- Sentiment has turned strongly bearish for Dogecoin, with Santiment’s NPL indicator plunging to a three-year low and Coinglass showing a long-to-short ratio of 0.79.

- After failing to hold above $0.24 and briefly rebounding from $0.21, $DOGE now faces critical support; a close below $0.21 could lead to a decline toward $0.18.

Dogecoin price is facing strong selling pressure today, correcting 4.5% and finding support at $0.22, as of press time. This comes as the Qubic community, behind the 51% attacks on privacy blockchain Monero, last week, has now set its eyes on the Dogecoin network. This has led to more selling pressure on $DOGE as of now.

Qubic Prepares for A Dogecoin Attack

Sergey Ivancheglo, lead developer of Qubic, announced on X that the Qubic community has voted to make Dogecoin its next target. The vote included other options such as Kaspa (KAS), Zcash (ZEC), and additional ASIC-mined coins.

This decision follows last week’s 51% attack on Monero by the same mining pool, which triggered a sharp price drop for the privacy-focused cryptocurrency. The move to target other proof-of-work networks raises concerns about potential risks to these blockchain ecosystems.

The #Qubic community has chosen #Dogecoin. pic.twitter.com/EnevIZUAw5

— Come-from-Beyond (@c___f___b) August 17, 2025

The user further asked the Qubic founder about his motive for the attack. Responding to this, Ivancheglo said: “A lot of electricity is burned for useless PoW, we need that electricity for AI. These words may be hard to get and I cannot reveal more now, in the future they will eventually click”.

$DOGE Price Comes Under Strong Bearish Grip

As per blockchain analytics firm Santiment, Dogecoin’s Network Realized Profit/Loss (NPL) indicator has dropped from 2.68 million to -271.41 million from Thursday to Friday, marking the lowest drop in three years. This decline suggests that holders were, on average, realizing losses, which added to the overall selling pressure.

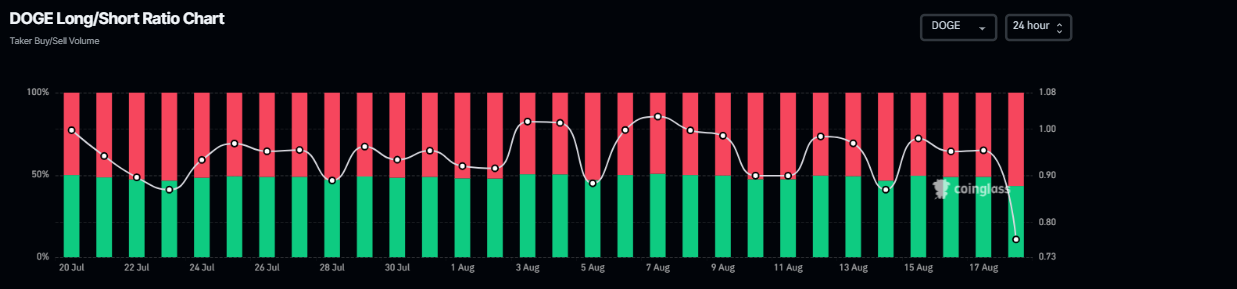

Additionally, Coinglass data shows the long-to-short ratio at 0.79 on Monday, its highest level in over a month. A ratio below one signals bearish sentiment, indicating traders expect Dogecoin’s price to decline.

Dogecoin price was rejected at the $0.24 daily level on Thursday, falling 8.58%, before finding support near $0.21 and rebounding 4.6% by Sunday. As of Monday, $DOGE trades 4% lower, approaching the $0.21 support zone.

A close below $0.21 could open the door for a further decline toward the weekly support at $0.18. The daily RSI sits near the neutral 50 mark, signaling market indecision, while converging MACD lines reinforce the lack of clear momentum.

As reported by CNF, the Dogecoin whale activity has surged significantly, buying more than 680 million $DOGE. Wallets holding over 100 million $DOGE have accumulated an additional 680 million tokens since August 1, pushing their total holdings to 98.56 billion $DOGE—the highest level recorded for this cohort since December 1.