- Bitwise filed a spot ETF with the SEC to directly own the $HYPE token of Hyperliquid.

- The ETF will adopt in-kind redemptions and Coinbase Custody as the custodian.

Bitwise Asset Management has filed with U.S. regulators to launch a spot exchange-traded fund (ETF) tied to Hyperliquid’s native token, $HYPE. The move places the digital asset manager at the center of growing institutional interest in blockchain-based perpetual futures protocols.

The proposal, filed via an S-1 with the Securities and Exchange Commission (SEC), describes the Bitwise Hyperliquid ETF. If approved, the fund will hold directly $HYPE tokens in a trust. Coinbase Custody Trust Company has been appointed as custodian, providing asset security and private insurance coverage.

The custodian, however, is not backed by the Federal Deposit Insurance Corporation (FDIC).

The filing clarifies that Bitwise seeks to take the path of the Securities Act of 1933, which involves regulatory review and a possible rule change. Unlike vehicles registered under the Investment Company Act of 1940, this structure is consistent with other recent crypto ETF approvals. Interestingly, the SEC approved the Rex-Osprey XRP ETF within 90 days of filing.

The product’s approval will also depend on a Form 19b-4 filing, which could increase the review timeline to 240 days. The filing does not present the exchange listing, ticker symbol, or investor fees.

In-Kind Redemptions and Market Liquidity

Bitwise intends to facilitate the in-kind creation and redemption of the proposed ETF. In addition, investors could swap fund shares for real $HYPE tokens, which are meant to reinforce liquidity and create a closer connection between the trust and the underlying asset.

The filing also states that the ETF sponsor will not be subject to the jurisdiction of the Commodity Futures Trading Commission (CFTC). That distinction makes the fund subject to securities regulation, much like other spot digital asset ETFs.

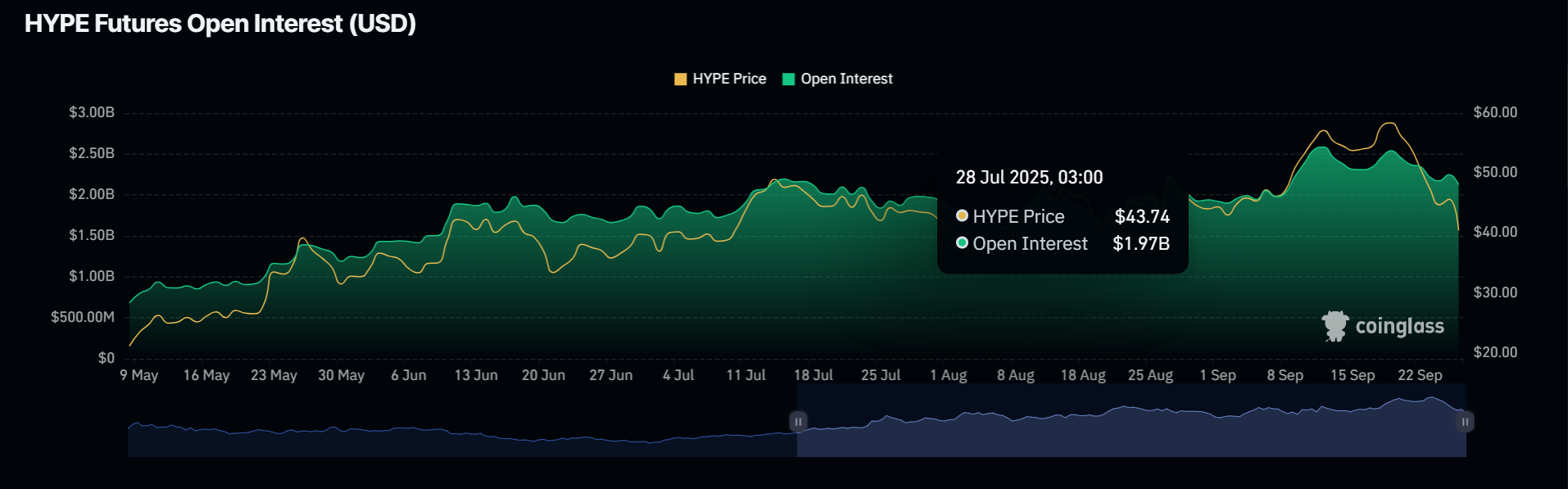

Despite the gravity of the announcement, $HYPE’s price reacted weakly. The token fell 1.24% over the past 24 hours at $42.41, extending weekly losses to more than 25%. Market data indicated consolidation in a narrow range between $40.11 and $43.46. Meanwhile, open interest on the $HYPE token is up 3.31% over the past day to $2.2 billion.

Institutional Momentum in Crypto ETFs

Bitwise’s filing comes at a time when other asset managers are rushing to bridge the digital and traditional finance asset classes. VanEck recently advised the SEC’s Crypto Task Force on tokenizing ETFs and discussed issuers’ roles in smart contract-based structures.

The task force has also discussed with firms like Term Finance to get compliance frameworks for tokenized funds right.

Earlier this month, Bitwise filed a filing to track stablecoins and leaders in tokenization, an increase in institutional interest in blockchain infrastructure. The firm’s move into $HYPE is an indication of its belief in protocols that unite perpetual futures mechanics with decentralized exchange models.

Recently, the SEC implemented generic listing standards in the case of crypto ETFs, which would simplify the process of approving tokens trading in CFTC-regulated markets over a period of more than six months. Such standards would help industry observers reduce the timeframe of products such as the Hyperliquid ETF.