Toncoin ($TON) has surged significantly in large transaction volume in the last 24 hours, signaling significant whale activity despite a $482 million market sell-off across the crypto sector. On-chain data shows an increase in $TON transactions valued at over $100,000, indicating that large holders are actively accumulating or redistributing their holdings.

The crypto market prolonged its sell-off from Tuesday's session into Thursday, with crypto positions worth $482 million liquidated in the last 24 hours, according to CoinGlass data. The substantial liquidations across various crypto assets reflect the selling pressure that has affected the majority of digital assets.

Bitcoin slipped for the third consecutive day, down 2.26% in the last 24 hours. Most other major tokens slid as well. Dogecoin was down 3.83%, while Cardano (ADA) fell 6.83%.

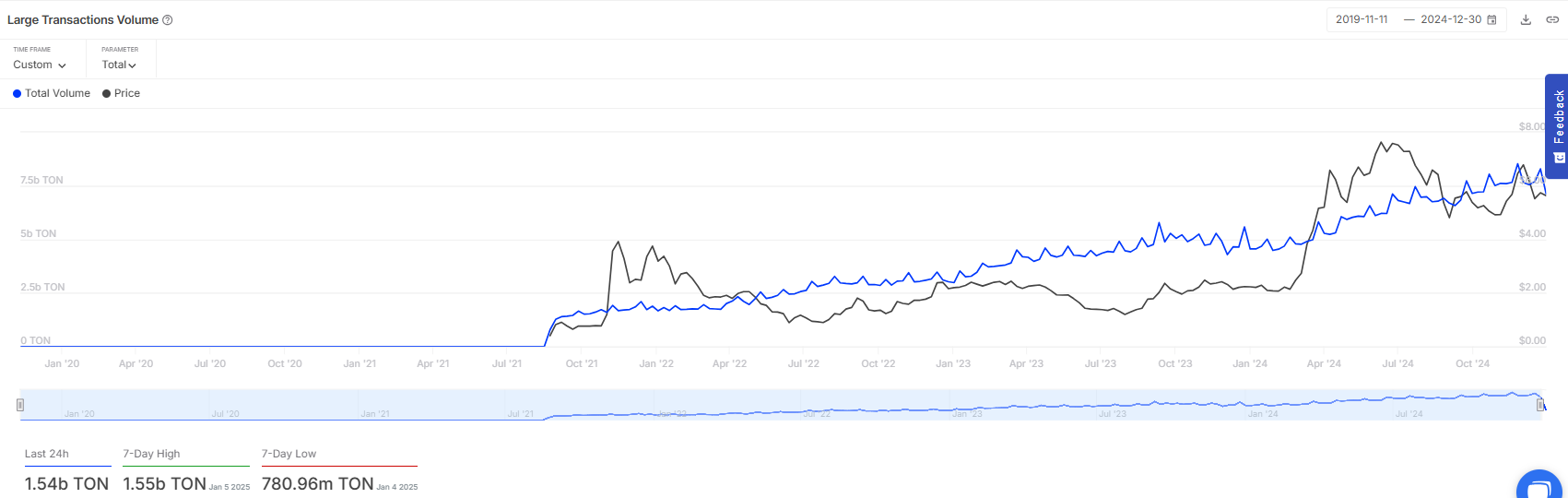

Amid this, Toncoin has reflected a surge in large transaction volumes, which, according to IntoTheBlock data, come in at $8.21 billion, or 1.54 trillion $TON in crypto terms, representing a 94% increase in the 24-hour time frame. An increase in large transaction volume usually depicts a surge in whale activity, either buying or selling.

At the time of writing, $TON was showing initial signs of rebound, up 0.09% in the last 24 hours and down 7.49% in the past week.

Inflation concerns stoke market sell-off

The crypto market extended its sell-off as investors weighed the Federal Reserve's December Meeting minutes released on Wednesday. Fed officials hinted during the meeting that the pace of interest rate cuts might slow this year, raising concerns about inflation.

"Almost all participants judged that upside risks to the inflation outlook had increased," according to the meeting minutes. "As reasons for this judgment, participants cited recent stronger-than-expected readings on inflation and the likely effects of potential changes in trade and immigration policy."

A slew of job data has been released this week, and investors are eagerly awaiting the nonfarm payrolls report on Friday — one of the final critical pieces of data to be revealed before the Fed's meeting at the end of January.

u.today

u.today