On-chain data shows that the value of tokenized RWA on the XRP Ledger (XRPL) has increased by an impressive 2,200% in 2025 alone.

The real-world asset tokenization theme, championed by BlackRock CEO Larry Fink and the SEC Chair Paul Atkins, dominated discussions across multiple crypto communities this year, and the XRPL is looking to benefit from the movement.

XRP Ledger Sees 23x Growth in RWA Value

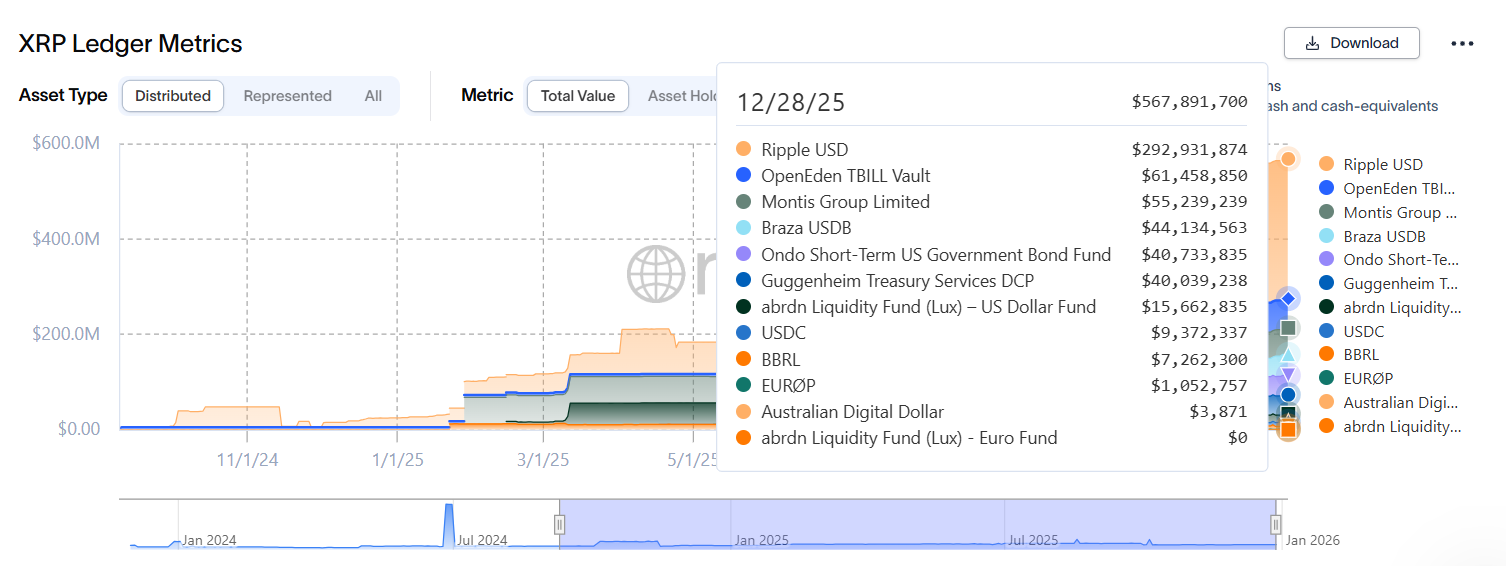

Data from rwa.xyz confirms that the network saw a 23x increase in native real-world assets value, including stablecoins, this year, as it crossed the $500 million mark.

Specifically, at the start of this year, 2025, the XRP Ledger contributed little to the overall global RWA market value, featuring only $24.681 million on Jan. 1. Notably, the Ripple stablecoin RLUSD, which was only two weeks old at the time, accounted for most of this value, at $19.6 million. Meanwhile, $5 million came from the OpenEden TBILL Vault.

This figure saw a gradual increase in January until Archax Group’s Montis Group Limited debuted on the network, introducing $55.35 million worth of value and making up over 50% of the total $101.659 million RWA value as of Feb. 1. By April, RLUSD had grown to $94 million worth of value on the XRPL, pushing the total value above $200 million.

RLUSD Has Led Most of the Rise in RWA Value

Since then, most of the increase in total RWA value has come from the impressive growth of RLUSD, the rise in OpenEden TBILL Vault’s worth, and the introduction of new products such as the Ondo Short-Term US Government Bond Fund, as well as the US Dollar Fund from Aberdeen Investments.

Today, the total value of tokenized real-world assets on the XRPL sits at $567.89 million, representing a 2,200% increase from the $24.681 million figure on Jan. 1. Of the latest total, RLUSD accounts for $292.93 million, representing 51%.

Meanwhile, the TBILL Vault from OpenEden represents the second-largest product, worth $61.458 million. Montis Group Limited ($55.239 million) and the USDB stablecoin from Brazilian fintech Banza Group ($44.134 million) sit third and fourth. Circle’s USDC, which launched on the XRPL in June, only holds a $9.37 million value on the network.

XRPL Still Lags Compared to Other Networks

However, while the XRPL has witnessed some noteworthy growth in RWA value this year, it still lags compared to other prominent networks despite being built specifically for the industry.

Excluding stablecoins, the XRP Ledger hosts $213 million worth of distributed RWA value. Notably, this makes it only the ninth-largest network in terms of RWA value, behind Ethereum, BNB Chain, Stellar, Solana, and even Polygon. However, total value (featuring distributed and represented figures) for the XRPL sit at $487.61 million.

Nonetheless, the XRPL seems to be expanding, albeit at a slow pace, while networks like Polygon and Ethereum lose some of their value. Data shows that the XRPL has seen $72 million worth of value inflows over the past 60 days, while Ethereum and Polygon have respectively lost $84 million and $629 million within the same period.

thecryptobasic.com

thecryptobasic.com