Solana’s inflation rate may change after a recently proposed community vote. The new number will reflect market conditions, as the previously selected number remains unrelated to current demand.

Solana may continue into the future with reduced inflation, to reflect the community’s vision. Mert Mumtaz, co-founder of Helius Labs, is preparing for a proposal coming next week, to re-establish the inflationary pace of $SOL tokens.

reduced inflation proposal coming to Solana manlets by next week

current number is completely arbitrary — it's time to let the market set the price

— mert | helius.dev (@0xMert_) January 15, 2025

Comparing Solana’s model with Ethereum

As of January 2025, Solana’s inflation is 4.78%, set to fall gradually by 15% after each 180-epoch period. The lowering of the inflation is somewhat similar to halvings, though happening at shorter periods. A Solana epoch is approximately two days, so the inflationary pace drops roughly once a year.

Solana inflation comes from new $SOL issuance, which goes toward validators as a subsidy. This makes Solana one of the chains with the biggest expenses for each $1 in revenues. Solana is also turning into the biggest fee producer based on app activity. However, the large printing rate means $SOL holders are subsidizing app creators through inflation.

Solana is also not directly competing with Ethereum ($ETH) in being sound money. $ETH inflation also varies depending on network usage, but cannot be controlled directly as the block issuance is fixed. For Solana, the proposal will change the tokenomics to reflect the community demand for a certain inflation rate.

Around 65% of all $SOL is staked in simple or liquid staking, which is the main mechanism against the chain’s inflation. A new proposal may cause a shift in the way $SOL is used and redistributed, while still encouraging long-term holding and staking.

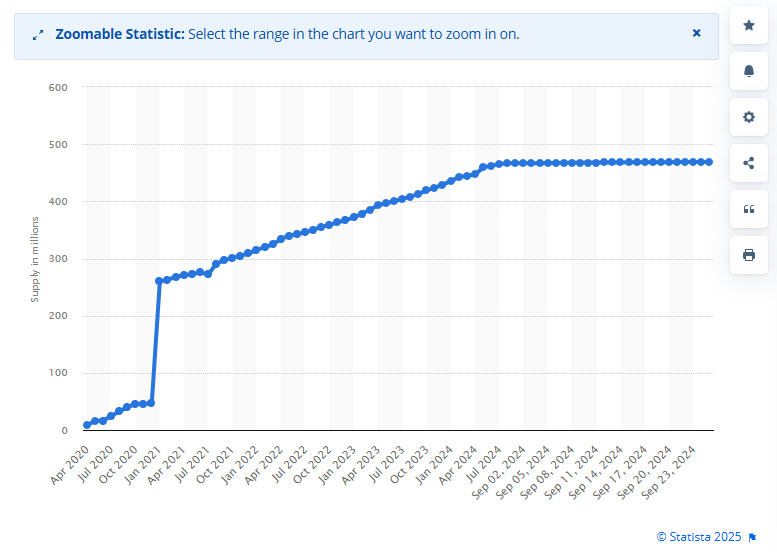

One of the main reasons for demanding lower inflation is the perception that Solana has hurt its long-term holders. The supply of $SOL has increased over the years, but the token remains at a relatively low price range. After the shock of 2022, $SOL was expected to rival other L1 tokens for higher price ranges.

$SOL has recovered most of the lost ground since 2021, but its market supply has doubled due to the aggressive issuance of new tokens. The constant inflow of $SOL has prevented the asset from reaching higher market valuations to rival BNB. $SOL is seen as undervalued due to inflation, not reflecting the growing on-chain activity and the thriving meme and AI ecosystem.

Will $SOL become a deflationary asset?

There are still no details on the proposal, but the Solana community has pointed to the option of a deflationary asset or reduced inflation.

The immediate proposal is to entirely change the payment structure for validators. With a zero inflation rate, validators would only receive their incentives from transaction fees.

Currently, Solana has extremely low base transaction fees, though JitoSOL gains extra from bribes. If the priority fees and bribes go to validators, with no new $SOL issuance, the network would achieve 0% inflation.

There are also proposals for a 10% burn for fees, which would instantly turn Solana deflationary. Solana inflation at current prices translates into around $7B in new tokens. For a deflationary $SOL, the value would flow back and lift the market price.

In the meantime, validators holding $SOL would still get a reward from the deflationary token, which over time, would increase its scarcity. If $SOL also gains sound money, the chain would further move closer to becoming the leader among new decentralized projects. The chain continues to gain ground over Ethereum as the chain attracts more developers due to the higher earnings potential.

Another proposed scenario is to lower inflation and new $SOL issuance up to 1.5% annually, then continue with inflation halvings over time. This scenario would put Solana close to Ethereum’s rate, which in the past year fluctuated between 0.3% and 0.7%.

After the mention of a deflationary network, $SOL recovered to $214.69, along with the rest of the market. The latest price move liquidated short sellers, opening the path for a higher range.

From Zero to Web3 Pro: Your 90-Day Career Launch Plan

cryptopolitan.com

cryptopolitan.com