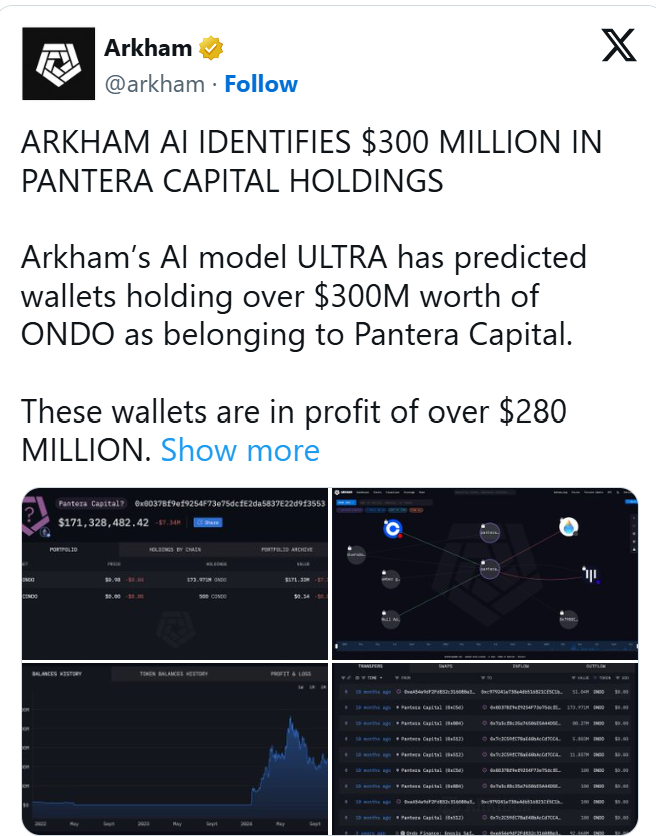

Arkham’s artificial intelligence model, ULTRA, recently unveiled that Pantera Capital controls wallets containing ONDO crypto tokens valued at over $300 Million.

These findings spotlight Pantera’s significant investment in cryptocurrency, revealing a remarkable profit exceeding $280 Million.

The discovery stemmed from ULTRA’s deep data analysis capabilities, designed to accurately associate digital wallets with institutional entities.

Arkham confirmed the AI’s predictions through rigorous verification processes, ensuring the findings’ authenticity.

Arkham’s revelation has prompted further industry discussions around transparency and the tracking of institutional investments in the cryptocurrency sector.

The identification of such substantial holdings illustrates the increasing role of AI technologies in enhancing market understanding and investor confidence.

Institutional Involvement in ONDO Crypto Could Spark a Rally

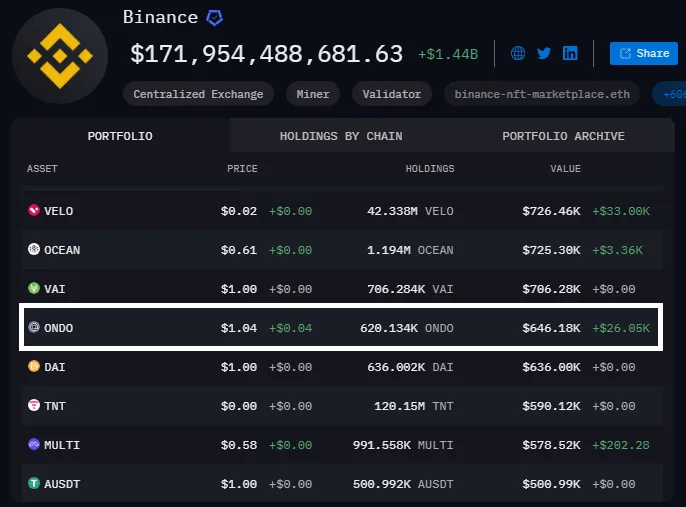

Assessing the long-term outlook for ONDO shows that Binance has been subtly increasing its cryptocurrency holdings.

Over the past six days, Binance’s accumulative strategy saw its total ONDO stash grow to 631,000 from 594,000. Conseuquently the Binance wallet 14 holds an additional 17,147K ONDO.

The approach involves buying small volumes to avoid price manipulation, signaling strong institutional interest.

Simultaneously, market maker Wintermute and the exchange Official_Upbit have also been actively buying ONDO. This likely hints at a broader institutional consensus that the asset is poised for growth.

Further bolstering the outlook for ONDO, 21Shares has unveiled plans to launch four new Exchange-Traded Products (ETPs). These incorporate ONDO alongside other prominent crypto projects like PYTH, RNDR, and NEAR.

These products will debut on exchanges in Amsterdam and Paris. NEAR is being specifically highlighted as a staking product where returns are reinvested to enhance ETP performance.

This surge in institutional activity suggests that the market may see significant movements in the asset’s value soon.

The ONDO crypto price chart also showed a remarkable recovery, bouncing back above the $1 mark. Initially, a sharp decline followed in a triangle pattern from early highs, reflecting bearish sentiment.

However, the price broke out and solidified the $0.6 support as the floor of the correction phase.

This zone acted as a springboard, propelling prices upward as traders capitalized on lower prices to accumulate.

The MACD indicator, remaining in close proximity above and below its signal line. Furthermore, it suggests mixed sentiments with potential shifts in momentum.

The recent price uptick could confirm the bullish uptrend if ONDO maintains its trajectory above the $1 key support level.

Looking forward, the market could see further gains if the upward momentum continues. It is breaking past the descending trendline resistance.

This action would confirm a trend reversal, potentially setting new targets near the previous resistance around $1.4951.

Tokenization in Crypto as AGRI Comes On-chain

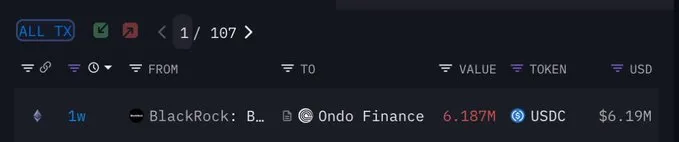

Looking at integration of the real world assets in crypto, Larry Fink, CEO of BlackRock, highlighted the shift towards tokenization of securities. He noted that security tokenization is the next significant step for financial markets.

His comments come as BlackRock funnels millions into Ondo Finance, a decentralized investment platform at the forefront of this movement.

Fink referred to this transformation as “Wall Street 2.0,” predicting a major shift in how assets are handled and traded.

With the continued tokenization, new AgriDex platform with its AGRI token, aimed at revolutionizing the agriculture sector is launching as Michael van de Poppe noted on X.

With a potential market of over $10 Trillion projected for tokenized real-world assets, AGRI is launching on December 4th. It is attracting significant attention for its promise to innovate a $2.7 Trillion industry.

The excitement around this launch points to increasing investor interest in tokenized assets. Undoubtedly, it marks a pivotal development in the blending of traditional and decentralized finance sectors.

thecoinrepublic.com

thecoinrepublic.com