Amina Bank has launched regulated staking for Polygon’s $POL token, offering institutional clients up to 15% rewards. The Zug-based, FINMA‑licensed bank enables asset managers, family offices and corporate treasuries to earn yield while supporting Polygon’s network security through a partnership with the Polygon Foundation.

-

First regulated $POL staking offering by a bank

-

Institutional access with up to 15% staking rewards and FINMA oversight

-

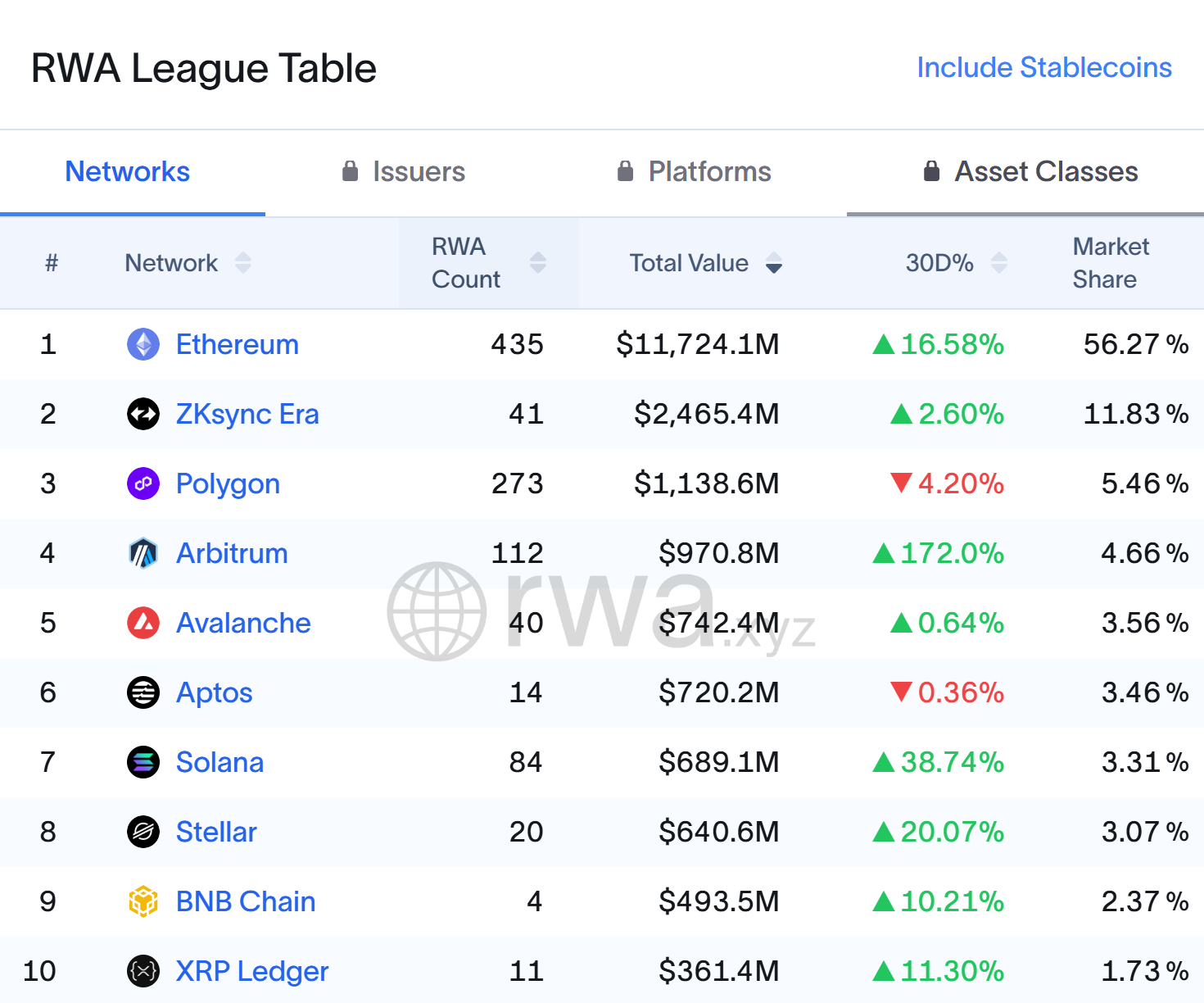

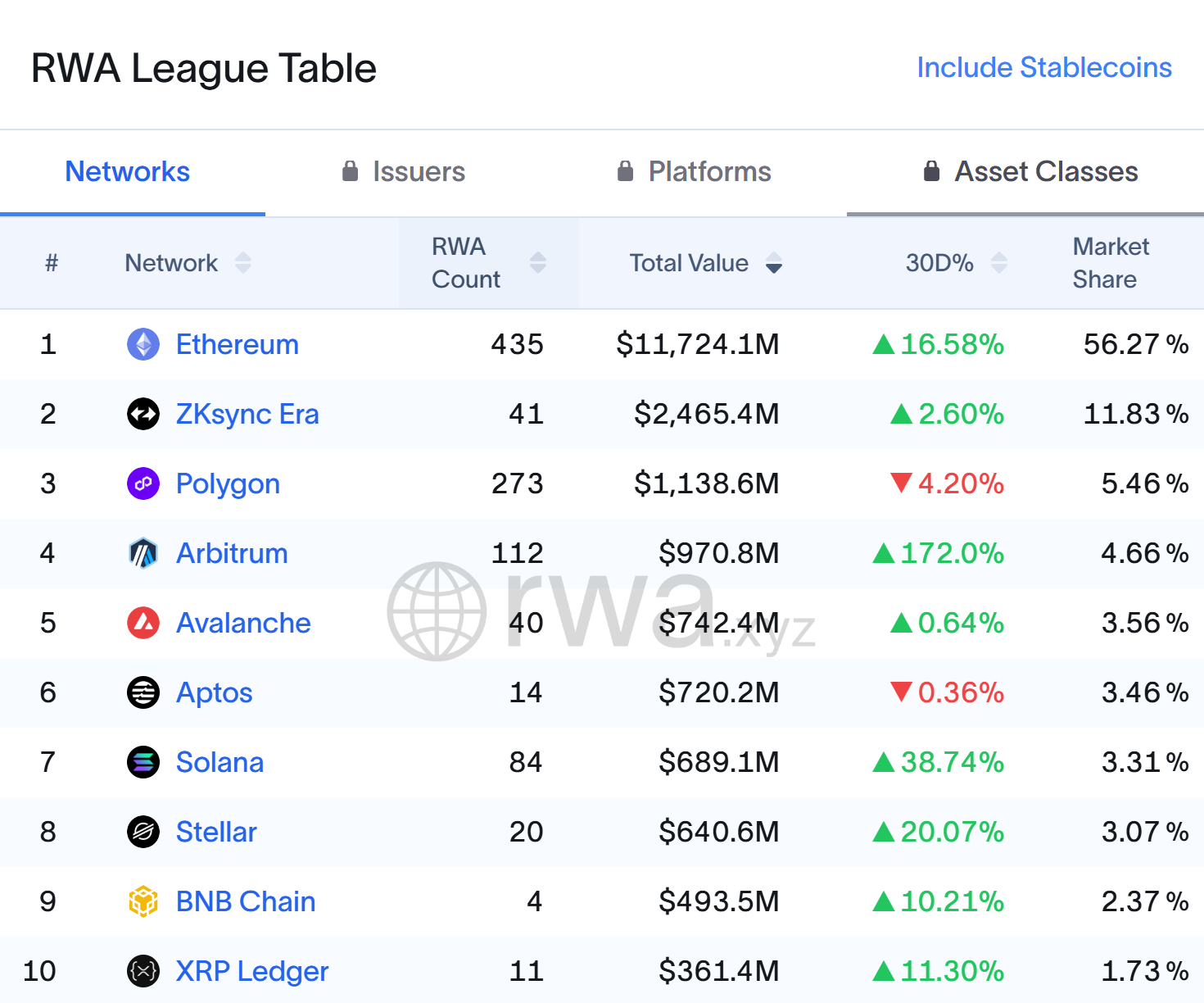

Polygon hosts $1.13B in tokenized real‑world assets across 273 tokens (RWA.xyz)

Amina Bank $POL staking: Regulated institutional staking for $POL with up to 15% rewards. Learn how institutions can participate and what it means for tokenization.

What is Amina Bank’s $POL staking offering?

Amina Bank $POL staking is a regulated institutional service that allows clients to stake Polygon’s native token, $POL, and earn up to 15% annual rewards. The Zug-based, FINMA-licensed bank provides custody, compliance controls and direct staking participation through a partnership with the Polygon Foundation.

How does the service work for institutional clients?

Amina Bank offers custody and custody-linked staking, enabling asset managers, family offices and corporate treasuries to delegate $POL while the bank handles node operations, compliance and reporting. Clients receive periodic reward distributions and institutional-grade safeguards designed to meet regulatory requirements.

Amina Bank, formerly known as Seba Bank, says the product gives regulated access to blockchain participation and yield without direct operational complexity for clients.

$POL), Potentially Yielding Up to 15% 1">

Top 10 RWA blockchains. Source: RWA.xyz

Why is this significant for Polygon and institutional staking?

Institutional-grade staking from a FINMA-licensed bank signals mainstream infrastructure maturation. Polygon ($POL) underpins tokenization projects with major financial participants and benefits when regulated entities provide secure staking channels.

Data from RWA.xyz shows Polygon ranks third in real‑world asset tokenization with over $1.13 billion across 273 tokenized assets, reinforcing Polygon’s role in onchain finance and tokenized securities.

When did Amina Bank roll out the $POL staking product?

The bank announced the staking product in October 2025, following a partnership with the Polygon Foundation. The rollout targets institutional demand documented in Amina’s 2024 financial results and ongoing global expansion.

Frequently Asked Questions

Can non‑institutional clients stake $POL with Amina Bank?

Currently, the offering targets institutional clients — asset managers, family offices and corporate treasuries — through regulated custody and compliance processes. Retail access is not part of the initial product launch.

How does this compare to other staking options?

Amina Bank provides regulated custody and oversight, which differs from self-custody or exchange-led staking. Institutional clients gain compliance reporting and FINMA-aligned controls, trading operational autonomy for regulatory assurance.

Key Takeaways

-

Regulated access: Amina Bank is FINMA-licensed and now offers institutional $POL staking with custody and compliance.

-

Competitive rewards: Institutional clients can earn up to 15% staking rewards, depending on network conditions.

-

Tokenization tailwind: Polygon supports $1.13B in tokenized assets, strengthening demand for institutional staking and onchain finance solutions.

Conclusion

The launch of Amina Bank $POL staking marks a step toward institutional adoption of proof‑of‑stake networks by combining regulated custody with yield opportunities. As tokenization on Polygon expands, regulated staking channels are likely to play a growing role in institutional crypto strategies. Institutions should evaluate custody, reward mechanics and compliance reporting when considering participation.

In Case You Missed It: BNB Chain Memecoin "4" May Drive Rapid Trader Gains Amid Social-Driven Speculation

$POL), Potentially Yielding Up to 15% 1">

$POL), Potentially Yielding Up to 15% 1">