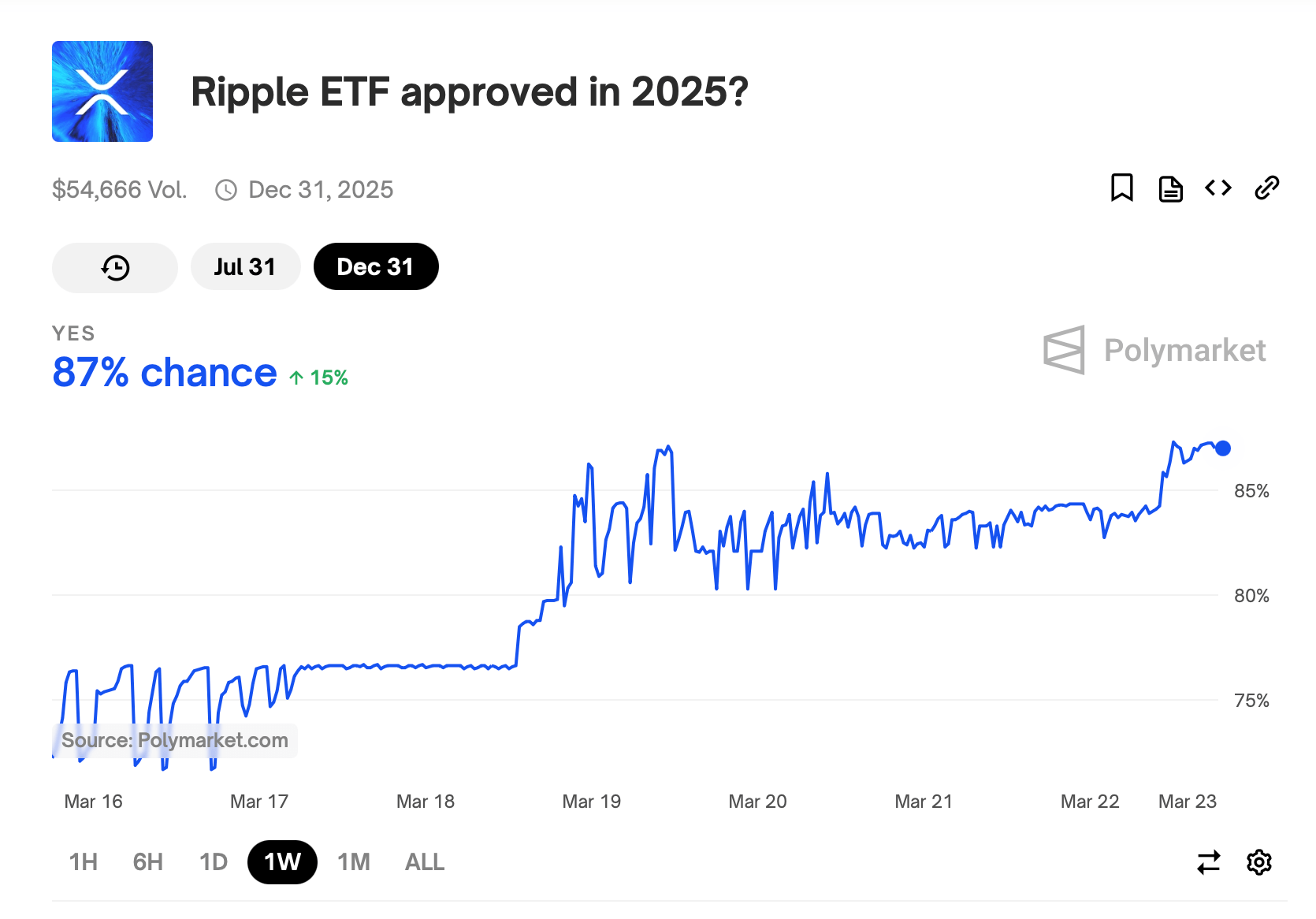

A Polymarket wager amassing $54,666 in trading volume suggests an 87% likelihood that a spot $XRP exchange-traded fund (ETF) will secure regulatory approval by 2025.

$XRP ETF Mania Hits 87% Confidence: Polymarket Traders Bet Big on 2025 Approval

In January 2024, the U.S. Securities and Exchange Commission (SEC) cleared the way for multiple spot bitcoin ( BTC) exchange-traded funds (ETFs), followed by ethereum ( ETH) ETFs in July. These approvals marked pivotal moments for digital asset accessibility, aligning with broader shifts in regulatory scrutiny.

Since Donald Trump assumed the 47th presidency, a wave of alternative crypto asset ETF registrations has flooded the SEC’s pipeline, encompassing $XRP, $LTC, $HBAR, $SOL, $ADA, $MOVE, $APT, $DOT, and $SUI. A Polymarket wager currently reflects an 87% probability that a spot $XRP exchange-traded fund (ETF) will be greenlit by 2025, nearing the bet’s highest confidence level since its inception.

This optimism surged after it was revealed that the SEC was dismissing its lawsuit against Ripple Labs, a decision that sharply elevated market expectations.

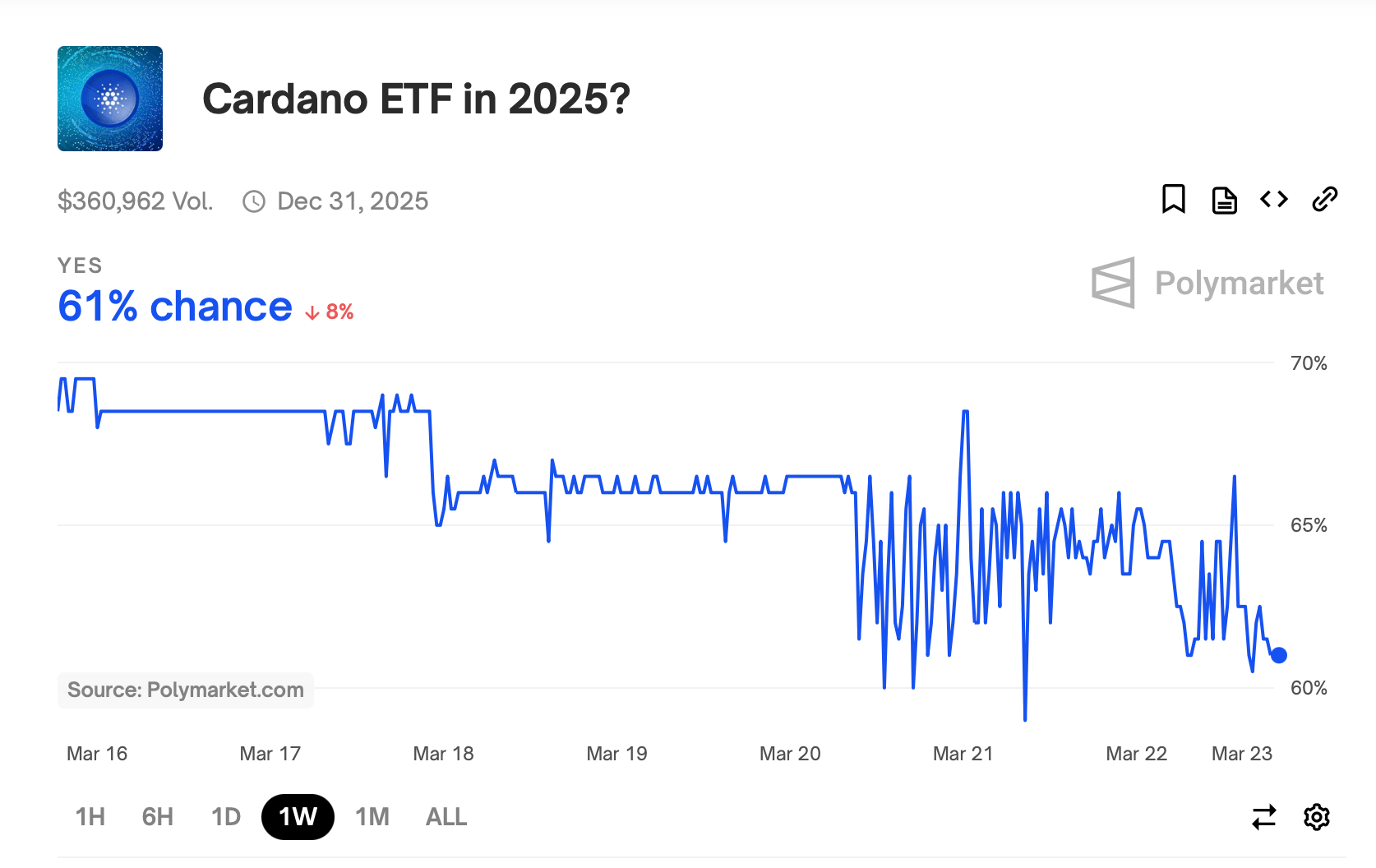

Separately, a Polymarket bet tracking a potential cardano ( $ADA) ETF approval in 2025 shows a 61% likelihood as of March 23. Grayscale submitted an application with the SEC for a spot $ADA ETF.

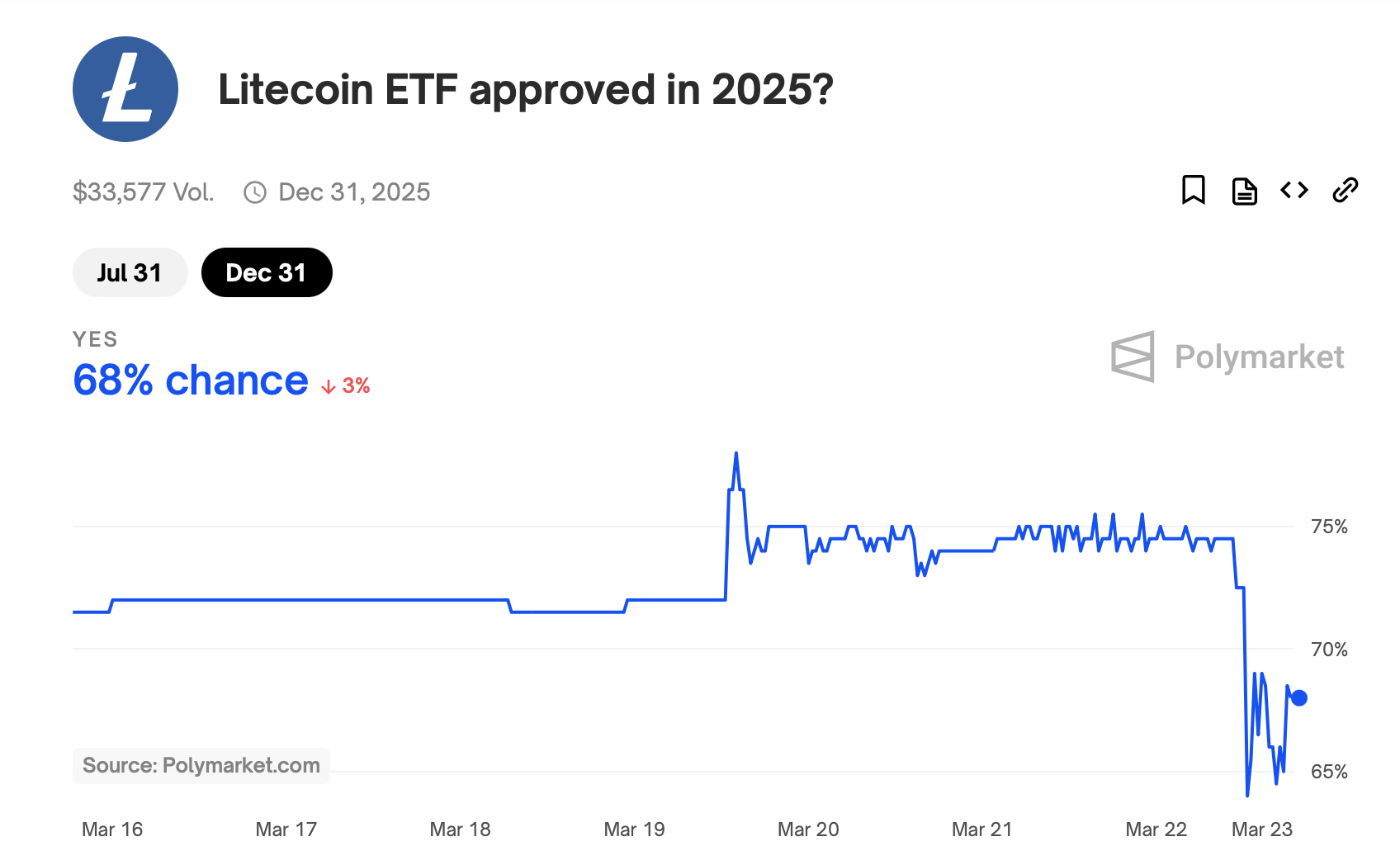

Litecoin ( $LTC) is also on the platform, with a $33,577-traded bet reflecting a 68% probability of an $LTC ETF approval as of March 23. Firms like Coinshares, Canary Capital, and Grayscale are competing to secure regulatory clearance for an $LTC product.

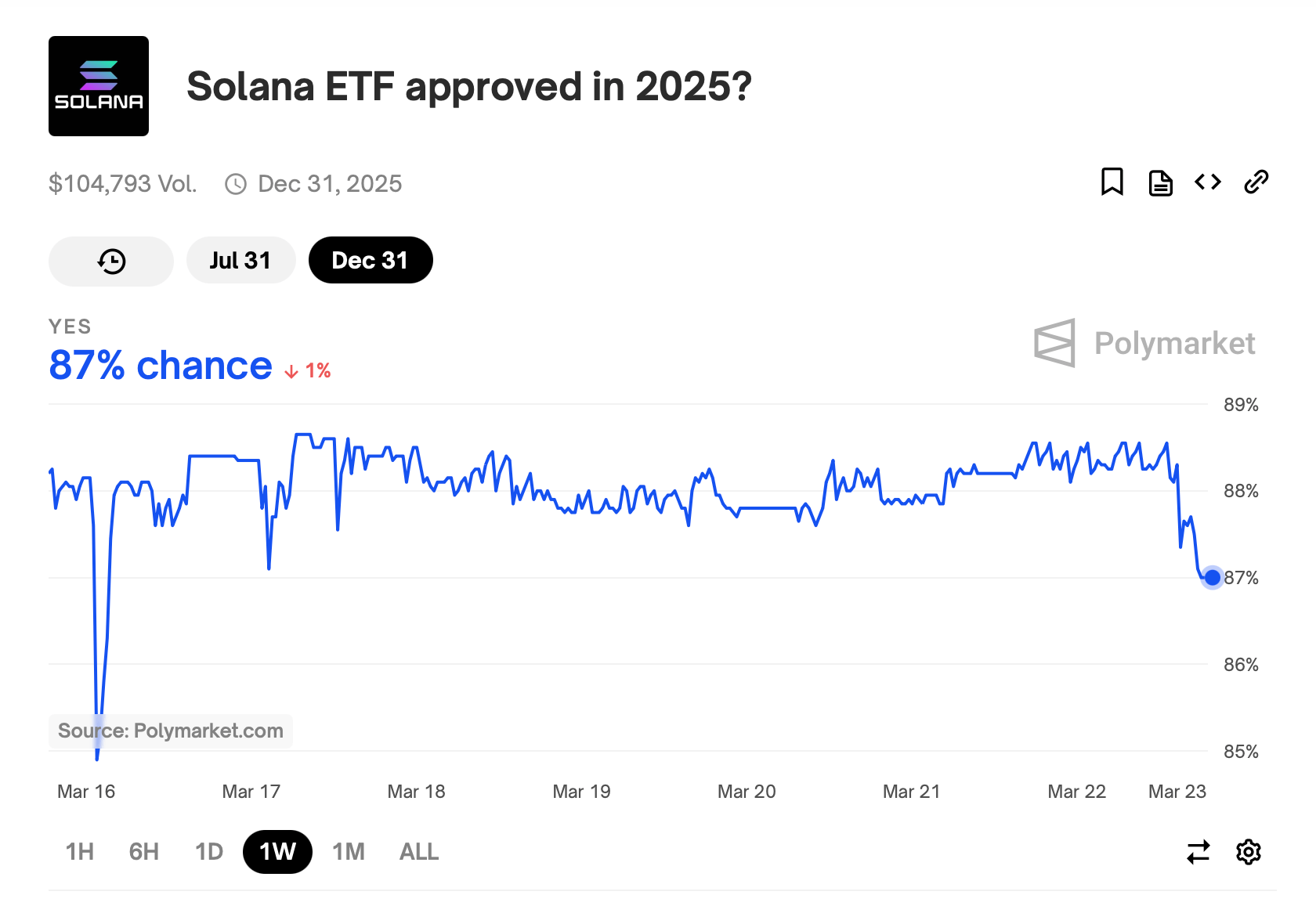

Meanwhile, a solana ( $SOL) ETF proposal, backed by a $104,793-volume Polymarket wager, holds an 87% approval probability according to bettors. A roster of financial firms, including Vaneck, Grayscale, 21shares, Bitwise, Franklin Templeton, and Canary, are seeking to debut a $SOL ETF.

Notably, the prediction marketplace hosts no active bets for $DOT, $HBAR, $MOVE, $APT, or $SUI ETFs. The growing interest in crypto ETFs highlights a pivotal shift toward mainstream adoption, driven by regulatory clarity and institutional backing.

news.bitcoin.com

news.bitcoin.com