On the first day of every month, Ripple unlocks 1 billion XRP tokens from an escrow system using the XRP Ledger. On December 1 (Sunday), the company will unlock $1.60 billion worth of tokens in three transactions of 200 million, 300 million, and 500 million XRP.

Interestingly, December 2024’s unlock accounts for 1.75% of the current 56.99 billion circulating supply. Moreover, accrues for 2.61% of the remaining 38.23 billion XRP tokens locked in escrows under Ripple’s control.

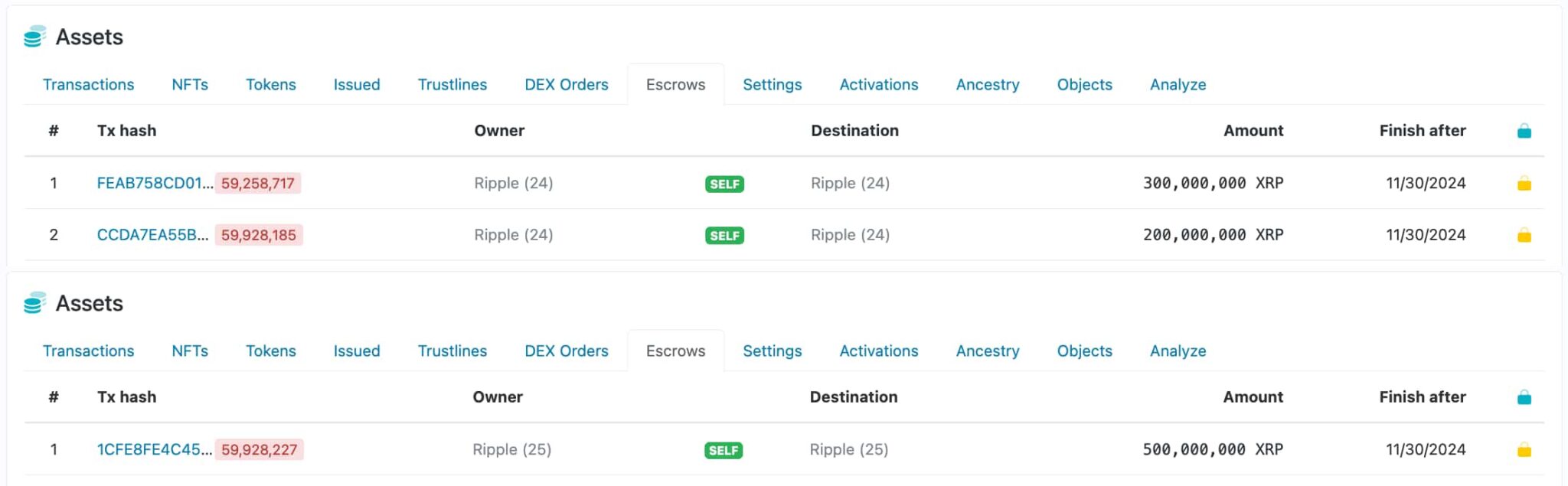

Three escrows will reach finality in the last minutes of November 30, held by two known wallet addresses Ripple owns. In particular, ‘Ripple (24)’ will unlock 200 and 300 million XRP, previously locked in November and December 2020.

Second, ‘Ripple (25)’ will unlock 500 million tokens, previously locked in December 2020. After these unlocks, both accounts will have one more month left, but there are more escrows in other Ripple-controlled addresses.

This is what Ripple did to the 1 billion XRP unlock in November

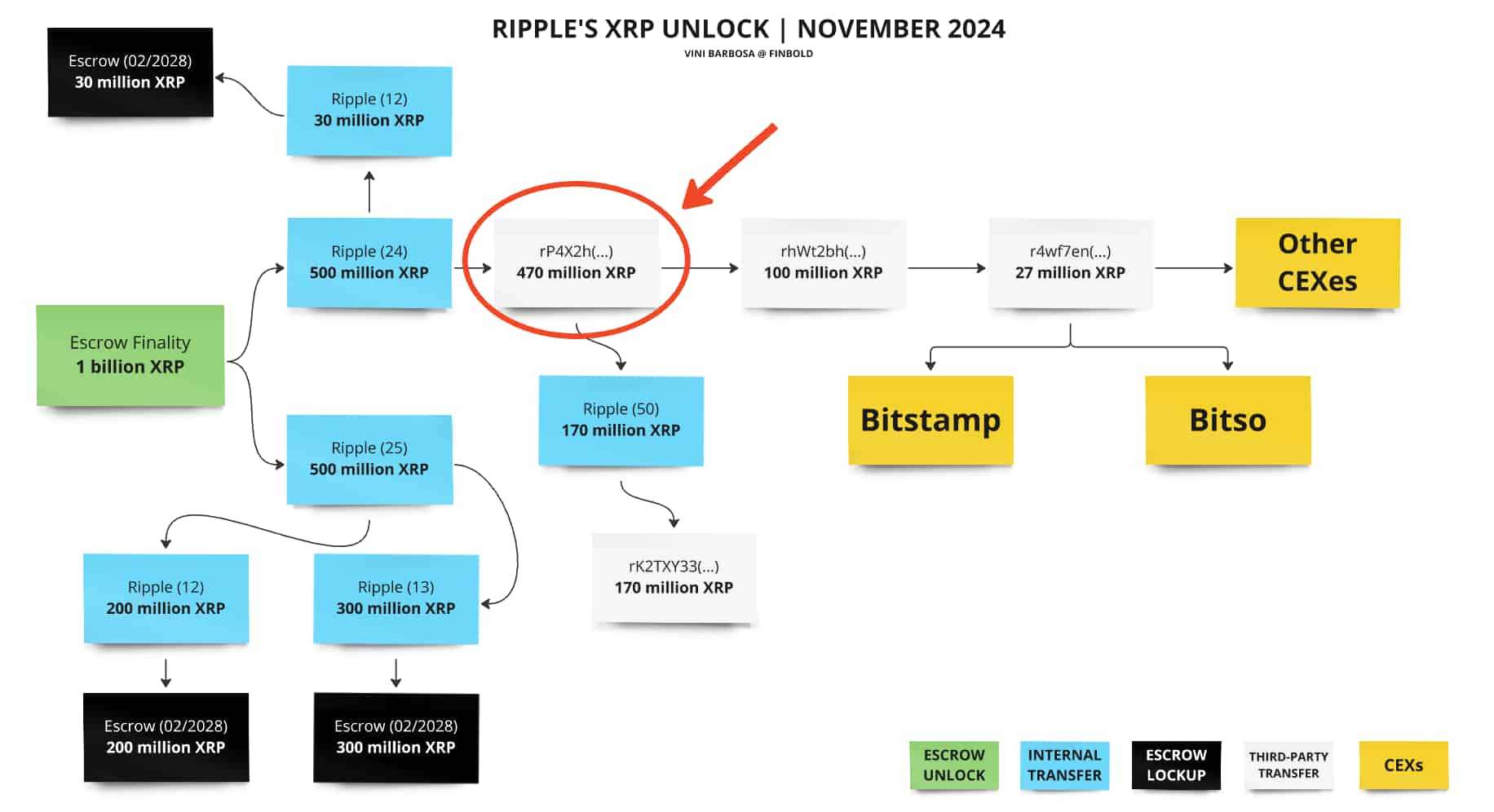

The escrow system unlocked 1 billion XRP on November 1. Later, Ripple re-locked 530 million of the total (53%) in escrows that will end by February 2028 in two accounts.

Notably, this was Ripple’s largest reserved amount in the last seven years, sending 470 million XRP to ‘Ripple (1)’. These reserved tokens were later split and sent to ‘Ripple (50)’ and rP4X2h(…) for Ripple’s sales, as Finbold reported.

XRP price analysis and Ripple sales in 2024

So far in 2024, Ripple has sold 3.046 billion XRP, according to each month’s reserved amounts we have tracked. Last month’s 470 million was indeed the largest monthly movement, which unfolded a counter-intuitive price action, with XRP surging aggressively.

In summary, XRP is up 162% year-to-date (YTD) in a yearly sell-off that surpasses $5 billion at current prices. As of this writing, the token is trading at $1.66 as Ripple prepares for 2024’s last month of sales.

Despite the positive price action, each unlock and reserve at Ripple’s treasury causes XRP supply to inflate, diluting investors’ holdings.

According to Ripple’s Q3 2024 report, the company is using an On-Demand Liquidity (ODL) model, selling at market price to willing customers, which diminishes the economic effects of gigantic potential sell walls with the proportionally high unlocks each month.

Featured image from Shutterstock.

finbold.com

finbold.com