The stablecoin market, currently valued at $206 billion according to defillama.com, has experienced notable shifts, including growth in the first six days of 2025.

Nearly $4 Billion Vanishes as Tether and Ethena Decline in Early 2025

Among the top ten stablecoins, tether ($USDT) and ethena usd (USDE) recorded significant outflows, collectively amounting to nearly $4 billion, or precisely $3.98 billion. Tether faced the most substantial decline, losing $3.79 billion from its peak valuation of just over $141 billion. As of Jan. 6, 2025, $USDT’s market capitalization stands at $137.21 billion.

Ethena’s USDE, a yield-bearing stablecoin, similarly peaked on Dec. 19, 2024, the same day as $USDT, with a market cap exceeding $6 billion. It has since decreased by $190 million, leaving the current market valuation of USDE at $5.81 billion. Meanwhile, two other stablecoins, $USD0 and USDX, are climbing the rankings as their supplies expand.

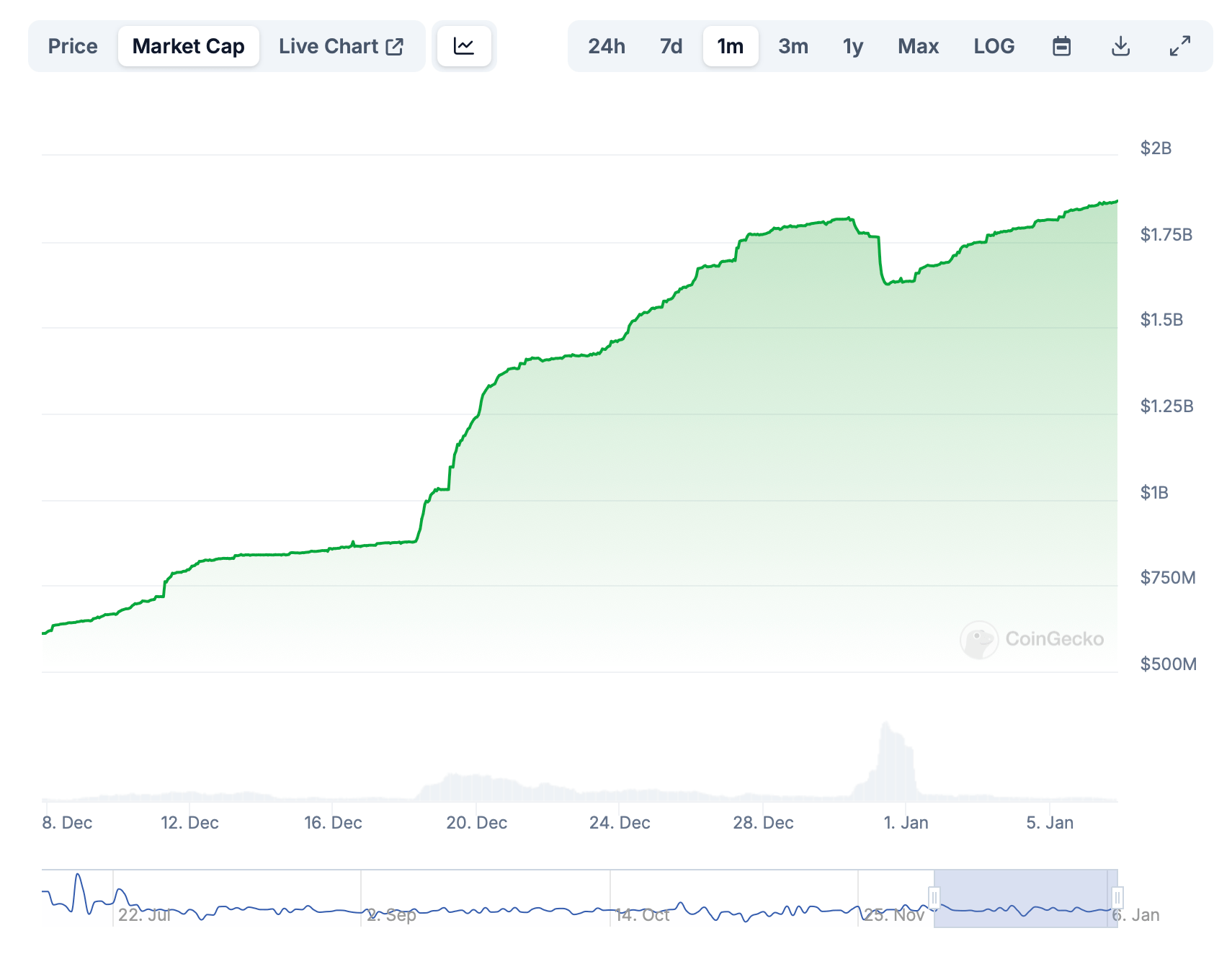

Usual’s $USD0 now ranks as the fifth-largest stablecoin by market capitalization, currently valued at $1.864 billion. On Dec. 31, 2024, $USD0’s market cap stood at $1.62 billion, reflecting an inflow of $244 million. Issued by Usual Money, $USD0 is fully backed 1:1 by real-world assets (RWAs), primarily ultra-short-maturity U.S. Treasury Bills. It is actively traded on decentralized exchange (dex) platforms such as Curve and Uniswap.

Similarly, Usdx Money’s USDX has demonstrated considerable growth. Now the ninth-largest stablecoin, it holds a market valuation of $585.23 million. Just a month ago, USDX’s market cap was $184 million, with $70 million of that growth occurring in 2025. The most active exchanges swapping USDX today include Uniswap and Pancakeswap’s Stableswap app.

The stablecoin sector has seen a reshuffling of rankings over the past year, with players rising and falling. Despite tether shedding $3.79 billion, its dominance still remains unmatched, with a market valuation nearly three times that of its closest competitor, USDC. Nevertheless, the $3.79 billion contraction marked one of the most significant supply reductions for $USDT in over a year within such a condensed timeframe.

news.bitcoin.com

news.bitcoin.com