XRP spot exchange-traded funds (ETFs) launched in mid-November and quickly amassed over $1.1 billion in inflows. Consistent weekly demand and rising assets positioned the products as a serious contender heading into 2026.

Capital, Liquidity, and Conviction: XRP ETFs in 2025

XRP ETFs entered U.S. markets late in 2025, but they wasted no time making an impact. Officially launched on Nov. 14, spot XRP ETFs arrived after months of regulatory clarity and growing institutional comfort with crypto-based exchange-traded products. What followed was a six-week stretch of uninterrupted inflows that pushed assets past the $1 billion mark before year-end.

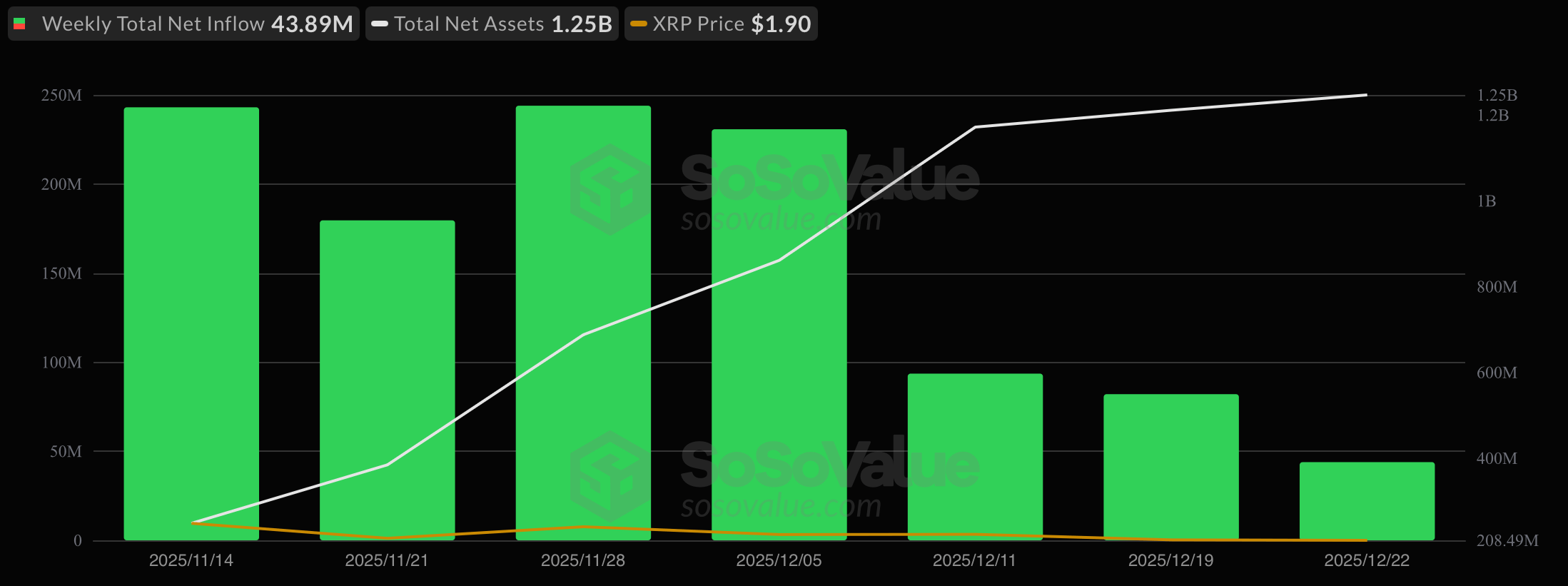

The opening week set expectations high. In the period ending November 14, XRP ETFs pulled in $243.05 million, lifting net assets to $248.16 million. Trading activity was solid for a debut, with nearly $86 million in value traded as market participants established initial positions.

Momentum accelerated through the rest of November. The week ending Nov. 21 added another $179.6 million in net inflows, while total value traded jumped to $150.7 million. A week later, inflows strengthened again, reaching $243.95 million and pushing cumulative inflows to $666.6 million. By that point, net assets had nearly tripled from launch levels to $687.8 million, underscoring sustained demand rather than one-off speculative interest.

December confirmed the staying power. XRP ETFs recorded their largest weekly inflow on December 5, bringing in $230.74 million alongside $145.2 million in trading volume. Assets climbed to $861.3 million, and cumulative inflows approached $900 million. The following week, inflows moderated but remained robust at $93.57 million, with trading activity still above $129 million.

The strongest signal came in the final two reporting weeks of the year. XRP ETFs added $82.04 million in the week ending December 19 and another $43.89 million by December 22. While weekly trading volumes eased to $17.9 million in the final week, total net assets climbed to $1.25 billion, and cumulative inflows crossed $1.12 billion.

Notably, XRP ETFs did not record a single weekly net outflow during their inaugural run. This consistency stands out, especially given the products launched into a volatile broader crypto market where bitcoin and ether ETFs experienced sharp swings in flows.

Read more: XRP and Solana ETFs Maintain Strength as Bitcoin and Ether See Outflows

The takeaway from 2025 is clear: XRP ETFs found an audience quickly. Regulatory clarity, pent-up demand, and diversified issuer participation all contributed to a smooth rollout.

Looking ahead to 2026, the challenge will be sustaining engagement as the novelty fades. With over $1 billion in assets already secured, XRP ETFs enter the new year from a position of strength, but future flows will hinge on liquidity depth, broader market sentiment, and XRP’s evolving role within institutional crypto portfolios.

FAQ 🚀

-

When did XRP spot ETFs launch in the U.S.?

XRP spot ETFs launched on November 14, 2025, following improved regulatory clarity and institutional readiness. -

How much capital did XRP ETFs attract in 2025?

They amassed over $1.1 billion in cumulative inflows within six weeks, pushing net assets above $1.25 billion. -

Did XRP ETFs experience any early outflows?

No, the products recorded uninterrupted weekly inflows throughout their 2025 launch period. -

What will drive XRP ETF performance in 2026?

Future flows will depend on liquidity depth, market sentiment, and XRP’s role in institutional portfolios.

news.bitcoin.com

news.bitcoin.com