- $XRP's uptrend gains steam, supported by a major comeback in Open Interest to $4.96 billion.

- Volatility Shares will debut $XRP futures ETF on NASDAQ, allocating 80% of net assets to $XRP instruments.

- $XRP upholds a higher low pattern with the RSI at 56, signaling room for more growth before reaching overbought conditions.

Ripple's ($XRP) price accelerates the uptrend to around $2.43 at the time of writing on Thursday, propelled by improving sentiment in the broader crypto market after Bitcoin (BTC) rapidly rallied to new all-time highs at approximately $111,880.

The impressive rally in Bitcoin's price, which has also triggered subsequent increases in altcoins like $XRP and meme coins, comes amid concerns about the sustainability of United States (US) debt, as discussed in the top gainers analysis.

Volatility Shares set to launch $XRP futures ETF on NASDAQ

As $XRP's price edges higher, Volatility Shares, a registered investment advisor, is preparing to launch the first-ever $XRP futures Exchange-Traded Fund (ETF) on the Nasdaq stock market on Thursday.

According to a post-effective amendment filed with the Securities & Exchange Commission (SEC), the fund, part of the Volatility Shares Trust, will trade under the ticker XRPI.

Volatility Shares outlined in a press release on Wednesday that it will allocate at least 80% of its net assets to $XRP-linked instruments, offering investors unlevelled exposure to $XRP futures through a Cayman Islands-based subsidiary.

Moreover, the company announced plans to launch a 2x $XRP futures ETF that pledges twice the daily appreciation of $XRP via double the leveraged exposure to $XRP futures contracts.

VolatilityShares is launching the first-ever $XRP futures ETF tomorrow, ticker $XRPI.. yes there is a 2x $XRP already on market (this is first 1x) and it has $120m aum and trades $35m/day. Good signal that there will be demand for this one. pic.twitter.com/rCooyNZgu0

— Eric Balchunas (@EricBalchunas) May 21, 2025

This development follows Teucrium Investment Advisors' launch of a leveraged $XRP ETF in April, signaling swelling institutional interest in $XRP-related financial products.

$XRP's market dynamics have improved in the last few months with the Chicago Mercantile Exchange (CME) recently introducing regulated $XRP futures contracts.

The longstanding lawsuit is also nearing its end after Ripple and the SEC agreed on a $50 million settlement, subsequently filing a joint motion to drop the appeals. Despite the Court denying the motion, Ripple and the Commission are committed to working together to meet the requirements for an indicative ruling.

$XRP reignites bullish momentum as Open Interest surges

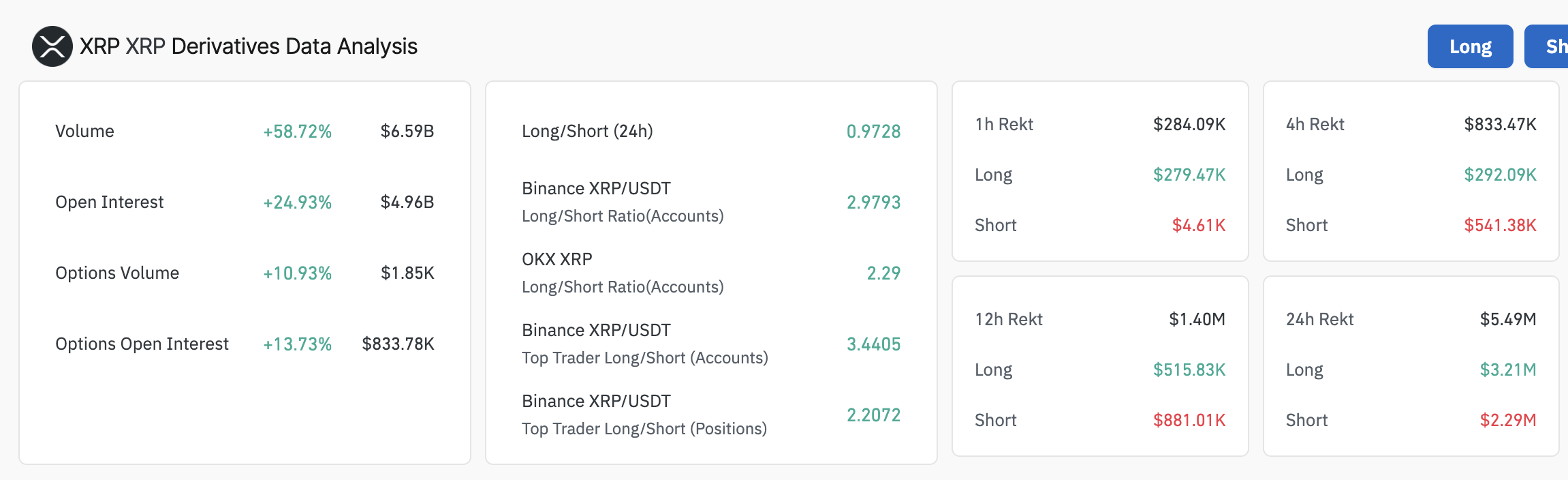

$XRP's uptrend is gaining traction with Open Interest (OI) surging nearly 25% to $4.96 billion. This increase signals a robust comeback in market participation combined with the trading volume rising approximately 59% to $6.59 billion over the past 24 hours.

$XRP derivatives data | Source: CoinGlass

The colossal influx of capital alongside heightened trader interest supports a potential push toward $3.00. The daily chart below highlights this potential with $XRP sitting above key moving averages, ranging from the 50-day Exponential Moving Average (EMA) at $2.29, the 100-day EMA at $2.26, and the 200-day EMA at $2.05.

A trendline (dotted) drawn from the tariff-triggered crash at $1.61 affirms the uptrend's strength, forming a higher low pattern.

$XRP/USDT daily chart

With the Relative Strength Index (RSI) at 56 and climbing toward the overbought region above 70, $XRP is building strength for its $3.00 mid-term target. Since it's not overbought yet, bulls have room to push higher before profit-taking changes dynamics, potentially triggering a reversal.

fxstreet.com

fxstreet.com