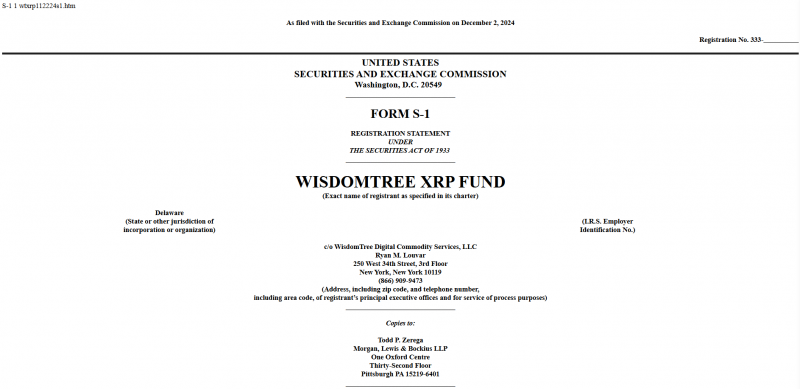

WisdomTree has officially filed a Form S-1 registration statement with the Securities and Exchange Commission for a spot XRP exchange-traded fund, marking its entry into the growing field of asset managers seeking to launch XRP-based investment products.

Bank of New York Mellon will serve as the administrator for the proposed trust, according to the December 2 filing. The planned ETF would track XRP’s price, which currently ranks as the third-largest crypto asset by market value.

With this move, WisdomTree joins a growing group of asset managers seeking to introduce XRP-based funds in the US, including Bitwise and Canary Capital, both of which filed for XRP ETFs earlier this year. The asset manager has not yet specified an exchange venue or ticker symbol for the proposed fund.

The filing follows WisdomTree’s recent establishment of a trust entity in Delaware for the proposed fund. The move comes amid uncertainty over the SEC’s stance on XRP, particularly given Ripple Labs’ ongoing legal disputes with the regulator.

Industry observers suggest that SEC Chair Gary Gensler’s imminent resignation could prompt a reevaluation of the agency’s approach to litigation, potentially creating a more favorable environment for XRP ETFs under future leadership.

This is a developing story.

cryptobriefing.com

cryptobriefing.com