Users who haven’t retrieved their assets from Terra’s Shuttle Bridge are out of luck. The platform permanently closed the bridge and burned all remaining tokens. This marks the end of Shuttle Bridge and signals Terra’s focus on evolving its infrastructure. This shutdown will impact users who have yet to retrieve assets bridged to Ethereum, BNB Chain, and Harmony.

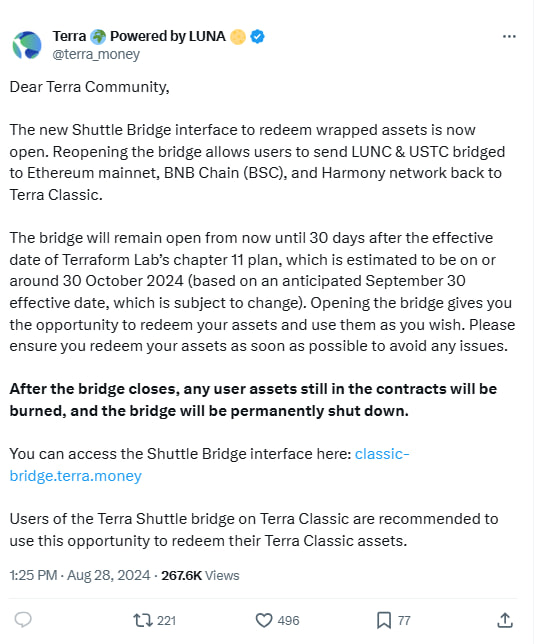

The Terra Shuttle Bridge interface was once a crucial access point for transferring LUNC and USTC assets across Ethereum, BNB Chain, and Harmony. The announcement indicates that it has now reached its final phase. On August 28th, the Terra platform reopened the bridge for a limited time, allowing users one last chance to reclaim their wrapped assets and return them to Terra Classic.

Terra urged users to redeem their tokens promptly and set a clear deadline tied to Terraform Labs’ Chapter 11 plan, which projected a closure around October 30, 2024. This reopening aimed to facilitate a smooth asset transition, ensuring no funds remained stranded in bridge contracts after closure.

With the Shuttle Bridge now permanently disabled, the platform irreversibly burned any tokens that remained unredeemed in the Shuttle Bridge wallets.

Terra Classic (LUNC) Breaks Out and Shows Bullish Signs

Meanwhile, Terra Classic (LUNC) broke out of a descending triangle pattern, signaling a potential for significant bullish movement. The altcoin is on the brink of a significant price surge, with analysts predicting a target price of $0.000593.

This represents a staggering +570% increase from current levels. Investors should closely monitor LUNC for imminent upward momentum.

Ultimately, this final action by Terra underscores its commitment to streamlining operations and responsibly managing user assets. The burn effectively safeguards Terra’s ecosystem from potential residual issues related to idle tokens. For users, this signifies an essential shift in Terra’s roadmap and potentially redirects focus to other developments within Terra Classic and beyond.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com