A recent report shows how Ripple’s $XRP holdings have evolved since the last quarter of 2024, including other details on the ecosystem’s performance.

Notably, Ripple holds a substantial part of $XRP’s 100 billion total supply. The cross-border payment giant, which is a major contributor to the $XRP Ledger, received 80 billion $XRP in an initial allocation in 2012 to support its business development.

Meanwhile, while the stash has reduced over the years to its current valuation, it still holds over 40% of the $XRP’s supply. Ripple’s recent quarterly disclosure has revealed its holdings compared to the last quarter of 2024.

Ripple’s $XRP Holdings

Ripple subdivides its holdings into two categories: $XRP held in its spendable wallet and those locked up in escrow. The firm uses the former to conduct its payment ventures and releases 1 million $XRP from the latter every month.

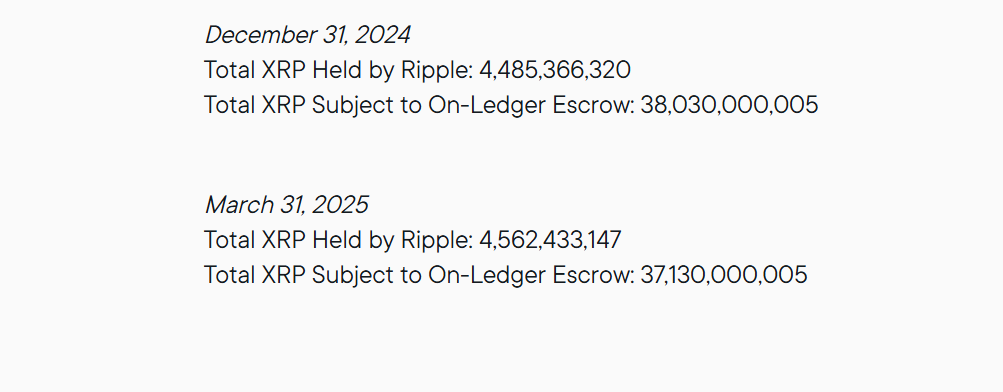

As per its Q4 2024 attestation filing, Ripple held 4,485,366,320 $XRP in its wallet and 38,030,000,005 $XRP in its on-ledger escrow account. However, its Q1 2025 market report shows a notable variation.

For context, Ripple’s wallet balance has 4,564,433,147 $XRP, and its locked escrow address has 37,130,000,005 $XRP as of March 31. The report shows a 79,066,827 $XRP increase in the amount held and a 900,000,000 $XRP decrease in escrow.

Notably, considering the standard 1 billion $XRP that should be released to Ripple every month, the escrow account should be down by 3 billion $XRP by the end of Q1 2025. However, the firm does not use all the monthly unlocked stash, relocking 70% each month.

Remarkably, Ripple’s massive $XRP holdings have been a long-standing debate in the crypto community. While some disagree, $XRP community researcher Anderson believes the fintech firm’s holding is beneficial for $XRP’s long-term adoption.

Key Highlights from Q1 2025 Market Report

Meanwhile, Ripple revealed it will discontinue its quarterly market report in its current form, citing regulatory misuse of information. It stressed that these disclosures, dating back to 2017, formed the basis for the US Securities and Exchange Commission’s prosecution of the firm.

However, it would continue to adhere to its transparency policy on its operations through official channels and keep its $XRP holdings publicly on its website.

The report also highlighted increased institutional adoption of $XRP products. It spotlighted progress like Franklin Templeton’s $XRP spot ETF filing, CME Group’s derivative expansion to include $XRP, and the launch of the first futures product in the United States through Teucrium’s 2x Long Daily $XRP ETF.

Other notable events include the US SEC’s pause on its case against Ripple and the $1.25 billion acquisition of brokerage firm Hidden Road.

thecryptobasic.com

thecryptobasic.com