The Grayscale XRP Trust is set to end this year 2024 with a whopping 300% gain due to XRP’s impressive gains in November and December.

As 2024 draws to a close and the Christmas festivities enter full swing, crypto investors have many reasons to be cheerful. This is particularly true for institutional investors in XRP.

Grayscale XRP Trust Investors See Massive Gains

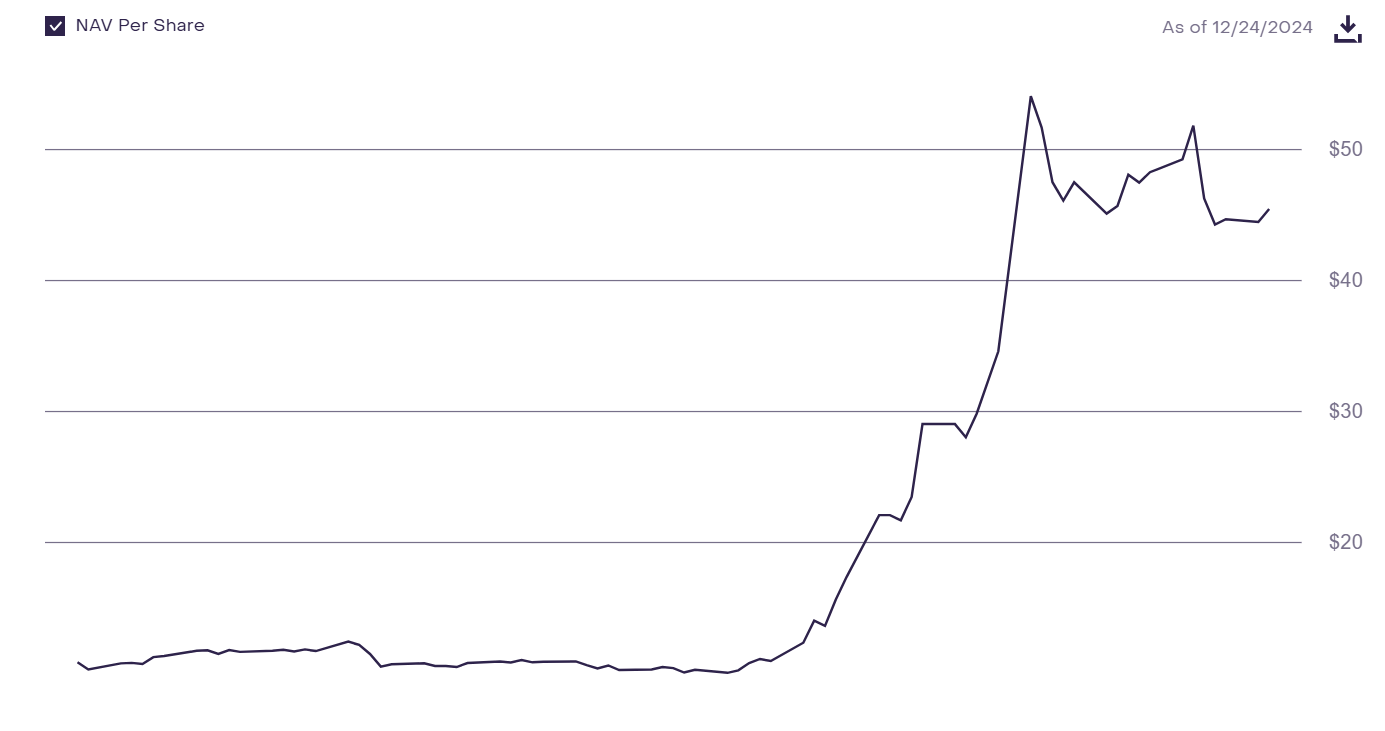

Early investors in Grayscale’s XRP Trust will likely be smiling to the bank this holiday. The product, which re-launched in September 2024, looks set to end the year with a share price gain of over 300% since inception, surging from $10.85 to $45.46 at the time of writing.

Interestingly, most of XRP’s gains that reflected in the XRP trust share price have come within the past month primarily due to Donald Trump’s election victory, which has sparked a wave of pro-crypto sentiment amid promises made to the industry on the campaign trail.

At the same time, many believe that the regulatory cloud that has long shrouded the asset may be dissipating. For context, XRP has been at the center of an SEC lawsuit from 2020 alleging that Ripple, one of the project’s primary developers, broke securities laws through its sale of the asset.

Following a partial court victory in July 2023 and the imminent change of the SEC guard, many are optimistic that the asset will continue to gain more clarity, so much so that it could soon get spot exchange-traded funds (ETFs) to broaden access for institutions, potentially leading to billions in capital inflow.

Spot XRP ETFs Coming Soon?

Recently, controversial crypto influencer Ben “Bitboy” Armstrong suggested that the gains recorded by Grayscale’s XRP Trust could play a role in pushing XRP ETFs over the finish line soon. The view comes as the gains may bolster investor confidence in the asset, adding to the many factors driving the ETF push.

At least four asset managers have already thrown their hats in the ring to launch spot XRP ETFs. These prospective issuers include Canary Capital, 21Shares, Bitwise, and WisdomTree.

With the most recent ETF application coming in November 2024, XRP holders could be looking at an approval timeline that extends to July 2025 in the best-case scenario, as the SEC typically has 240 days to respond.

thecryptobasic.com

thecryptobasic.com