Cardano ($ADA) is back in the Grayscale Digital Large Cap Fund (GDLC).

Over the past few months, Cardano ($ADA) has experienced a renaissance thanks to technical developments, key partnerships, and a significant price surge.

This renaissance may have now translated to increased institutional adoption per a quiet change in the composition of Grayscale‘s largest multi-asset fund.

Cardano Returns to Grayscale Digital Large Cap Fund

In April 2024, leading crypto asset manager Grayscale had the Cardano ($ADA) community up in arms over its decision to drop the asset from the Grayscale Digital Large Cap Fund (GDLC), its largest multi-asset fund.

At the time, the firm cited a rebalancing in the CoinDesk Large Cap Select Index (DLCS), which the fund tracks. This index measures the market cap-weighted performance of the five most liquid non-stablecoin crypto assets in the top 20 by market capitalization.

Fast forward to January 6, 2024, $ADA is now back in the GDLC per Grayscale’s website, reflecting an increase in $ADA volumes in recent months.

While it is not clear exactly when Grayscale made the change, it is likely to have happened around Q4 2024, aligning with $ADA’s over 300% price surge from $0.3263 to highs of $1.3264. Grayscale’s Q3 rebalancing statement also did not include $ADA in the GDLC.

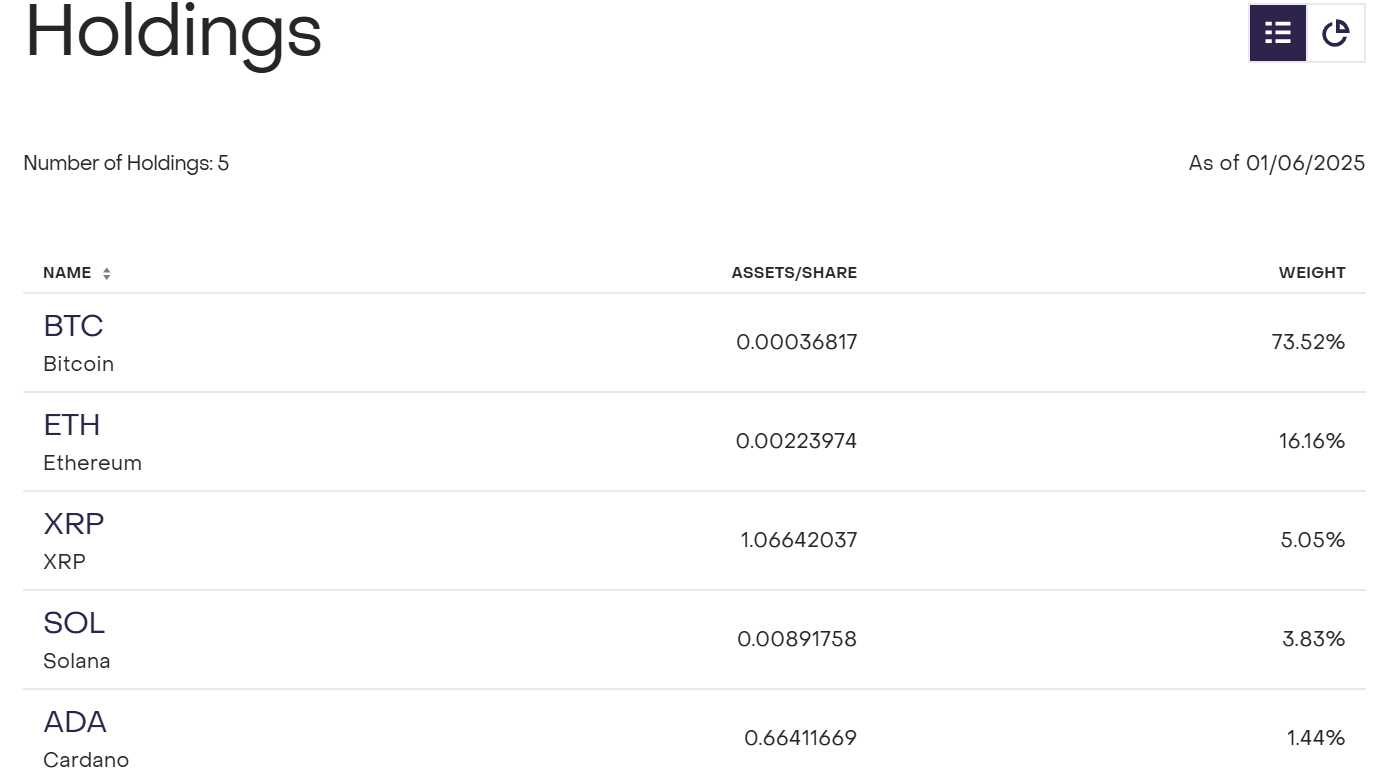

$ADA replaces Avalanche (AVAX) to join Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and XRP in the $811.5 million fund.

Increased Institutional Adoption for Cardano ($ADA)

With $ADA’s return to the GDLC, it looks set to get increased institutional exposure. Representing 1.44% of the market cap-weighted fund’s composition, the fund holds over $11 million worth of $ADA for investors.

This $ADA holding could balloon in the near future if Grayscale receives approval to convert the GDLC into an exchange-traded fund. The firm filed to do so in October 2024.

thecryptobasic.com

thecryptobasic.com