The native token of Hyperliquid ($HYPE) surged to a fresh all-time high early Wednesday, continuing its meteoric climb this year as the decentralized exchange best known for on-chain perpetual trading has attracted record activity.

The token broke through the $50 mark for the first time, gaining about 8% in the past 24 hours. $HYPE is now up 430% since its April nadir and up roughly 15x since it began trading in late November at around $3.

The rally has been fueled by record trading activity across the exchange and its automated buyback mechanism, which steadily absorbs tokens from the market and reduces circulating supply.

Read more: Hyperliquid Now Dominates DeFi Derivatives, Processing $30B a Day

Trading boom

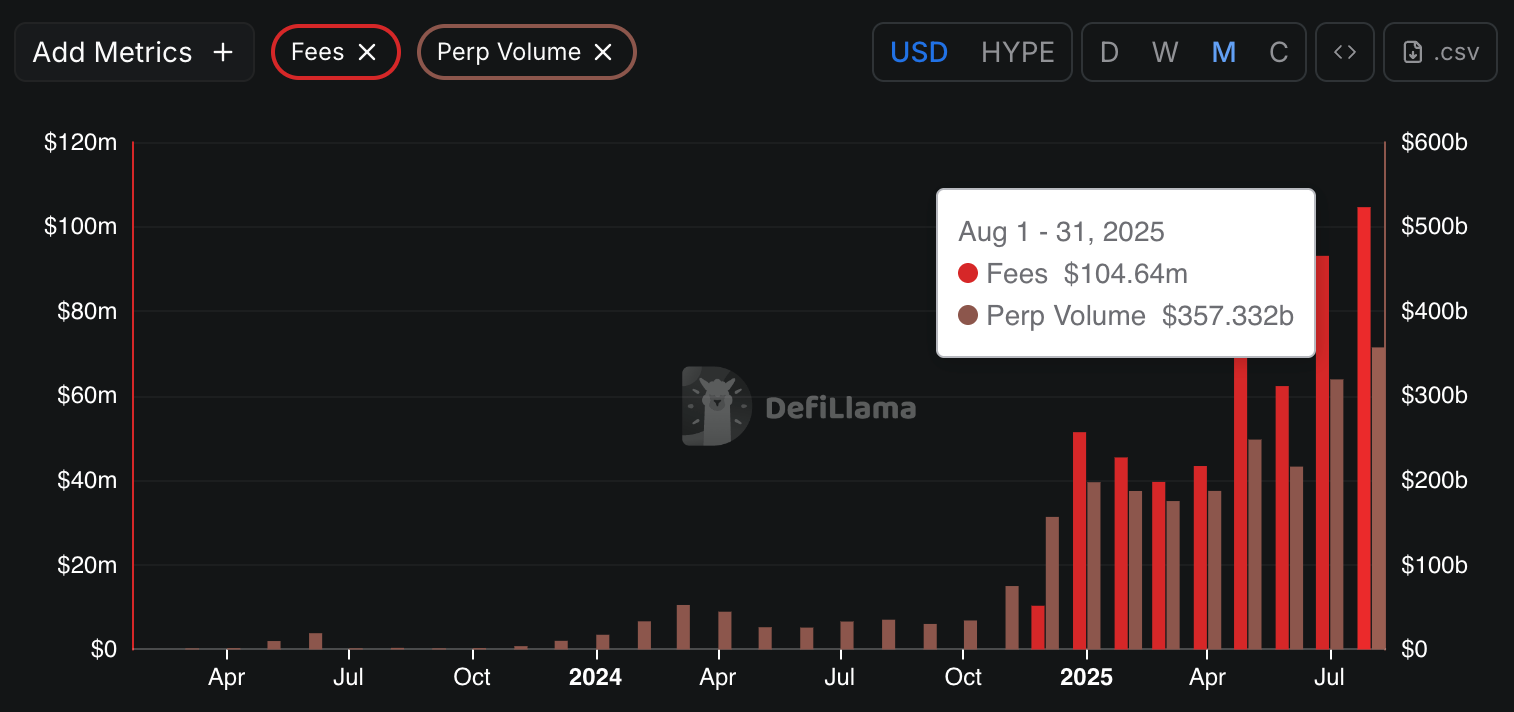

The decentralized exchange recorded more than $357 billion in derivatives volume in August, according to DefiLlama data, up from $319 billion in July and nearly ten times higher than a year ago. Spot trading volumes also set a record, surpassing $3 billion for the week ending Aug. 24, Blockworks data shows.

These flows translated into a windfall for the protocol. Hyperliquid booked $105 million in trading fees during August, the highest this year, per DefiLlama data.

Much of those earnings are funneled directly into purchasing $HYPE on the market through Hyperliquid's Assistance Fund. The facility is an automated on-chain mechanism that buys back tokens on the open market, creating sustained buy pressure for $HYPE and effectively reducing the circulating supply.

Since its launch in January, the fund’s holdings ballooned from 3 million tokens to 29.8 million $HYPE, now worth over $1.5 billion, fueling the token's rally.

On the news front, digital asset custodian BitGo added support on Tuesday for the HyperEVM network, which underpins the Hyperliquid ecosystem, unlocking institutional access to $HYPE and related applications.

Analysts flag risks amid strong fundamentals

In a recent research note, ByteTree analysts Shehriyar Ali and Charlie Morris described Hyperliquid as a "powerhouse" that has become the largest decentralized perpetual futures venue.

"All things considered, HyperLiquid is among the most compelling protocols in DeFi today," they wrote. "Its strong fundamentals, record-breaking fee generation and dominant market share make it impossible to ignore."

Despite the bullish fundamentals, the report also flagged concerns about the token's valuation. $HYPE currently trades at a fully diluted valuation (FDV) of over $50 billion, with only about third of supply in circulation with a 16.8 billion market capitalization.

Scheduled token unlocks starting in November could also introduce selling pressure, potentially testing the strength of demand, the report noted.

"Although the token has already seen a sharp run-up in recent months, its robust on-chain activity continues to underpin its valuation," the analysts said.

Read more: XPL Futures on Hyperliquid See $130M Wiped Out Ahead of the Plasma Token's Launch

coindesk.com

coindesk.com