$AVAX price touched $30 on Binance, the highest level since February. This performance has shifted investor sentiment toward a more optimistic outlook for the rest of the year.

Many now view $AVAX as a strong candidate for portfolio allocation. What fueled this rally? The following details explain the drivers.

Avalanche ($AVAX) Expands Institutional Exposure in September

Financial Times reported that the Avalanche Foundation is negotiating the creation of two US-based crypto treasury vehicles, targeting $1 billion.

The first deal, led by Hivemind Capital, aims to raise up to $500 million through a Nasdaq-listed company and is expected to be completed by late September.

The second deal involves a SPAC backed by Dragonfly Capital, which also targets $500 million, though the process may extend into October.

Funds from both transactions will be used to purchase millions of $AVAX from the Foundation’s reserves, leveraging a maximum total supply of 720 million tokens, 420 million of which are already in circulation.

This news likely pushed $AVAX to $30 on September 11 before a correction to $28.8, according to BeInCrypto data.

The $AVAX trading volume on the exchange today exceeded $1.8 billion, which is also the highest daily volume since February. This shows that this altcoin has again attracted traders’ attention.

Real-World Assets (RWA) Growth Strengthens $AVAX Outlook

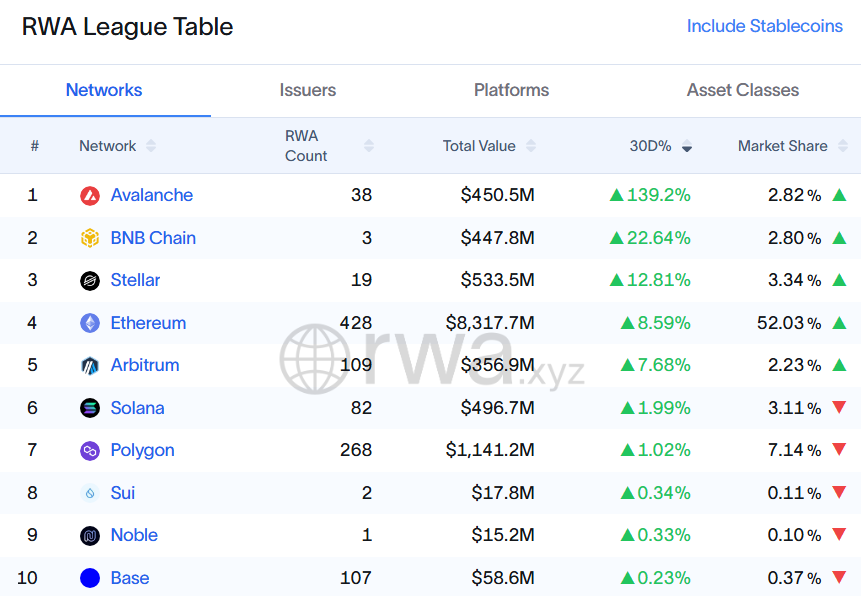

Another major highlight for $AVAX is its leading position in Real-World Asset growth over the past 30 days. Data from RWA.xyz shows Avalanche recorded more than 139% growth in total RWA value, exceeding $450 million.

Much of this growth stems from the tokenization of assets by Janus Henderson, a global investment firm managing over $379 billion. Specifically, the Janus Henderson Anemoy AAA CLO Fund (JAAA) was issued fully on-chain via the Centrifuge protocol on Avalanche.

Since early September, the total value of JAAA on Avalanche has surpassed $250 million. However, the data also shows that $AVAX’s RWA market share is still very small at just 2.82%, reflecting today’s fierce competition in the RWA space.

The increase in institutional engagement during September has lifted sentiment and supported $AVAX’s rally. Based on this momentum, technical analysts see potential for higher targets, with some expecting a return above $40 by year-end.

The post $AVAX Price Breaks $30 as RWA Adoption and Treasury Plans Boost Sentiment appeared first on BeInCrypto.

beincrypto.com

beincrypto.com