$SYRUP surged as much as 16% on the 24-hour chart after Maple Finance, an on-chain asset manager overseeing more than $3 billion, announced it had allocated 25% of its November revenue to repurchasing 2 million of its native asset.

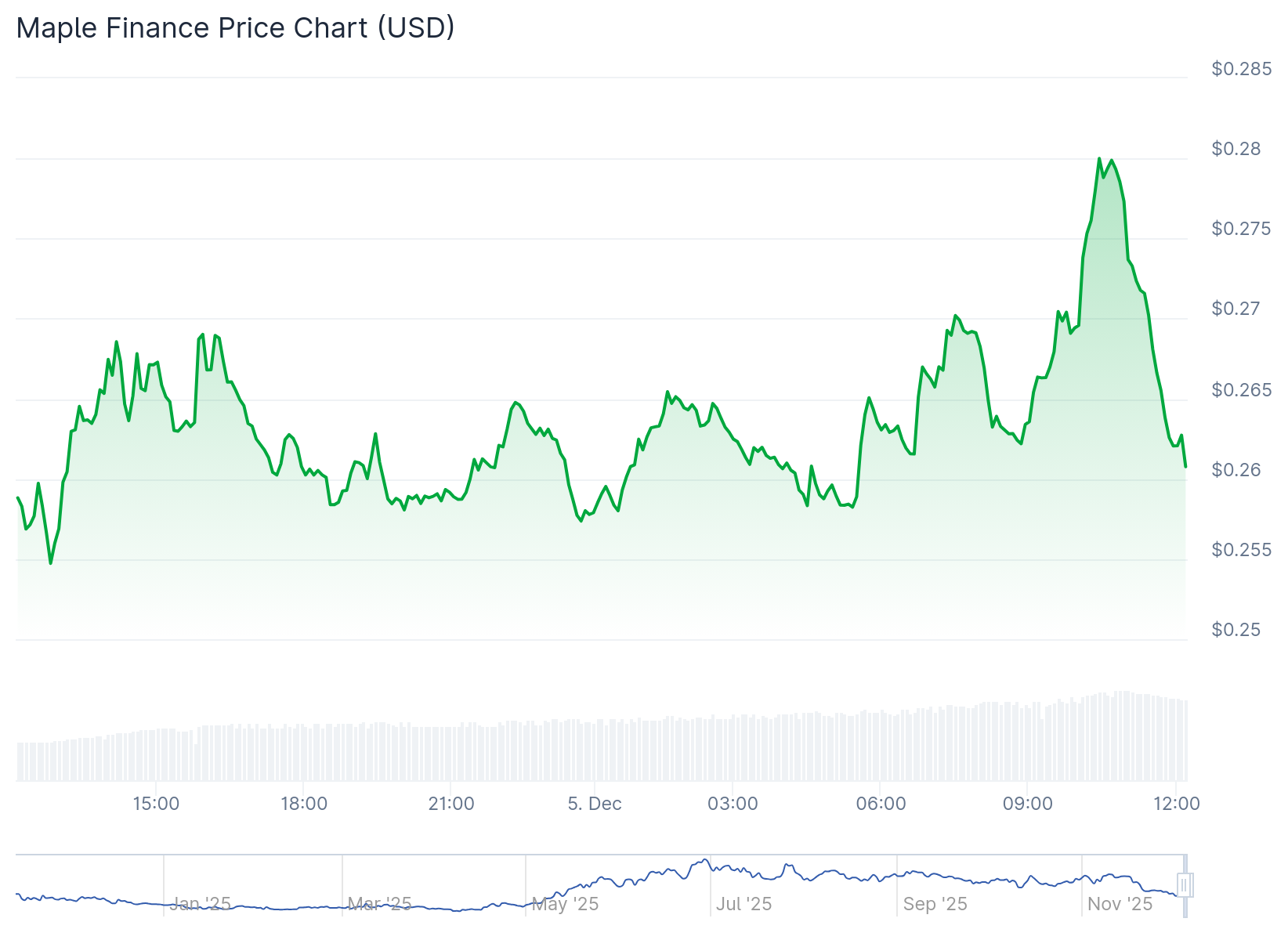

After Maple announced that it had bought back 2 million tokens, removing them from the circulating supply, $SYRUP rallied to touch $0.28 with a market capitalization of over $318 million, according to CoinGecko. The asset as since retraced to just above $0.26 by press time. Though the token is up about 19% this year, it has had a rough last month, dropping about 32% in 30 days.

“Maple just used 25% of November revenue to buy back 2M $SYRUP,” the company wrote in a post on X this morning. “Less supply on the market, more value driven to long-term holders. Keep this pace of buybacks and >2% of all $SYRUP gets pulled from circulation each year.”

The move reflects a broader trend of growing buybacks across crypto, as more projects choose to use revenue in a way that could benefit token holders, instead of reinvesting it all into growth and marketing.

One recent report from investment firm Keyrock found that token buybacks have increasingly become a key tokenomics feature, jumping more than fivefold since 2024. “Token buybacks are rapidly becoming a central lever in how protocols think about value distribution,” the report reads. “Still, their rise has sparked debate over timing and trade-offs, particularly given that most crypto protocols remain in their growth stage.”

New Buyback Policy

Maple’s token purchase using its November revenue marks the first month of its new buyback policy, after token holders passed a proposal aimed at “long-term sustainability.”

In October, $SYRUP stakers voted to end staking rewards and redirect a portion of protocol revenue into the Syrup Strategic Fund, which will in part be used for regular $SYRUP buybacks, as The Defiant previously reported.

The changes come as Maple Finance has recorded significant growth this year, with total value locked (TVL) climbing from $513 million at the start of the year to around $2.8 billion today, according to DefiLlama.

The buybacks also come at a time when Maple is facing legal pressure abroad. Earlier this month, a Cayman Islands court issued an injunction blocking the launch of syrupBTC, a new Bitcoin yield product, after partner Core accused Maple of violating an exclusivity agreement.