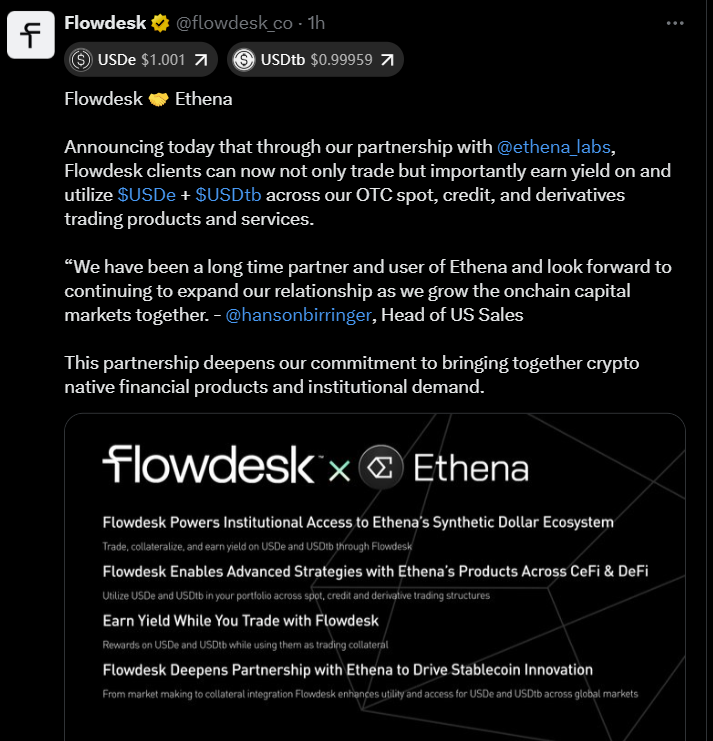

The rapid growth of the Ethena stablecoin ecosystem continued on Friday as Ethena Labs announced a partnership with institutional OTC desk Flowdesk, aimed at expanding access to its two tokens — $USDe and USDtb.

Flowdesk, whose clients include token issuers, hedge funds and exchanges, will support trading and reward programs tied to both stablecoins, the companies said.

$USDe is Ethena’s synthetic dollar, backed mainly by crypto assets and stabilized through a delta-neutral hedging strategy that keeps its value pegged to $1.

USDtb is backed by real-world assets — primarily BlackRock’s tokenized money market fund, BUIDL, and stablecoins — giving it a risk profile broadly comparable to fiat-backed stablecoins like $USDC ($USDC) and USDt ($USDT).

The announcement comes as $USDe surpassed $14 billion in market capitalization, according to CoinMarketCap, with its circulating supply climbing 21% over the past month. That growth has propelled $USDe into the position of the third-largest stablecoin by market cap, trailing only $USDT and $USDC.

Ethena ecosystem attracts public players

Ethena’s rapid growth has been fueled in part by $USDe’s yield-generation model, which allows holders to earn returns while providing attractive collateral for decentralized finance markets.

That yield potential was a key factor behind Mega Matrix’s $2 billion shelf registration, giving the public holding company flexibility to acquire Ethena’s governance token, $ENA. Owning $ENA would allow Mega Matrix to participate in governance and capture revenue generated by $USDe.

Ethena’s cumulative revenue surpassed $500 million in August, bringing the protocol closer to activating its anticipated “fee-switch” mechanism, which would distribute a share of protocol revenue to $ENA holders.

Another soon-to-be public company is also eyeing Ethena. StablecoinX and TLGY Acquisition recently secured $890 million as part of a merger, with the new entity explicitly targeting acquisitions of digital assets — including $ENA.

Despite its rapid growth, Ethena has been met with caution from market participants wary of derivatives-backed stablecoin models. Cointelegraph Research notes that synthetic stablecoins face funding rate volatility, since yields rely on positive funding rates, as well as counterparty risk and exposure to $USDT-margined contracts.

The central question is whether synthetic dollars can remain resilient during extended periods of negative funding rates or prolonged stress in derivatives markets.

For now, $USDe has defied those concerns, with demand continuing to climb as users appear willing to assume synthetic risk in exchange for yield.

Related: ‘Ethena has 6x upside to Circle’: Mega Matrix doubles down on $ENA ecosystem

cointelegraph.com

cointelegraph.com