DBS Bank, the largest bank in Southeast Asia, has partnered with Franklin Templeton and Ripple to launch trading and lending solutions based on tokenized money market funds and $RLUSD.

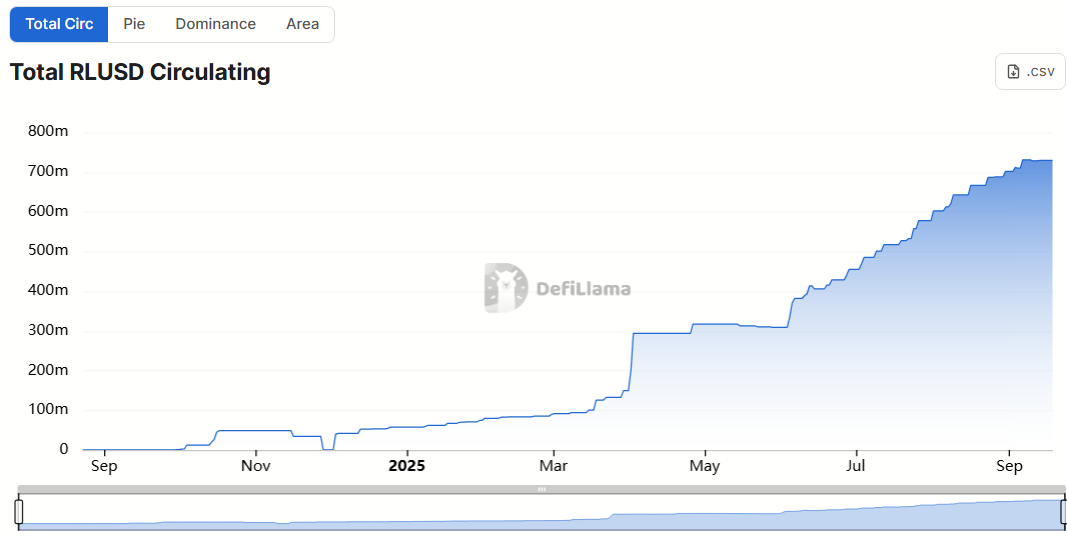

Ripple announced the partnership as $RLUSD’s market capitalization reached a new all-time high in September.

Ripple Expands $RLUSD Use Cases in September

According to Ripple, DBS, and Franklin Templeton signed a memorandum of understanding to introduce trading and lending solutions built on tokenized money market funds (MMFs) and Ripple’s $RLUSD stablecoin.

Investors can purchase sgBENJI tokens – representing Franklin Templeton’s money market fund – on DBS Digital Exchange using the $RLUSD stablecoin. In addition, Franklin Templeton will tokenize sgBENJI on the XRP Ledger, Ripple’s public, enterprise-grade blockchain.

“2025 has been marked by a series of industry-firsts when it comes to traditional financial institutions moving onchain – and the linkup between Ripple, DBS and Franklin Templeton to enable repo trades for a tokenised money market fund with a regulated, stable and liquid mode of exchange such as $RLUSD is truly a game-changer,” Nigel Khakoo, VP and Global Head of Trading and Markets at Ripple, said.

Data from DefiLlama shows that $RLUSD’s market capitalization hit a new record of $729 million in September. This marks more than a tenfold increase since the start of the year. Some analysts predict that $RLUSD’s market cap could soon surpass $1 billion following this collaboration.

However, this figure remains modest compared to USDT’s $170 billion market cap or USDC’s $73 billion.

$RLUSD">

$RLUSD">

RWA data indicates that $RLUSD currently has about 36,000 holders, accounting for only 0.26% of the total stablecoin market capitalization.

In September, Ripple also partnered with Chipper Cash, VALR, and Yellow Card to launch $RLUSD across African markets. Chainalysis reported that Sub-Saharan Africa has emerged as the third-fastest growing region for crypto, driven by strong retail activity in the first half of 2025.

Last month, Ripple and SBI Holdings signed a memorandum of understanding to distribute $RLUSD through the SBI VC Trade platform.

These institutional partnerships highlight Ripple’s efforts to expand $RLUSD adoption worldwide.

With these developments, $RLUSD’s growth potential looks highly promising.

The post $RLUSD Hits New Milestone as Ripple Joins Forces With DBS and Franklin Templeton appeared first on BeInCrypto.

beincrypto.com

beincrypto.com