- OKX permanently locked OKB’s supply at 21M, triggering a price spike of over 160% to a new all-time high.

- OKTChain will be phased out, and OKT holders can swap based on a 30-day average price near $47.

News from OKX stunned the market. They announced the permanent burning of over 65 million OKB tokens. This move also removed manual minting and burning capabilities from their smart contracts. The effect? The total number of OKB tokens is now locked at 21 million. This truly creates scarcity.

OKB Skyrockets as OKX Phases Out OKTChain and Locks Swap Rate

Not stopping there, OKX also announced that it would gradually shut down OKTChain. OKT tokens are exchanged for OKB based on the average daily closing price from July 13th to August 12th, 2025. So, it’s not a random transaction. Their calculations are based on market prices for a full month to maintain a reasonable exchange rate.

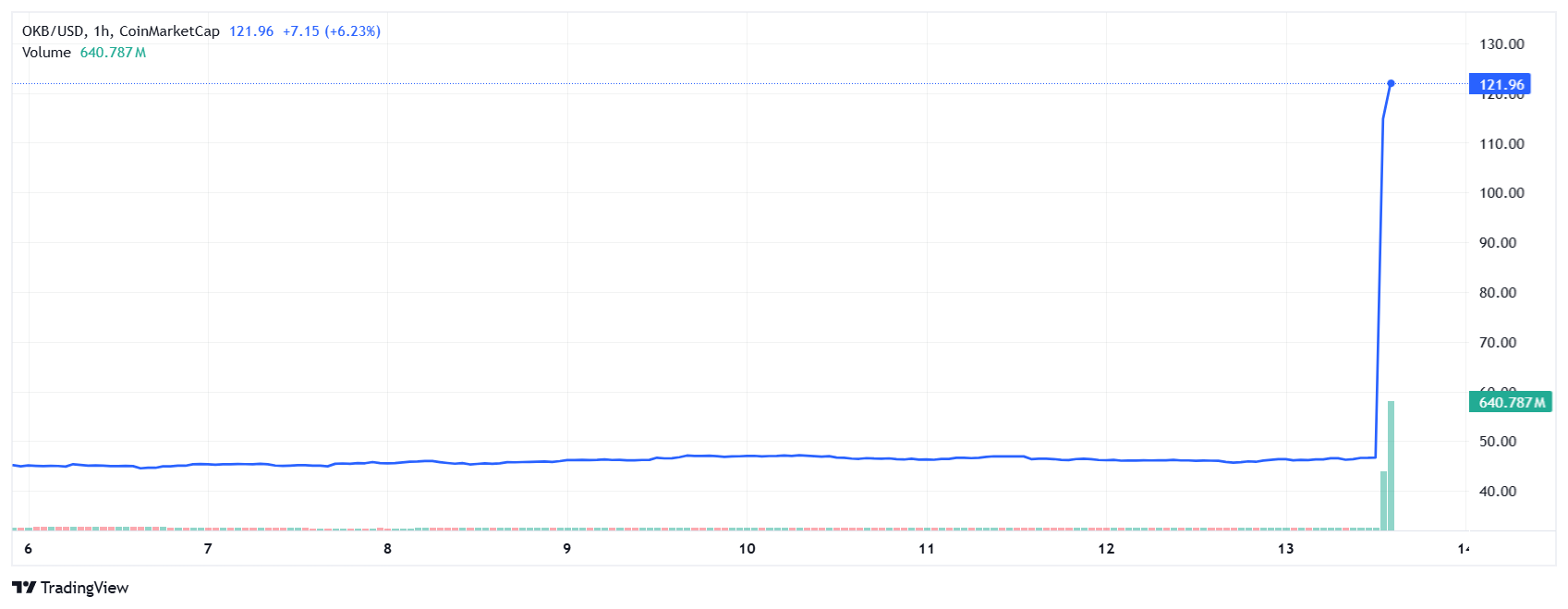

What impact has this had on the price? Insane. OKB has skyrocketed. In the last 24 hours alone, the token has surged by over 160%. From a price below $50, the token suddenly soared to around $121.96. Its market cap has also soared, now exceeding $7 billion.

OKB immediately took the 23rd spot on the list of the world’s largest cryptocurrencies. It’s understandable that many traders claim to have missed the train—again.

Furthermore, the removal of the minting feature opens the door for OKB to become a purely deflationary asset. Many analysts suspect that this is not just a short-term strategy, but also a way for OKX to restructure its internal economic map. Moreover, with the total supply locked, the potential for wild speculation is more limited. This means that OKB’s value can rely more heavily on real demand.

On the other hand, this moment also serves as a showcase for OKX’s global presence. They are preparing for an IPO in the United States, following in the successful footsteps of Circle. CEO Roshan Robert is reportedly leading the preparations for the NYSE listing.

Previously, they had reached a $500 million legal settlement with the US Department of Justice in February 2025. This move paved the way for OKX to re-enter the US market in April 2025, this time with services compliant with MiCA regulations.

Meanwhile, in mid-June, the exchange launched fully legal crypto exchanges in Germany and Poland. Both platforms are licensed under MiCA and MiFID II regulations. The service is comprehensive: SEPA support, a localized UI, over 270 crypto assets, and spot trading with euro pairs. It’s no joke.

Not only that, MetaMask even integrated OKX’s DEX API last June. This means users can now enjoy faster cross-chain swaps and reduced slippage. Interestingly, MetaMask is also the first third-party wallet to enable MEV protection through Servo—a direct partnership with OKX.

Looking back, all of these steps seem to be orchestrated sequentially. OKX burned tokens, locked supply, strengthened the ecosystem, and began to take a serious stance on the regulatory front. When OKB prices soar, it’s not just about hype. It’s about how an exchange harnesses momentum with a strategy they’ve prepared long ago.