Kinetiq, a liquid staking platform on the Hyperliquid blockchain, launched its $KNTQ governance token on Nov. 27.

At press time, $KNTQ is trading at $0.13, up nearly 19% over 24 hours, with $27.7 million in trading volume and a market cap of $35.3 million, implying a fully diluted valuation (FDV) of around $130 million.

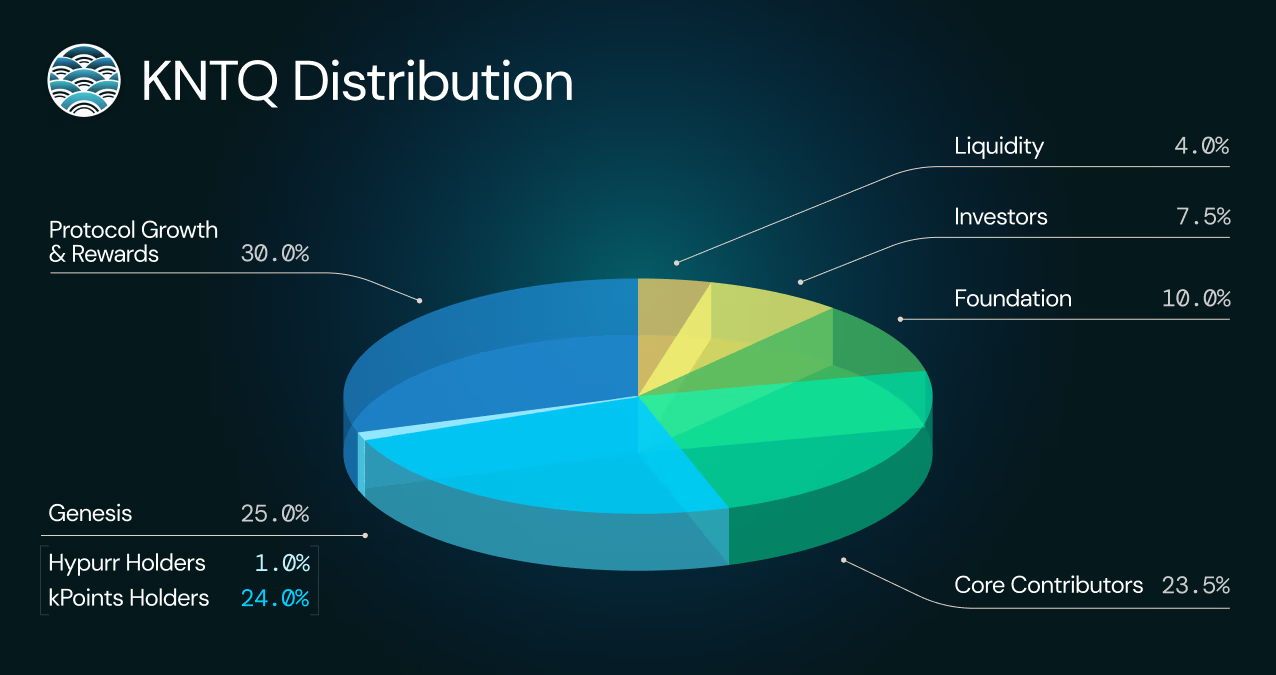

The token distribution allocates 25% to early users, 30% to protocol growth and rewards, and the rest to contributors, investors, and the Kinetiq Foundation, The Defiant reported earlier.

Liquid staking lets users lock up tokens to earn staking rewards while retaining access to liquidity. Kinetiq’s core product, kHYPE, is a liquid form of staked HYPE, allowing users to keep earning while still using the asset across the network.

Launched in late 2024, Kinetiq quickly attracted billions in staked liquidity, becoming the largest protocol by total volume locked (TVL) on Hyperliquid, according to data from DefiLlama.

However, Kinetiq’s TVL has fallen around 60% from $2.63 billion in early October to around $1.1 billion at press time, likely driven by airdrop farmers unwinding their positions ahead of the token launch.