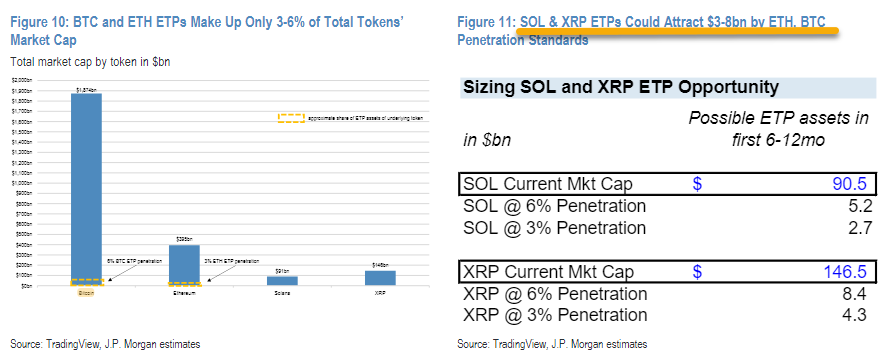

JPMorgan Chase expects that potential Solana (SOL) and XRP exchange-traded funds (ETFs) could see multi-billion dollar inflows.

VanEck’s head of digital asset research Matthew Sigel reports on the social media platform X that JPMorgan says SOL and XRP ETFs could attract up to $16 billion in total.

“SOL & XRP exchange-traded products (ETPs) Could Attract $3-8bn Each: JPM

ETP assets ($108bn) make up 6% of the total Bitcoin market cap ($1,874bn) after the ETPs’ first year of trading; likewise, ether ETP assets ($12bn) have a 3% penetration rate of the total Ethereum market cap ($395bn) within its first 6 months since launch.

When applying these so-called “adoption rates” to SOL and XRP, we see SOL attracting roughly $3-6bn of new net assets and XRP gathering $4-8bn in net new assets.”

Last year, the chief executive of VanEck said that a Solana ETF could only be possible if the Republicans won the US Presidential Election.

And last winter, Ripple CEO Brad Garlinghouse said it “makes sense” for an XRP ETF to eventually be approved.

“I think it makes sense that there will be other ETFs. It’s sort of like the earliest days of the stock market – you don’t really want exposure to one stock, or one company, you want to typically think about diversifying risk and what have you. I think we will see other [crypto] ETFs.

When we will see them is hard to predict. The sad reality of what we saw with the Bitcoin ETF is [it happened] only because the courts forced the SEC’s hand, and really [SEC Chair] Gary Gensler’s hand.”

dailyhodl.com

dailyhodl.com