REX-Osprey Seeks Approval for $BNB Staking ETF That May Yield 1.5%–3%

The REX-Osprey $BNB + Staking ETF is a proposed U.S. exchange-traded fund that would allocate at least 80% to $BNB and seek staking yield (estimated 1.5%–3% annually). It plans to stake holdings while keeping illiquid assets below 15% and uses Anchorage Digital Bank as custodian.

-

$BNB staking yield: estimated 1.5%–3% annually for validators.

-

Fund would allocate ≥80% to $BNB or Cayman subsidiary exposure; remainder in related ETFs.

-

Custodian: Anchorage Digital Bank; adviser must keep illiquid assets under 15% for redemptions.

$BNB staking ETF: REX-Osprey $BNB + Staking ETF targets $BNB exposure and staking yield — read key details and next steps.

What is the REX-Osprey $BNB + Staking ETF?

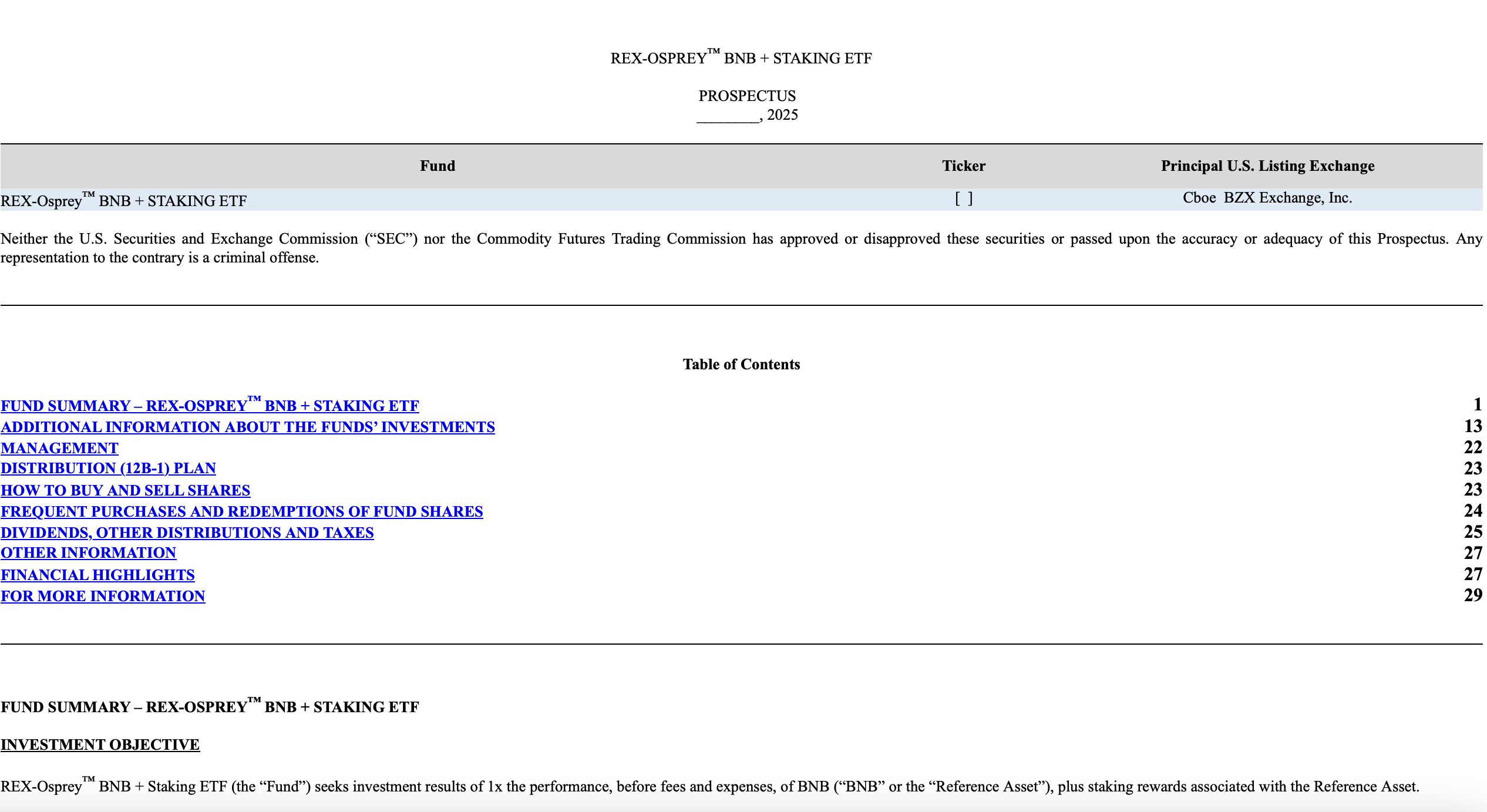

The REX-Osprey $BNB + Staking ETF is a proposed exchange-traded fund filed with the U.S. Securities and Exchange Commission that would hold predominantly $BNB and seek staking yield. The fund would stake $BNB (if liquidity rules permit) and allocate at least 80% of assets to $BNB or $BNB exposure via a Cayman Islands subsidiary.

How would the fund capture $BNB staking yield?

The filing states the fund intends to stake its $BNB to generate network yields estimated at 1.5%–3% annually. Staking would be executed only if the adviser can keep illiquid assets below the regulatory 15% threshold, preserving investor redemption capability. Anchorage Digital Bank is named as custodian for on-chain assets and liquid staking tokens.

$BNB Staking ETF That May Yield 1.5%–3% 1">

$BNB Staking ETF That May Yield 1.5%–3% 1">REX-Osprey $BNB + Staking ETF Filing excerpt. Source: SEC.gov

Why does staking yield matter for an ETF?

Staking yield directly increases potential total return for holders beyond price appreciation. For $BNB, validator rewards on the Binance Chain (proof-of-staked-authority) are estimated at 1.5%–3% annually. Including staking yield in an ETF could make $BNB products more competitive versus spot-only funds.

How does this filing compare to other $BNB ETF efforts?

VanEck filed a $BNB ETF in May 2025 also seeking to capture staking yield, marking growing industry interest in yield-bearing crypto products. The REX-Osprey filing follows that trend and proposes custodial and staking arrangements designed to meet U.S. regulatory liquidity standards.

Industry data show strong investor appetite for crypto ETFs. According to SoSoValue.com, Bitcoin ETFs recorded monthly inflows between $3 billion (April) and $6 billion (July), while Ether ETFs saw $5.4 billion in July and $3.7 billion so far in August. During the week of Aug. 15, combined BTC and ETH ETF trading volumes set new records, with Ether ETFs trading about $17 billion during one week, per market commentary in financial reporting.

$BNB Staking ETF That May Yield 1.5%–3% 2">

$BNB Staking ETF That May Yield 1.5%–3% 2">Ether spot ETF monthly inflows. Source: SoSoValue.com

When could investors see this ETF approved?

There is no guaranteed timeline. SEC review cycles vary and hinge on regulatory questions around custody, staking, liquidity and investor protections. Market participants and prior filings (VanEck, Osprey) suggest firms are preparing detailed operational controls to address SEC concerns.