Tokens of decentralized finance (DeFi) protocol Olympus (OHM) dropped as much as 32% in the past 24 hours as crypto traders moved away from experimental DeFi projects amid an overall negative sentiment in the crypto market.

OHM fell from Monday’s peak of $264 to $161 during the early Asian hours on Tuesday, reaching lows previously seen in May 2021. The move was part of a larger downtrend since October 2021 highs of $1,360, when the protocol reached a market capitalization of $4 billion. As of Tuesday, OHM prices are down 87% from all-time highs.

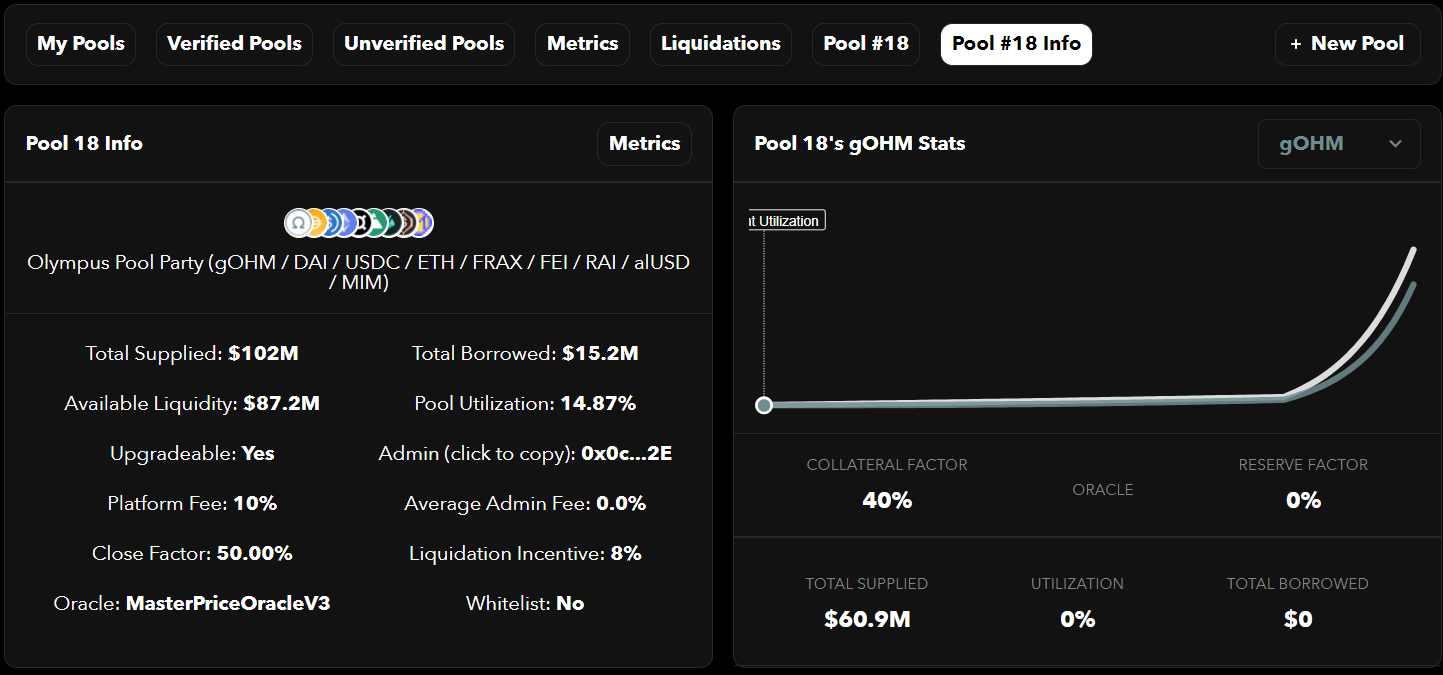

However, such borrowing features come with their drawbacks. Holdings are automatically liquidated when prices of underlying tokens fall below a certain level, as the Fuse protocol needs to maintain the collateral’s monetary position.

Sell-offs in the open market lead to falling prices, which in turn lead to further sell-offs by token holders who may want to take profits on their positions. This creates a cascading event that contributes to drastic price drops, one that OHM saw in the past 24 hours.

UPDATE (Jan. 11, 13:22 UTC): Corrects the first line of the eighth paragraph to say “eight other cryptocurrencies” not “right other cryptocurrencies.”

coindesk.com

coindesk.com