Ethena Labs — the developer of the synthetic dollar protocol with a total value locked (TVL) of $7.5 billion — has announced the formation of a new Ethena ($ENA)-focused treasury company, StableCoinX Inc. The $ENA treasury company has raised a total of $360 million and plans to list its stock on Nasdaq under the symbol USDE.

The capital raise, according to an Ethena Labs post on X (formerly Twitter) today, July 21, includes $260 million in cash, which will be used to buy locked $ENA from a subsidiary of the Ethena Foundation, and $60 million contribution of $ENA from the foundation. The cash will be used by the subsidiary to purchase $ENA on the open market.

Starting today, about $5 million worth of $ENA will be bought daily over the next six weeks. At current prices, $260 million represents about 8% of $ENA’s circulating supply, the post said.

“Importantly, the Ethena Foundation has the right to veto any sales of $ENA by StableCoinX at its sole discretion. Ideally, tokens will never be sold with a sole focus on accumulation,” Ethena Labs stated in the post.

StableCoinX’s treasury strategy focuses on a “deliberate, multi‑year capital allocation” approach designed to help the company benefit from the growing demand for digital dollars, while increasing the amount of $ENA tokens held per share “to the benefit of shareholders,” the X post reads.

“The Ethena Foundation’s mandate is to safeguard Ethena’s longevity and decentralisation,” said Marc Piano, director at the Ethena Foundation, in a press release announcing the deal. Piano continued:

“Partnering with StablecoinX under a disciplined, locked‑token framework ensures that capital entering the ecosystem is long-term and value‑accretive while enhancing ecosystem capital efficiency.”

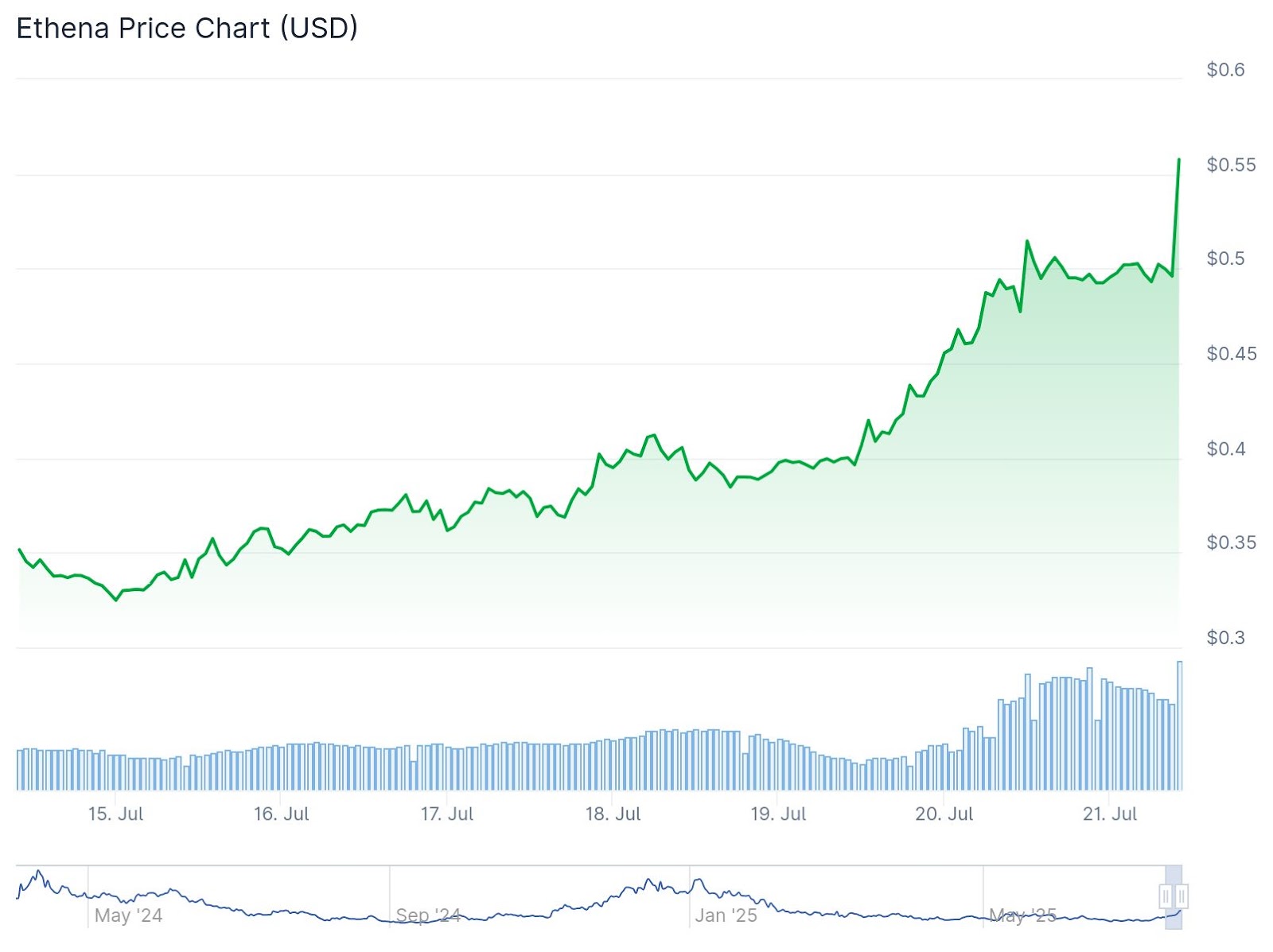

$ENA is currently trading at around $0.54 – up 13% on the day, with the rally from near $0.40 beginning over the weekend, before the official announcement went live, per CoinGecko data. This also marks a 57% increase over the past week, suggesting that some insiders may have anticipated the news.

News of StablecoinX’s treasury strategy comes as the broader stablecoin market has been on a growth streak for nearly two years. The Defiant has previously reported that stablecoins now account for roughly one-third of decentralized finance-generated revenue.

Meanwhile, the overall market capitalization of stablecoins now exceeds $261 billion, up nearly 3% over the past week, due to expanding user adoption. Tether’s USDT holds a 62% market share, with a market capitalization of $162 billion, per DefiLlama.

A recent report from Animoca Brands showed that the stocks of public companies adopting altcoin treasury strategies tend to surge, but the altcoins themselves don’t show the same price action.