Bloomberg ETF analyst James Seyffart has identified Cardano as an unexpected standout in the rapidly evolving crypto index exchange-traded product (ETP) market.

Since January 2024, the crypto ETF landscape has continued to gain momentum, as issuers roll out both single-asset funds and diversified basket ETPs.

Although single-asset ETPs have attracted the most capital so far, Seyffart, in his recent X post, said he expects crypto index ETPs to draw substantial inflows in the future. Notably, he described the category as one that will emerge “in many shapes and sizes.”

As part of this broader trend, Seyffart highlighted the 21Shares FTSE Crypto 10 Ex-BTC ETF (TXBC) as one to watch in 2026, noting that it signals the direction institutional crypto exposure is likely to take.

Cardano Features in Six Crypto ETPs Analyzed by Seyffart

Interestingly, Seyffart expressed surprise following Cardano’s consistent inclusion across every major crypto index product he reviewed. He stressed that Cardano was the only digital asset to appear in all six crypto ETPs under his analysis, highlighting its deeply entrenched role in institutional index construction.

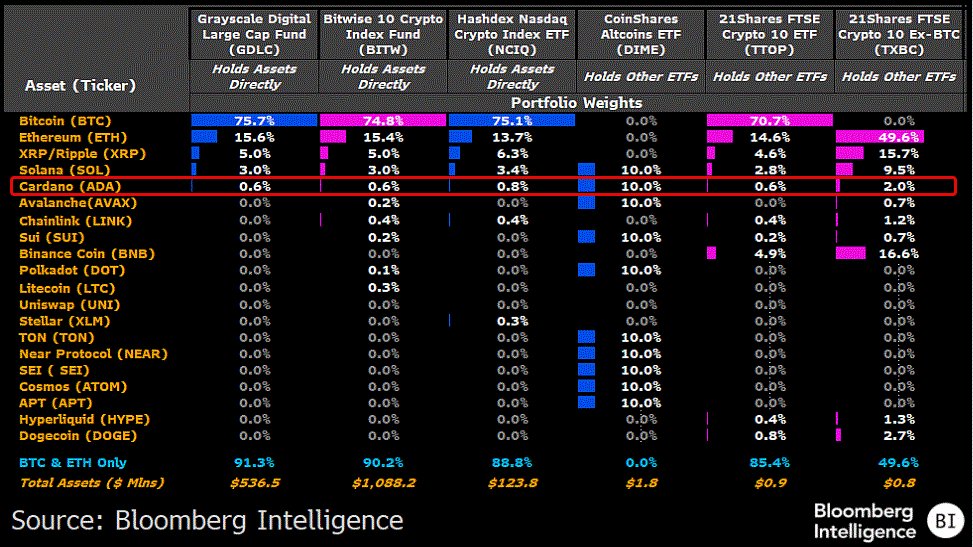

According to the accompanying data, the six crypto index ETPs that include Cardano are the CoinShares Altcoins ETF (DIME), Bitwise 10 Crypto Index Fund (BITW), Grayscale Digital Large Cap Fund (GDLC), Hashdex Nasdaq Crypto Index ETF (NCIQ), 21Shares FTSE Crypto 10 ETF (TTOP), and the 21Shares FTSE Crypto 10 Ex-BTC ETF (TXBC).

Notably, Cardano’s weighting varies across these products. In more conservative, large-cap funds such as GDLC, BITW, and TTOP, Cardano carries a modest 0.6% allocation. Its weighting increased to 0.8% in Hashdex’s NCIQ and 10% in CoinShares’ altcoin-focused DIME. Meanwhile, in TXBC, which excludes Bitcoin to promote diversified crypto exposure, Cardano accounts for a 2% allocation.

At the time of Seyffart’s post, BITW ranked as the largest crypto index ETP, managing $1.08 billion in total assets. Notably, GDLC held $536.5 million, NCIQ managed $123.8 million, DIME had $1.8 million, while TTOP and TXBC recorded net assets of approximately $900,000 and $800,000, respectively.

Still No Exclusive Cardano Spot ETF

Meanwhile, Cardano has yet to secure a spot ETF that tracks its performance. In October, Seyffart’s colleague, Eric Balchunas, revealed that three Cardano ETF applications remain under review by the U.S. SEC. Grayscale is among the issuers seeking approval to launch a Cardano-linked ETF.

Although the SEC acknowledged Grayscale’s Cardano 19b-4 filing in February, pushing the market approval odds to surge to 85% in August, those expectations have since faded sharply. Current estimates place the probability of approval at just 3%, suggesting that an exclusive ADA spot ETF is unlikely to reach the market in the near term.

Despite this, ADA has featured prominently across six major crypto index ETPs, as Seyffart highlighted.

thecryptobasic.com

thecryptobasic.com