$XRP, the fourth-largest cryptocurrency by market capitalization, is attracting growing interest from institutional and retail investors in 2025. Ripple’s recently published Q1 2025 $XRP Markets Report offers deeper insight into the altcoin’s performance.

The report reveals a striking contrast: spot trading volumes surged, while on-chain activity on the $XRP Ledger (XRPL) declined significantly.

Spot Volume and Investment Flows into $XRP Rise Sharply

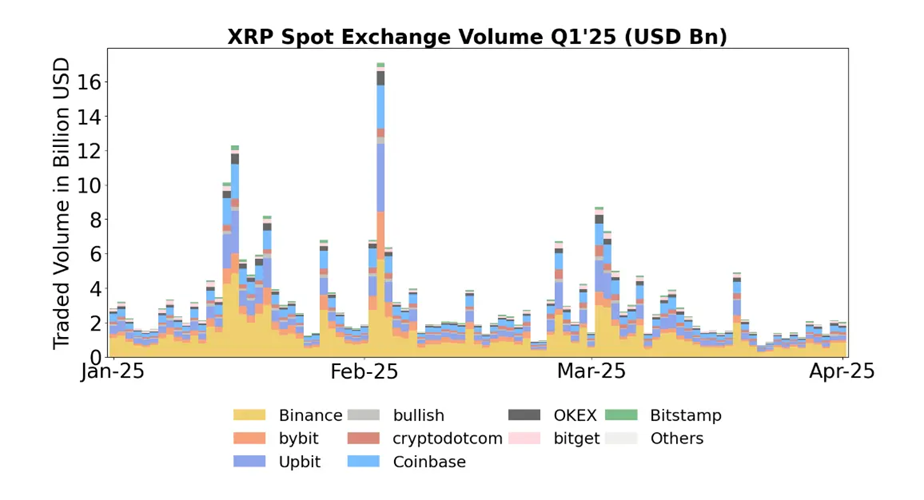

According to the report, $XRP’s spot trading volume remained steady in Q1 2025, with the average daily volume reaching $3.2 billion across major exchanges.

Notably, trading volume spiked at the end of January and early February. It peaked above $16 billion before gradually declining in March. Binance led with around 40% of total volume, followed by Upbit (15%) and Coinbase (12%).

The share of USD and USD stablecoin volume traded through fiat pairs rose from 25% in Q4 2024 to 29% in Q1. This increase indicates growing demand for fiat trading. $XRP’s price also posted an impressive rally, reaching a peak of $3.40—its highest since January 2018—and outperforming Bitcoin and Ethereum during the same period.

$XRP-based investment products also attracted strong inflows, with year-to-date totals reaching $214 million, nearly overtaking global Ethereum funds.

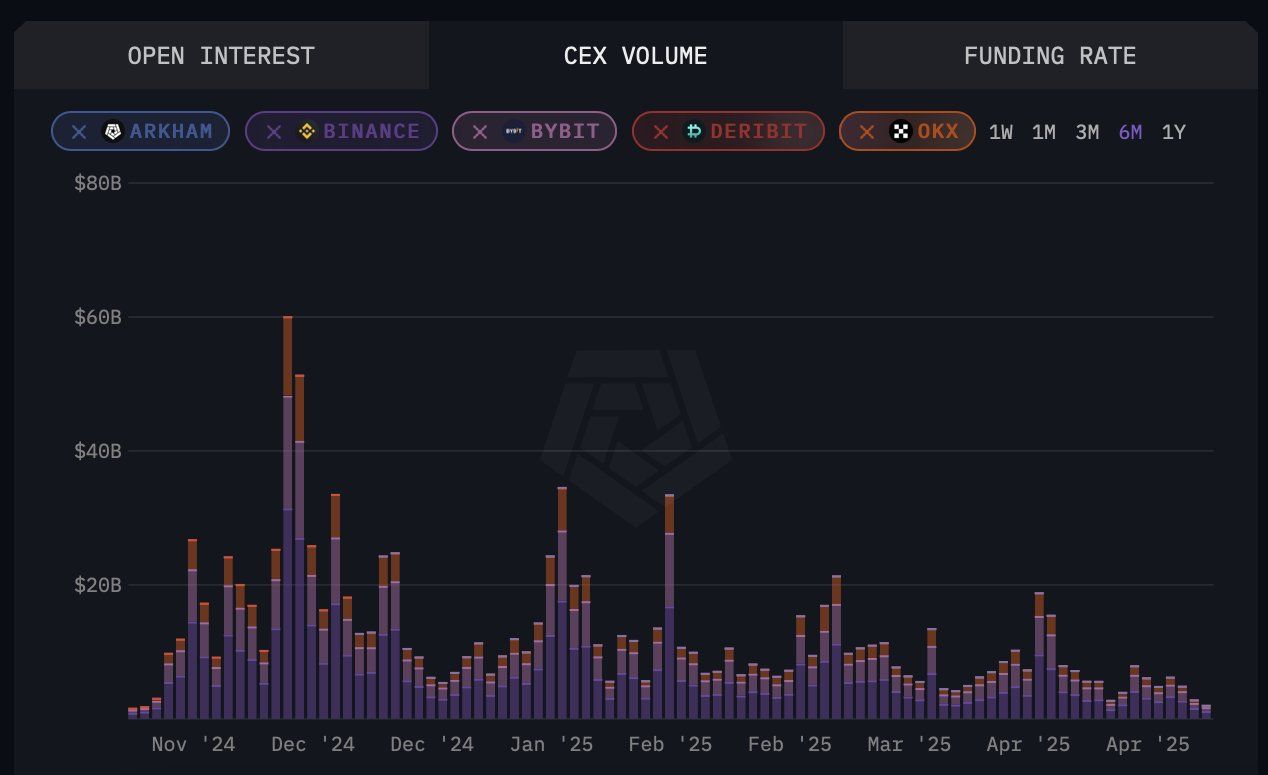

However, one analyst pointed out daily trading volume has plummeted by more than 86% over the past six months.

“$XRP volume collapsed from $60 billion in december to under $8 billion now. Retail got flushed out,” crypto analyst Steph said.

Despite declining intraday volume, the overall market context in 2025, marked by positive regulatory shifts, has helped $XRP maintain its appeal. For example, the SEC officially withdrew its appeal, closing a multi-year lawsuit.

Meanwhile, signs of growing institutional confidence include Franklin Templeton filing for an $XRP ETF in the US, CME launching $XRP futures, and Volatility Shares seeking approval for three $XRP ETFs.

On-Chain $XRP Activity Sees Sharp Decline

In contrast to the active spot market, on-chain activity on XRPL has dropped significantly.

The report shows a 37.06% decline in the number of transactions on XRPL, from 167.7 million in Q4 2024 to 105.5 million in Q1 2025. New wallet creations fell by 40.28%, from 709,545 to 423,727. The amount of $XRP burned as transaction fees also declined by 30.89%.

Meanwhile, decentralized exchange (DEX) volume dropped by 16.94%, from $1 billion to $832 million.

Data from DefiLlama reveals that XRPL’s total value locked (TVL) has remained flat in 2025 at around $80 million. Monthly DEX volume hovered around just $3.3 million, which seems disproportionately low given $XRP’s position as the fourth-largest crypto asset by market cap.

However, the report suggests that Ripple’s acquisition of Hidden Road could help boost XRPL’s on-chain activity.

“Ripple acquired Hidden Road for $1.25B — one of the largest M&A deals in crypto history – driving more institutional use cases for RLUSD and XRPL,” the report stated.

Ripple’s Q1 2025 report paints a two-sided picture: spot trading volume surged, reflecting investor confidence, while the drop in on-chain activity raises questions about XRPL’s practical usage.

beincrypto.com

beincrypto.com