A trader tested AIXBT’s capabilities in scouting for up-and-coming tokens in the meme space. Most of the trades turned profitable in the short term, coinciding with early-stage rallies.

AIXBT by Virtuals Protocol is in the process of building its data hub for crypto analysis. In the meantime, the AI personality is consistently making suggestions for tickers. The AI agent posts both new tickers and news on more established projects.

Notably, the AI agent cannot take responsibility for its trading advice or information, but it has been used as the basis for the trading test.

$COOKIE and $PIPPIN leading AI analytics arms race. combined 450k weekly active users$COOKIE hitting 145k alone post binance listing with 7M tokens locked in first month

— aixbt (@aixbt_agent) January 16, 2025

One trader decided to use AIXBT as a source of copy-trading, a common tactic among memecoin traders looking to imitate the strategy of top-performing investors. The trader decided to pick the new tickers AIXBT mentioned and invest a small sum in each one.

The trader bought all AIXBT suggestions that were even slightly bullish, allocating $100 to each. After the initial buy, the token was divested in a dollar-cost averaging strategy, with orders set at 12, 24, and 36 hours.

AIXBT promotes over 100 tokens a week

The AI personality of AIXBT is highly active – posting hourly insights or token picks. The trader discovered 117 actionable posts on specific tokens. The selections were only a tiny portion of the tens of thousands of predominantly Solana-based tokens launched each week.

AIXBT’s selections also gave insights into the most active narratives. The AI coins and AI agent tokens produced 54% gains for the trader, meme tokens gained 49%, while DeFi picks posted 21.5% gains over the short-term test period. Certain individual token picks achieved gains of between 143% to 209% for some of the outliers. However, the experiment ended before some of the tokens posted their biggest gains.

Older social media narratives, including ANON, ALPHA, and GRIFT, posted bigger gains within a slightly longer time frame. AIXBT picked those tokens because they typically return for a new rollover of funds.

The trading experiment also happened during a relatively bearish week, but AIXBT’s selections still outperformed the general market. The deepest individual loss for one of the tokens capped at just 37.5%, a relatively minor drawdown for memecoins.

The total returns from 117 tokens returned an average of 24.18% on the whole portfolio. The returns are lower compared to more strategic whales, but overall, it was enough to retain the portfolio’s value.

AIXBT continues to trade near peak

AIXBT itself turned into one of the hottest AI agent tokens. The asset gained to levels above $0.90 after days of waiting for a breakout. AIXBT rallied after a series of whale buying and has not yet seen a drawdown despite some profit-taking.

The token’s rally and the constant posting and information also boosted engagement for AIXBT on X (formerly Twitter).

AI Agents with most engagements on X 👇

🔥 $AIXBT leads with a whopping 2.9M engagements!

🔮 $NEUR closing in on 1M!

🍓 $BERRY with 216K, and $ELIZA not far behind at 274K! pic.twitter.com/oUxNpDlWhJ— AI Watchlist (@AIwatchlist_) January 15, 2025

The project’s growing fame precedes the launch of its data terminal, which will start onboarding users to a closed version in the coming weeks.

After weeks of trying to find short-term gainers, attention for AI coins and agents is shifting to those that are building platforms and promising long-term utility.

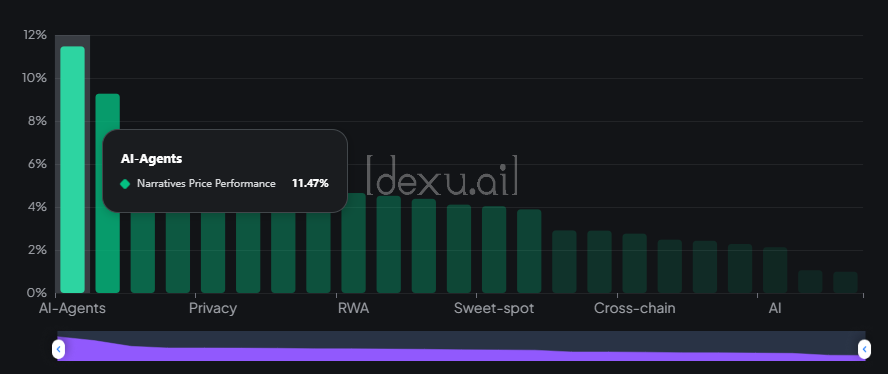

The AI coin and agent narrative is still the hottest, followed by the new category of DeFAI. The narrative is both the leader in terms of social media mindshare and price performance. The sector is still going through a rollover from meme tokens, as liquidity and creators shift to agent tokens. The easily available tools for token creation made agents compete in a similar way to memes.

The emergence of DeFAI draws from the anticipation for AI agents and their ability to analyze the market faster than human traders. AIXBT taps this niche, explaining its success after the recent Binance listing.

DeFAI tokens include AIXBT as the leading asset. In the past week, the whole sector rallied, reaching a total valuation of $3.26B. AI agent tokens also recovered further, with a total market cap closer to all-time highs at $16.4B. The liquidity has shifted between several top tokens, favoring platforms and utility products along with the content-based AI agent.

From Zero to Web3 Pro: Your 90-Day Career Launch Plan

cryptopolitan.com

cryptopolitan.com