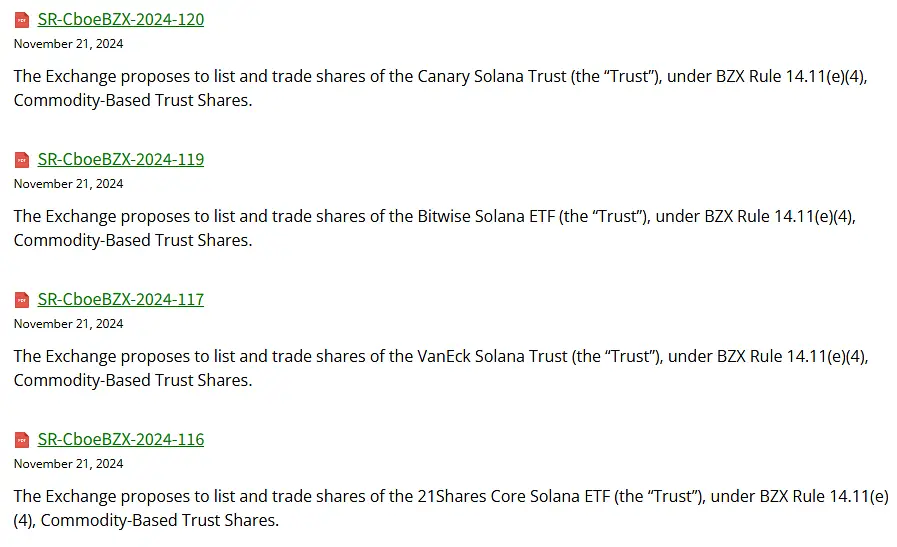

Cboe Exchange has submitted filings to the U.S. Securities and Exchange Commission (SEC) for four Solana(SOL) spot ETFs, with VanEck, 21Shares, Canary Capital, and Bitwise as the issuers.

In total @CBOE just filed for 4 Solana ETFs. One for @vaneck_us, @21Shares, @CanaryFunds and @BitwiseInvest. The ball is in SEC’s court now. pic.twitter.com/ga5B7HaR4M

— James Seyffart (@JSeyff) November 21, 2024

Bloomberg’s Senior ETF Analyst, James Seyffart, stated on social media, “Cboe just filed for 4 Solana spot ETFs with the U.S. SEC, with issuers being VanEck, 21Shares, Canary Capital, and Bitwise.” He added, “If the SEC does not reject these applications, the final deadline is around early August next year.”

Prospects of Solana ETF for investors:

The decision to file for four Solana spot ETFs follows a recent CoinShares survey, which revealed that nearly 20% of fund managers consider Solana to have one of the most compelling growth outlooks in crypto. Eliezer Ndinga, Head of Strategy at 21.co, noted, “Solana is telling a story that smart money is coming this way.”

Solana is the largest staking exchange-traded product at 21.co, with $1.4 billion in assets under management (AUM) available to traders in Europe and Bitcoin ranks second with $946 million AUM. Solana also constitutes 38% of crypto hedge funds’ capital investments. Given Solana’s ecosystem, boosted by the surge in memecoins, a Solana ETF offers significant prospects for traditional investors interested in cryptocurrencies beyond Bitcoin and Ethereum.

Brazil was the first country to list a Solana ETF, and the SOL ETF market soared, gaining over $2.75 million during its first public listing on B3, Brazil’s leading stock exchange.

As for market trends, Solana is currently trading at $262.78 after an 11.04% increase over the past day. The 24-hour trading volume for this popular cryptocurrency has risen by 74.63%, reaching $11.29 billion. With an 11.09% jump, SOL’s market capitalization now stands at $124.85 billion.

cryptonewsz.com

cryptonewsz.com