the assets were quickly withdrawn.

The value of shielding $ZEC was supposed to bring a new era of privacy in decentralized finance. The rapid rise in shielding coincided with last year’s $ZEC rally, which brought the asset back to levels not seen since 2018.

$ZEC whale unshields over 1% of the supply

In early January, a previous shielded holder removed over 200K $ZEC, valued at over $100M, from the highest-security vault of ZCash.

The whale’s holdings are still sitting idle and are now more traceable. The whale used a brand-new wallet with no other on-chain interactions or history. The whale previously shielded 1 $ZEC as a test.

The withdrawals from the high-privacy Orchard pool also follow a diminished supply in the Sprout and Sapling pools. Overall, the rush to shield more $ZEC and use it as a DeFi asset has diminished.

The whale’s $ZEC can now be traded or used as a non-privacy asset, or shielded again if needed. The whale’s move also created concerns for potential selling pressure.

$ZEC expansion slows down

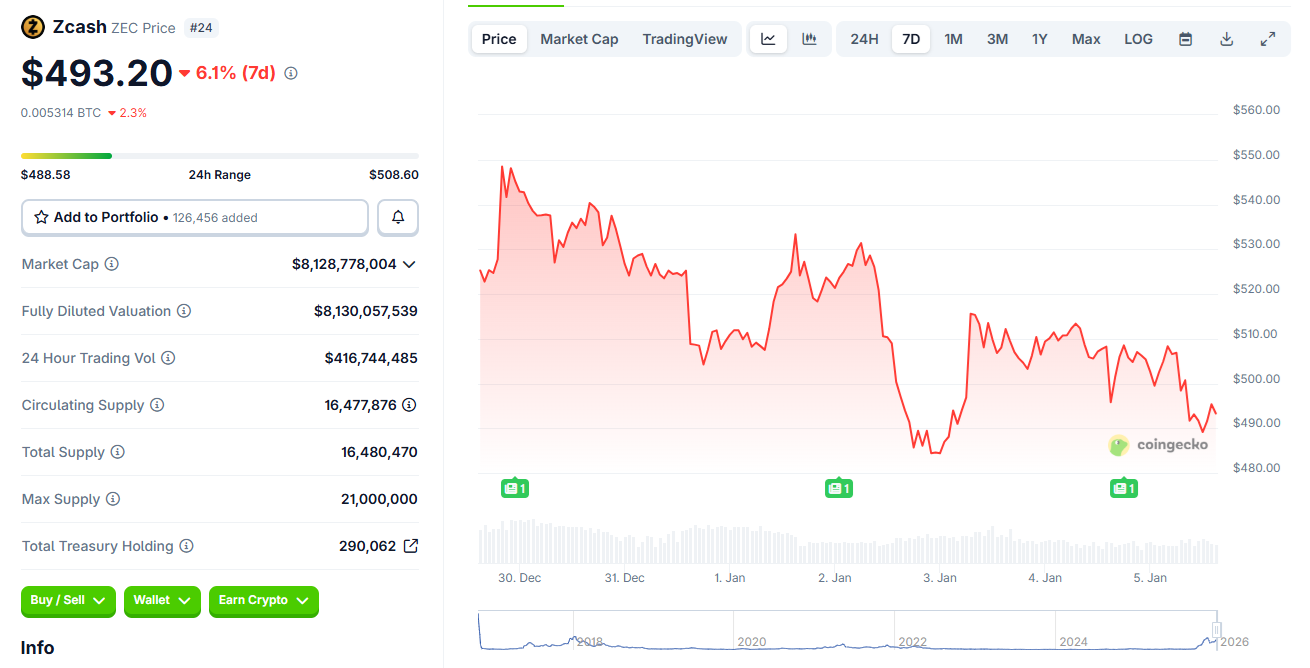

$ZEC was among the top-performing altcoins in 2025, briefly causing a rally for all privacy assets. In the past week, $ZEC slid to $492.51, down over 6.8%. Immediately following the large-scale unshilelding, the markets entered panic mode, pushing $ZEC to a local low of $484.41.

$ZEC open interest fell to $764M, down from its 2025 peak of nearly $1B. $ZEC is also no longer aggressively shorted, with a more even split of open interest.

Even after the recent market slowdown, $ZEC remained the leading privacy coin by market capitalization. XMR consolidated around the $428 range, while most of the legacy private coins were in the red.

For others, $ZEC is still preparing for a breakout as soon as traders return in the post-holiday period. One Hyperliquid whale has already made the bet, with a large $ZEC spot position and a sell limit order at $509.

Based on the most recent liquidation heatmap, $ZEC may dip lower to target the accumulated long positions. The asset may also meet resistance at around $520. The asset is trading with diminished mindshare, recently dropping by 67%, down to 0.3%.

The ZCash community also relied on support from Solana influencers, as the privacy coin was also used in its tokenized form.

$ZEC supporters and influencers still drive the narrative of displacing $BTC. $ZEC is expected to outperform the market, even if $BTC fails. Despite the $ZEC dollar price slide, the asset is up more than 31% against $BTC for the past month.

cryptopolitan.com

cryptopolitan.com