Stablecoins are an important part of the cryptocurrency economy and the decentralized finance (DeFi) ecosystem, currently dominated by two corporations. One of them, Circle’s $USDC, raised its redemption fees for the second time in 2024, driving demand for stablecoin alternatives.

As Bloomberg originally reported and Unchained covered further, Circle increased the “standard” redemption fees for $USDC on October 29. The “standard” redemption tier applies for holders who want to skip the usual two-day waiting period for “basic” redemptions, getting their dollar amount instantly but for a higher fee price.

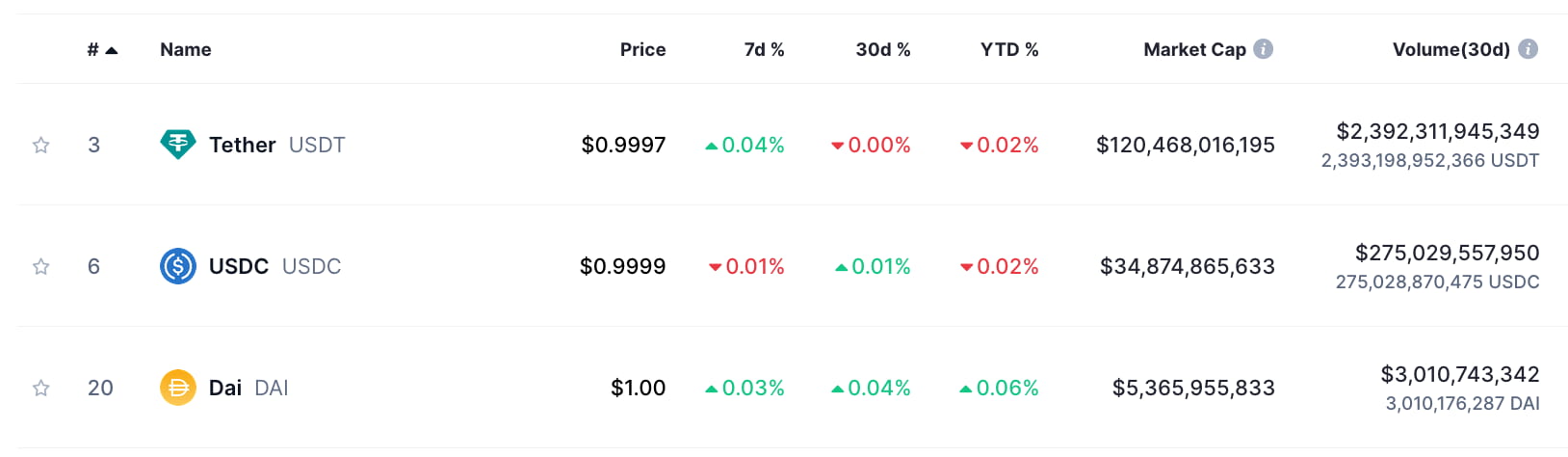

Analysts discussed this fee raise may slow down demand for $USDC from institutions and millionaires for trading, investments, and reserves. Interestingly, the decision came amid a loss of market share to Tether’s $USDT, which surpassed a $120 billion capitalization with over 70% dominance, as Finbold reported.

“In February, $USDC accounted for 31% of the stablecoin market, while $USDT represented 52%, but $USDC’s market share has since dropped to 20% as $USDT’s has grown to 70%.”

– Unchained

2 alternative stablecoins to consider for the next year

Given $USDC’s importance in challenging $USDT’s dominance and bringing balance to a highly dominated market, alternative stablecoins may see an increase in demand in 2025.

The alternatives can vary from similarly centralized solutions like PayPal’s $PYUSD or decentralized experiments like Ethena’s $USDe, which uses a totally new system based on a drafted model by the known crypto executive Arthur Hayes.

Nevertheless, users, traders, and investors must understand these alternatives are still mostly experimental, bringing considerable risks.

Maker’s $DAI: Leading decentralized stablecoin

First, Maker’s (MKR) $DAI is the third largest stablecoin by market cap, with over $5.36 billion minted. It has 15% of $USDC’s $34.87 billion capitalization and 4.5% of $USDT’s $120.47 billion market value.

$DAI is an overcollateralized stablecoin, which means that investors must deposit far more nominal value in different cryptocurrencies to Maker’s vaults in order to mint a smaller amount of $DAI in a decentralized manner.

However, recent governance moves from the MakerDAO, in an apparently failed rebranding attempt, raised market concerns and negative price consequences. MKR lost over 50% of its value since the rebranding announcement to Sky with the launch of a new token.

MKR holders offloaded their positions as the token would be rendered useless after the rebranding, now halted, was completed. Finbold reported how a MakerDAO’s investor capitulated for less than $2 million from a position previously worth $3 million.

Hatom’s USH: Promising alternative stablecoin for 2025

Similar to Maker’s $DAI, Hatom (HTM) is in the final stages of launching USH after years of development and tests. Hatom’s USH uses the $DAI’s battle-tested overcollateralized model to keep its peg to the U.S. dollar.

As of this writing, USH is going through public testing on an open testnet running on MultiversX’s ($EGLD) Devnet. The decentralized alternative stablecoin can be minted by the supply of cryptocurrencies like $EGLD, Bittensor (TAO), wBTC, wETH, $USDC, and $USDT, as announced on October 28.

The wait is finally over! We're excited to announce the introduction of both USH and Booster V2 on the Public Devnet for the community to start rigorous stress-testing.

— Hatom Labs (@HatomProtocol) October 28, 2024

We invite you all to explore all the features and put them to the test by accessing any of the links below:… pic.twitter.com/HhsEwb7Cx7

Moreover, Hatom Labs will offer different incentives for investors who provide liquidity and stake the minted USH in other protocols. At Finbold, we previously featured the protocol as a promising platform for yield farming and earning passive income through lending.

The MultiversX blockchain, despite having a proportionally low capitalization, is on the radar of significant market players. Namely, Uphold’s Head of Research Dr. Martin Hiesboeck mentioned MultiversX as a promising Ethereum rival in an article on X. Uphold also featured the chain in a closed webinar for institutional investors on October 15.

Additionally, the founder and CIO of Europe’s oldest crypto fund, Justin Bons, deemed $EGLD the “technological Holy Grail of crypto.”

In this rapidly evolving ecosystem, solutions like Maker’s $DAI and Hatom’s USH appear as decentralized alternatives to stablecoins.

As 2024 comes to an end and 2025 approaches, $USDT, $USDC, $PYUSD, $USDe, and other solutions will compete for users’ and investors’ attention and liquidity – requiring deep research and understanding of the inherent risks and trade-offs of each alternative.

finbold.com

finbold.com