A new institutional report by Amplify ETFs is strengthening the case for XRP real-world demand.

In a tweet, WrathofKahneman (WoK), a well-known XRP community figure, highlighted findings from Amplify ETFs’ December 2025 Digital Assets Monthly report. He described it as strongly bullish on Ripple’s expanding role in global payments.

Specifically, the report claims that Ripple’s pilot program with Mastercard ties directly to XRP demand, citing compliance advantages and institutional adoption.

Inside the Ripple, Mastercard, and WebBank Pilot

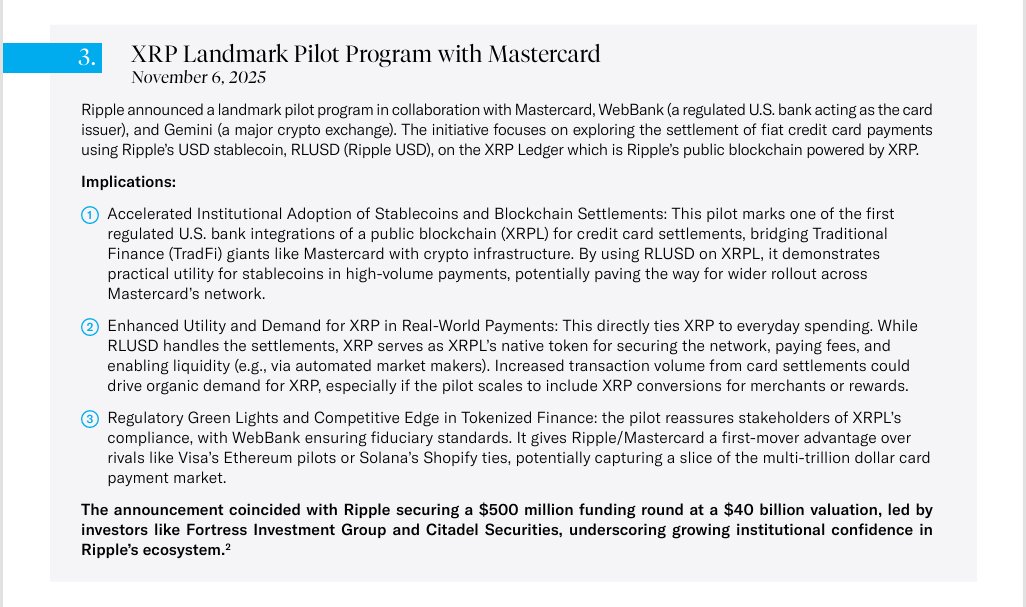

The Amplify ETFs report details the landmark pilot launched on November 6, 2025, involving Ripple, Mastercard, WebBank, and crypto exchange Gemini. The initiative explores settling fiat credit card payments using Ripple’s USD stablecoin, RLUSD, on the XRP Ledger (XRPL).

WebBank acts as the regulated U.S. bank issuer, placing the pilot within existing financial and fiduciary frameworks. The use of XRPL for settlement marks a major step in bridging traditional finance infrastructure with public blockchain networks.

How the Pilot Connects to XRP Demand

While RLUSD is for settlement, the report highlights that XRP remains central to the XRPL ecosystem. XRP secures the network, pays transaction fees, and supports on-ledger liquidity through mechanisms such as automated market makers.

Amplify ETFs notes that higher transaction volumes from credit card settlements could translate into organic XRP demand, especially if the pilot expands to merchant conversions, rewards programs, or more payment flows.

In this structure, XRP’s role grows alongside network usage rather than relying on speculative activity alone.

Compliance Edge Over Visa and Solana Rivals

The report also highlights Ripple and Mastercard’s compliance positioning as a competitive advantage. With WebBank ensuring regulatory standards, the pilot is one of the first regulated U.S. bank integrations of a public blockchain for credit card settlements.

Amplify ETFs argues this gives Ripple and Mastercard a first-mover advantage over rivals such as Visa’s Ethereum-based pilots and Solana’s Shopify-linked payment initiatives. This potentially allows XRPL to capture a portion of the multi-trillion-dollar card payments market.

OCC Licensing and Institutional Confidence Build the Case

Beyond payments, the report cites Ripple’s provisional bank licensing from the U.S. Office of the Comptroller of the Currency as another regulatory green light for the ecosystem.

This institutional confidence was further underscored by Ripple’s $500 million funding round at a $40 billion valuation, led by Citadel Securities and Fortress Investment Group in November.

Together, these developments support the report’s central claim that Ripple’s expanding institutional footprint is no longer abstract, and its growth in payment infrastructure increasingly ties back to XRP’s utility and demand.

thecryptobasic.com

thecryptobasic.com