JuCoin just launched its inaugural $USDT fixed-income product, joining a growing roster of trading platforms that offer tiered-yield and flexible staking solutions for $USDT holders.

On May 26, JuCoin, a Singapore-based trading platform, officially launched its first Tether ($USDT) fixed-income product with tiered APY. The offering includes six different terms—7, 15, 30, 45, 60, and 90 days—designed to cater to varying investor preferences.

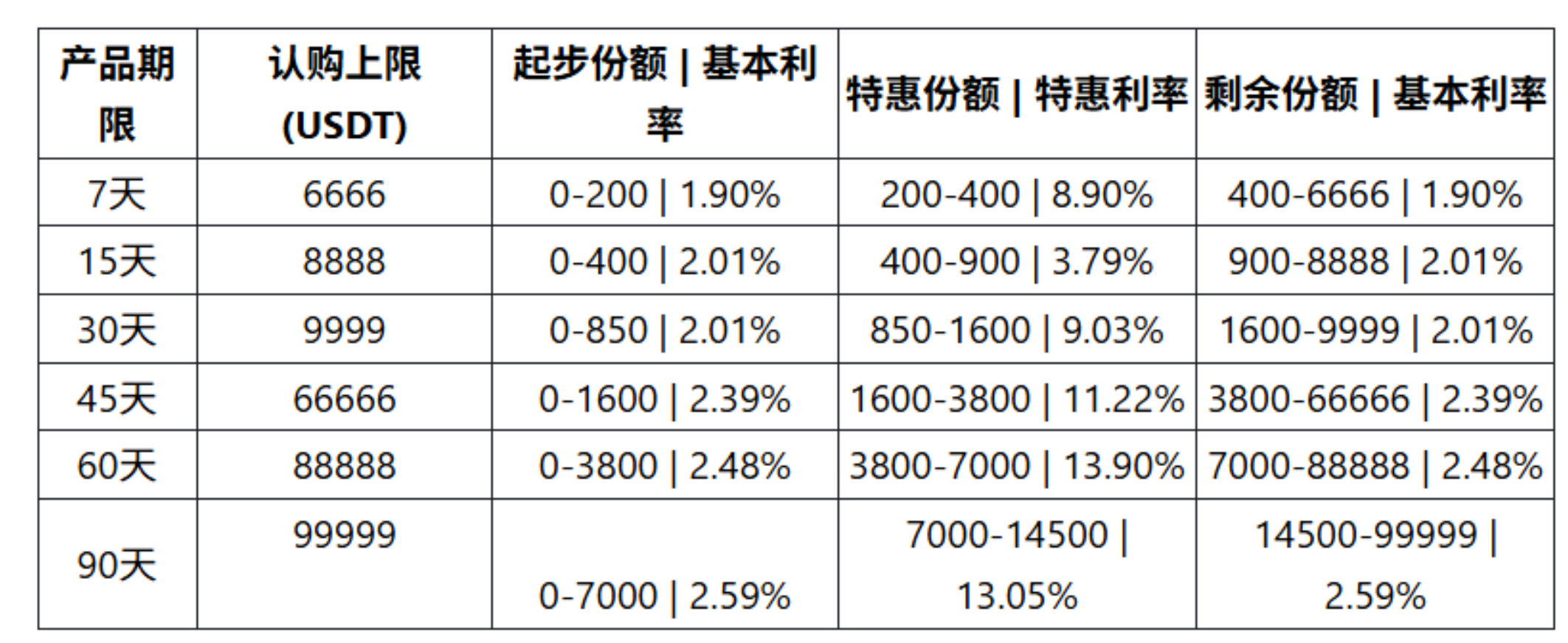

JuCoin employs a “ladder interest rate” model, where yields are tiered based on investment amounts. Each product has a base quota with a standard interest rate, followed by a preferential tier that offers a higher rate. Any amount exceeding this tier reverts to the base rate. Earnings are calculated daily and distributed automatically upon product maturity.

$USDT fixed-income product with tiered APY - 1">

$USDT fixed-income product with tiered APY - 1"> For example, an investment of 4,000 $USDT in the 45-day product is broken down as follows: the first 1,600 $USDT earns a base APY of 2.39%, the next 2,200 $USDT qualifies for a higher APY of 11.22%, and the remaining 200 $USDT returns to the base rate. The blended annualized return in this case would be approximately 7.25%.

With this new offering, JuCoin joins a growing number of trading platforms that are already offering similar products. For example, Bybit offers $USDT-based options with tiered yields across various durations, with current rates including 2.70% for 14 days, 3.20% for 30 days, 4.00% for 90 days for both fixed-term and flexible deposits. Among major exchanges, KuCoin, Binance, Kraken, and MEXC also offer $USDT staking across fixed and flexible terms with a range of APYs.

To be clear, in fixed-term staking, users commit $USDT for a set period in exchange for a predetermined APY, and they cannot withdraw until the term ends. The platform pools these locked funds and typically lends them out to institutional borrowers or uses them in liquidity-providing and yield-farming strategies, generating steady interest that’s shared with holders at maturity.

Flexible-term staking, by contrast, lets users deposit and redeem $USDT at any time. Rates are usually lower and can fluctuate based on demand but offer the convenience of instant access to locked capital.