Asset manager Canary Capital has submitted an S-1 registration with the U.S. SEC to launch an exchange-traded fund (ETF) tied to President Donald Trump’s memecoin, TRUMP.

This move would give investors regulated exposure to one of the most politically driven tokens in the crypto market.

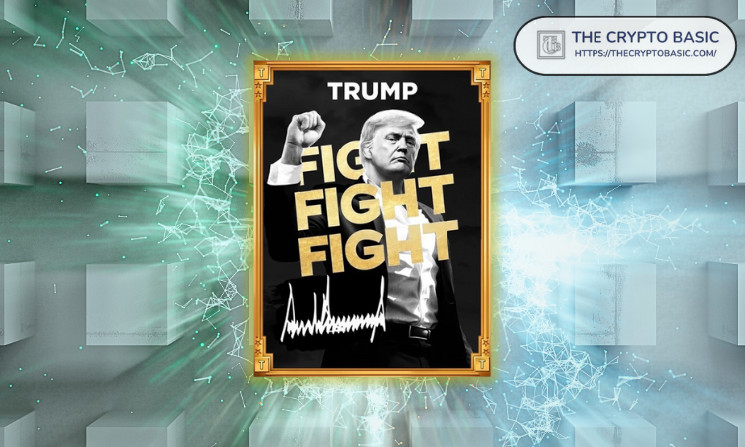

Trump Coin ETF Filing

The proposed Trump Coin ETF will track the price of TRUMP, a memecoin launched in January ahead of Trump’s inauguration. The fund would allow investors to buy the token through traditional brokerage accounts instead of relying solely on crypto exchanges.

Meanwhile, multiple asset managers see potential in the coin as they file for ETFs related to it. Notably, details such as management fees and the listing venue were not disclosed in the filing.

American-Made Crypto ETF Application

Alongside the Trump filing, Canary also applied for an “American-Made Crypto ETF” under the ticker MRCA. This product would track an index of U.S.-rooted cryptocurrencies such as XRP, Solana, Cardano, Chainlink, and Stellar, while excluding memecoins, stablecoins, and pegged tokens.

The fund plans to add staking rewards to its net asset value through third-party providers. Custody would be operated by a South Dakota trust company, with most assets stored in cold wallets.

SEC’s Delays on Crypto Funds

The filings come as the SEC continues to extend decision deadlines on multiple digital asset ETFs. New review dates for XRP, Solana, and Truth Social-linked funds now run into October 2025.

Canary itself has several pending ETF applications tied to SOL, XRP, SUI, TRX, and PENGU, all still awaiting review. While recent SEC guidance has clarified staking and custody rules, approvals remain slow-moving.

thecryptobasic.com

thecryptobasic.com