TL;DR

- Avalanche processes 10.9M weekly transactions, DEX volume tops $3B, and price trades near $23 today still.

- Grayscale files S-1 for spot $AVAX trust; Coinbase Custody and Coinbase serve roles as partners.

- CLS identifies $19–$20 FVG interest zone; targets $27, $28, $31, $34 if momentum holds weekly.

Network Activity Climbs

Avalanche ($AVAX) processed 10.9 million transactions over the past week, the highest reading since December 2023. Activity held near 2–4 million for months before rising sharply from mid-2025 as more apps went live.

$AVAX showing 10.9M weekly txns (highest since Dec ’23), $3B+ DEX volume holding strong, and TVL close to $4B after 3 years.

Growth is coming from partnerships, RWA tokenization, and gaming.

With gaming market expected to hit ~$615B by 2030, I feel $AVAX still has big upside.… pic.twitter.com/p1G9qhilsO

— Joe Swanson (@Joe_Swanson057) August 26, 2025

Weekly DEX volume stayed above $3 billion, with trading trending higher since early June 2025. Liquidity across swaps and lending has deepened. Analyst Joe Swanson wrote,

“$AVAX showing 10.9M weekly txns (highest since Dec ’23), $3B+ DEX volume holding strong.”

The price of Avalanche was $23 at the time of writing, with a 24-hour volume of over $711 million. $AVAX is down 3% on the day and up 1% over seven days. The move tracks broader crypto softness while on-chain activity stays firm.

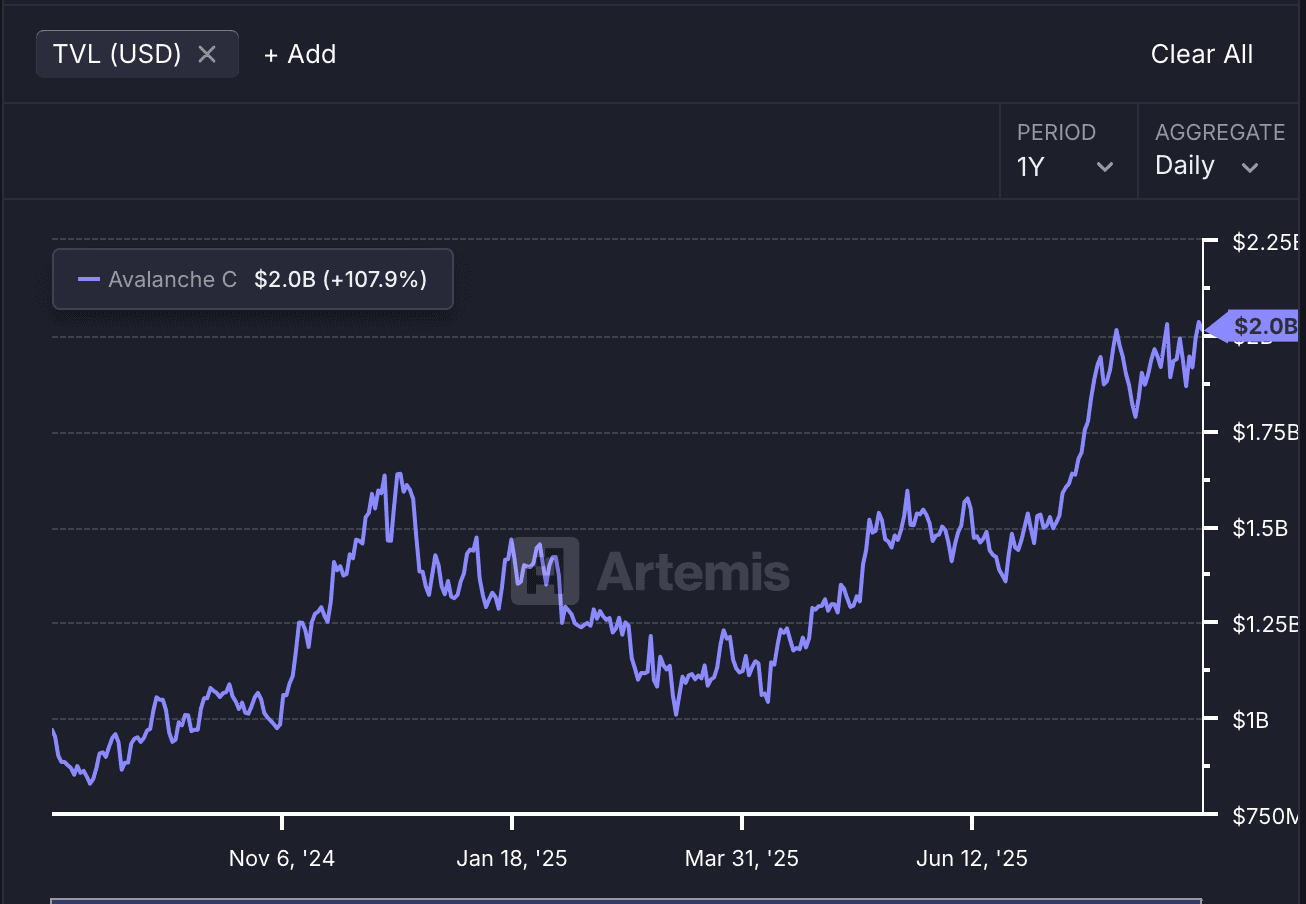

Avalanche’s TVL is $2.0B (Aug 26, 2025) per Artemis. The trend shows a steady climb through 2024 and faster growth in 2025, reaching near 1-year highs, but nowhere near prior cycle records.

Weekly Setup and Targets

CLS Global reports early signs of a bullish weekly structure. The team marks a 1-week Fair Value Gap (FVG) at $19–$20 as its interest zone for bids. The price trades above that area, keeping the setup constructive on their timeframe.

$AVAX/USDT Global Outlook

$AVAX showing signs of potential bullish rally on weekly timeframe.

Key Points:

– Upward structure forming on weekly

– FVG 1W ($19.173 – $20.382) serving as interest zone

– Potential upside exceeds 70%Targets: → $27.415 (weekly high) → $28.763 →… pic.twitter.com/pUc1AtUJrv

— CLS GLOBAL (@CoinLiquidity) August 26, 2025

CLS maps upside potential above 70% from the FVG, with targets at $27 (weekly high), $28, $31, and $34. A dip into the FVG could precede continuation. CLS wrote,

“$AVAX showing signs of potential bullish rally on weekly timeframe.”

Grayscale Files for Avalanche Trust

Grayscale Investments filed an S-1 with the US SEC to launch the Grayscale Avalanche Trust ($AVAX). The trust seeks to track $AVAX’s price, with Coinbase Custody as custodian and Coinbase, Inc. as prime broker.

Grayscale aims to list the product on Nasdaq, pending approval. Market participants are weighing how a listed vehicle could broaden access. Swanson linked growth to “partnerships, RWA tokenization, and gaming,” noting a gaming market forecast of nearly $615B by 2030.

cryptopotato.com

cryptopotato.com