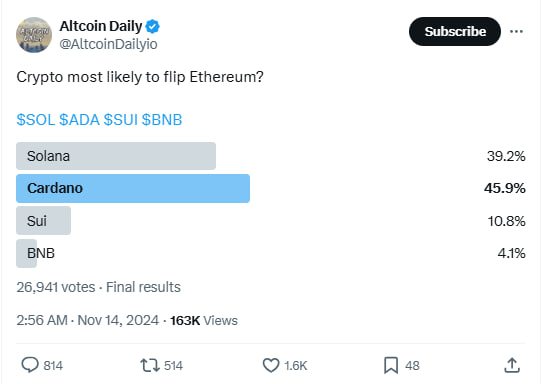

Cardano has emerged as a leading contender in the crypto community’s vote for the blockchain most likely to challenge Ethereum’s dominance. In a recent poll by Altcoin Daily, 45.9% of participants identified Cardano as the top decentralized protocol capable of outpacing Ethereum.

The poll pitted Cardano against three other blockchain protocols: Solana, Sui, and BNB. Solana came second, with 39.2% of the 27,000 voters backing it as the most likely to overtake Ethereum. Meanwhile, Sui, a newer blockchain that has gained traction over the past year, received 10.8% of votes, and BNB lagged with just 4.1%.

Cardano’s popularity in the poll reflects its resurgence, supported by an expanding ecosystem and strong community engagement. Positive developments, such as the Chang Hard Fork, have improved the network’s decentralization by overhauling its governance system. Additionally, Cardano founder Charles Hoskinson recently confirmed efforts to collaborate with Ripple to integrate DeFi components on the XRP Ledger.

Besides Cardano’s internal developments, emerging details about Hoskinson’s expected participation in the incoming administration of Donald Trump enhanced the blockchain project’s prospects in the eyes of crypto community members. There are suggestions that Cardano would partner with the U.S. government to create a blockchain-based voting system for future elections.

These, among other optimistic developments, fuel the positive sentiment behind Cardano and reflect on ADA, the blockchain solution’s native cryptocurrency. ADA has surged 160% since Trump’s election on November 5, flipping the blockchain token’s market momentum into a massively bullish condition. Cardano’s TVL also spiked from $233.26 million on November 5 to $484.7 million at the time of writing, according to data from DeFiLlama.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com