- Chainlink whales withdrew over $44M in $LINK from Binance, signalling possible accumulation trends.

- $LINK forms a bullish double-bottom pattern near $20.12, hinting at a potential price rebound.

- Chainlink secures $35B in total value, maintaining its dominance as the leading blockchain oracle provider.

Recent on-chain data reveals a significant Chainlink ($LINK) token accumulation by whales. According to transaction records, nine newly created wallets collectively withdrew 362,380 $LINK. It valued at approximately $8.19 million, from Binance over the past two days. This activity indicates potential accumulation as these large transfers represent substantial withdrawals from the exchange.

Among the wallets identified, one received 51,500 $LINK tokens in a single transaction, while others recorded transfers of varying amounts, including 35,802 and 27,147 $LINK tokens. These movements suggest a concerted effort by high-net-worth entities to secure Chainlink tokens off-exchange, possibly in anticipation of future market moves.

Whales are accumulating $LINK!

— Lookonchain (@lookonchain) December 22, 2024

We noticed 9 fresh wallets that withdrew 362,380 $LINK($8.19M) from #Binance in the last 48 hours.

Address:

0xdA44049389F87c1170C5e7319c9eb93acDf83304

0xC10396589a40438CcdF48bA1b2061a6067DAa972

0x5199b3Ce02a912056ea8A460371aD83020693F6C… pic.twitter.com/vpAMR0dhbd

Chainlink’s Market Performance and Double-Bottom Formation

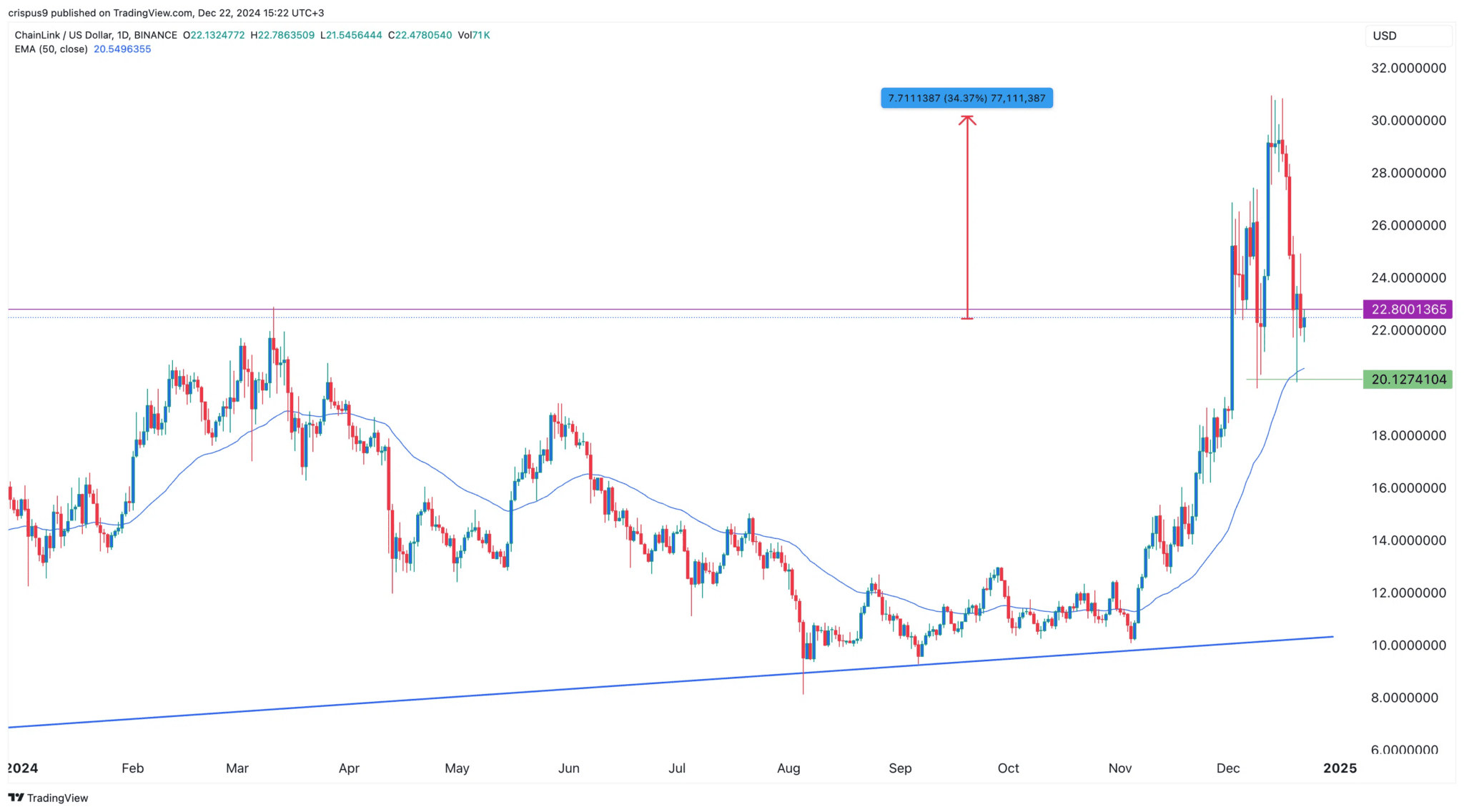

Based on a technical analysis of its price change, Chainlink has oscillated in the recent past and mostly resembles a double-bottom formation at $20.12. This technical formation will likely be a bullish reversal signal followed by a rebound. Currently trading near $22.50, the $LINK token remains approximately 27% below its monthly peak.

CoinMarketCap

Whale accumulation coincides with this price pattern, raising speculation about a possible recovery. If $LINK’s price maintains its current trajectory, investors may target psychological resistance levels near $30, representing a potential 35% gain from its current value.

Expanding Chainlink’s Ecosystem and Institutional Interest

Chainlink remains a dominant player in the blockchain oracle sector, securing over $35 billion in total value across various networks. Its partnerships with prominent institutions like Coinbase, Emirates NBD, and SWIFT further solidify its position as a infrastructure provider for decentralized finance (DeFi) and tokenized real-world assets (RWAs).

Justin Sun’s Tron blockchain recently transitioned from WINKLink to Chainlink’s oracles, highlighting the growing demand for decentralized solutions. This trend and the ongoing whale activity underscores the token’s attractiveness for institutional and retail investors.

With over $35 billion in total value secured across its network, Chainlink remains a leader in the oracle sector, outperforming competitors like Pyth, Chronicle, and Edge. The protocol’s sustained growth and institutional adoption underscore its fundamental strength, supporting bullish sentiment among investors.