Biotech company Sonnet BioTherapeutics announced that its shareholders have approved a merger with Rorschach LLC to launch the first major Hyperliquid digital asset treasury (DAT).

The vote was passed on Dec. 2, nearly five months after the company agreed to combine with Rorschach to form Hyperliquid Strategies, which aims to hold $583 million worth of $HYPE tokens and at least $305 million in cash, for an anticipated total value of $888 million.

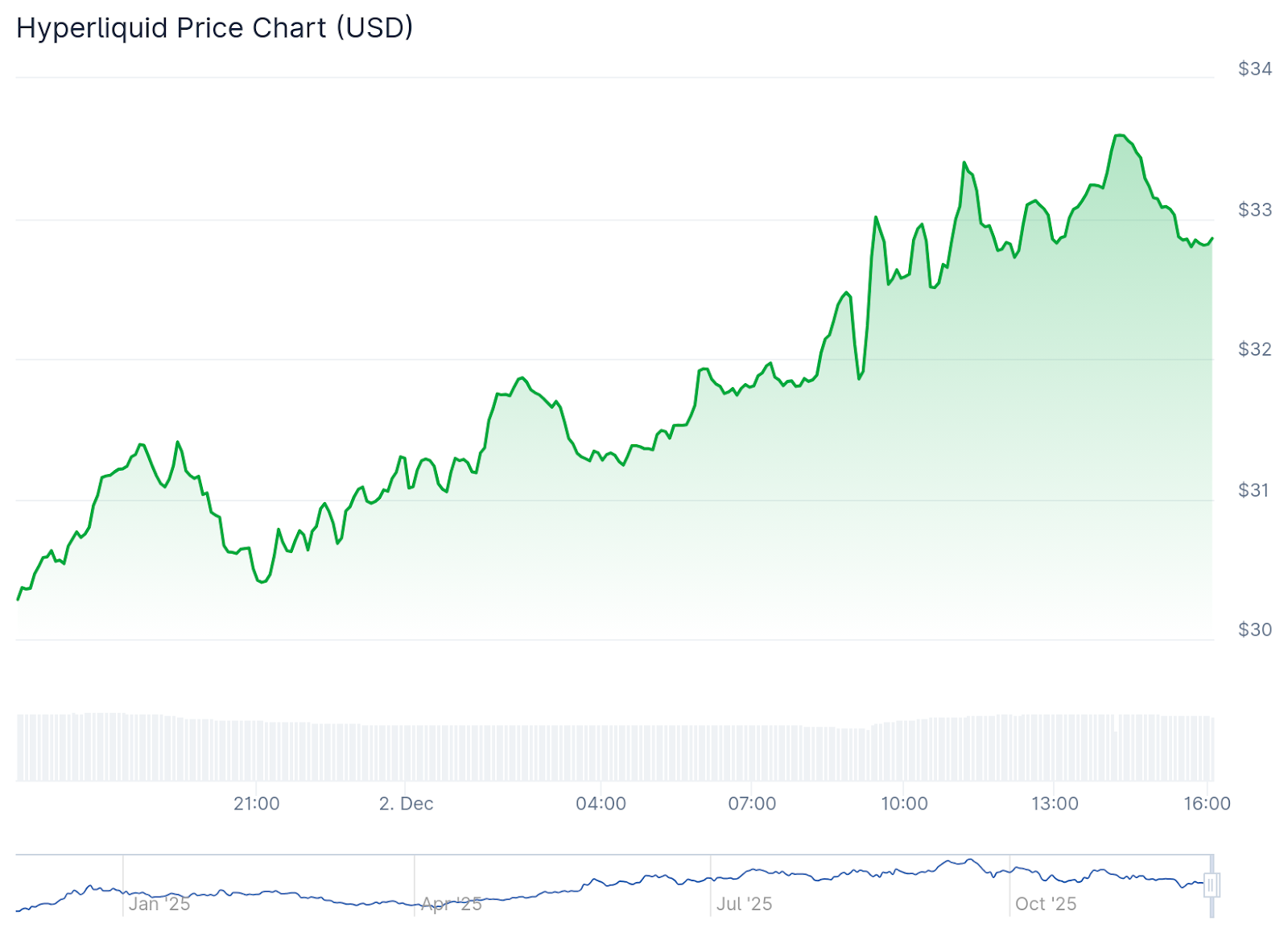

$HYPE is up 8% today, driven by the overall market’s bounce, and anticipated inflows into the token from Hyperliquid Strategies.

The news comes just days after the first major Hyperliquid token unlock on Nov. 29, which distributed 1.75 million $HYPE tokens, worth $57 million, to team addresses. None have sold on the open market yet, and a portion of the $HYPE has been restaked.

Inflows from Hyperliquid Strategies are likely to boost ongoing demand for $HYPE, in conjunction with buybacks currently fueled by trading fees totalling more than $1.25 billion annualized, as well as project fees from ecosystem protocols such as its tokenization layer, Hyperunit.