-

The stablecoin supply of Aptos ($APT) has dramatically surged, nearly tripling in value, signaling a significant uptick in market interest and liquidity.

-

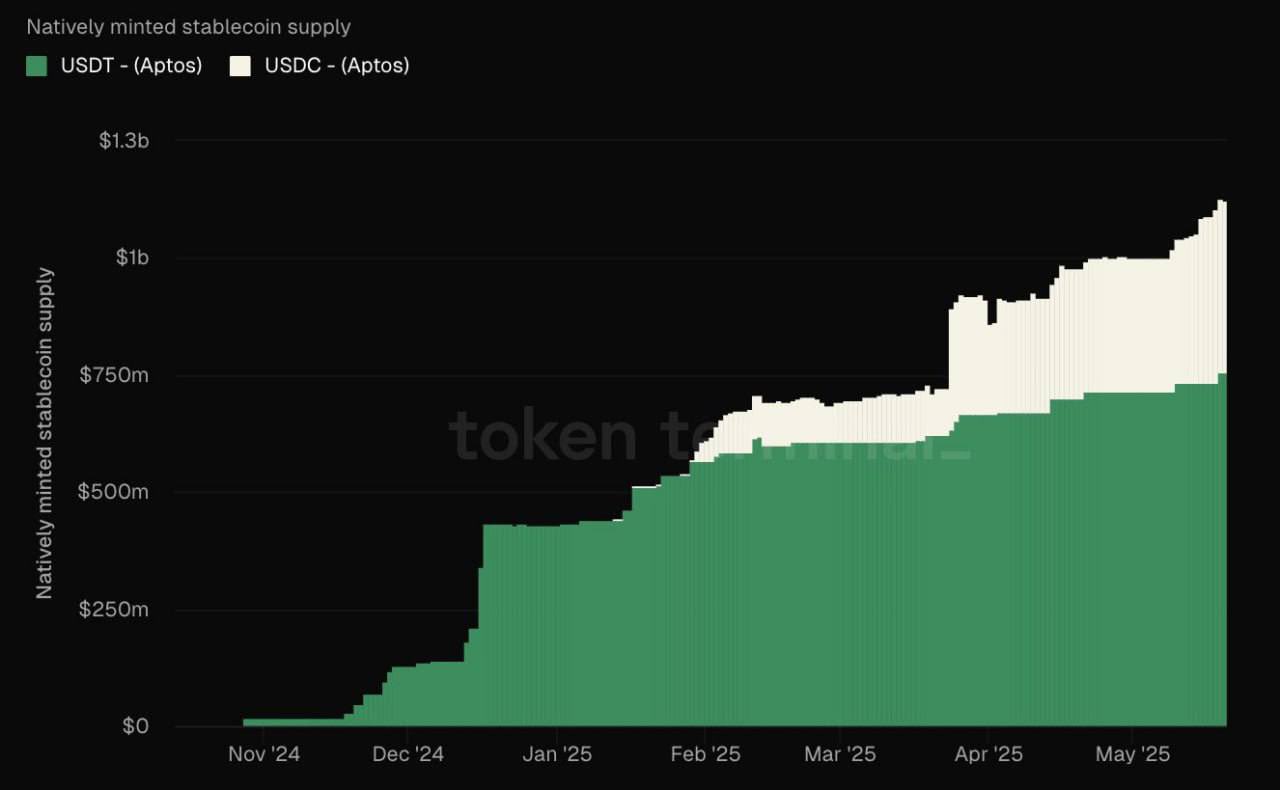

As of May 2025, $APT’s stablecoin supply skyrocketed from $430 million to approximately $1.13 billion, showcasing impressive growth within just five months.

-

“The rapid increase in stablecoin supply indicates greater liquidity and institutional interest,” noted a COINOTAG market analyst.

This article explores the recent surge in Aptos ($APT) stablecoin supply, its price movements, and the implications for liquidity and market dynamics.

Analyzing the Surge in $APT Stablecoin Supply

The recent growth of $APT’s stablecoin supply reflects robust demand for liquidity and a flourishing ecosystem in the decentralized finance (DeFi) arena. The supply jump from $430 million in late December 2024 to nearly $1.13 billion by May 2025 demonstrates not only the increasing adoption of Aptos but also a widening acceptance of stablecoins within financial networks.

Market Dynamics and Institutional Involvement

Current trends reveal that institutional investors are gravitating towards Aptos stablecoins, a shift seen markedly when USDC’s supply spiked in March 2025. At that time, major political parties were reportedly raising similar amounts, around $565 million each, underscoring a period where institutional engagement was on the rise. This increased participation from institutional investors promises to enhance the long-term viability of $APT as a stable asset.

$APT) Stablecoin Supply Nearly Triples, Raising Questions About Future Price Movements and Market Demand 1">

$APT) Stablecoin Supply Nearly Triples, Raising Questions About Future Price Movements and Market Demand 1">

Source: Token Terminal