“Uptober” is playing out for Bitcoin (BTC) and altcoins, with indicators suggesting crypto’s bull market is back after seven months. Yet, some cryptocurrencies will perform better than others, bearing significant risks that pose a threat that traders should avoid.

One of the most significant risks for legitimate projects is related to liquidity and potential massive selling pressures. In particular, upcoming token unlocks can suddenly increase a cryptocurrency’s supply, diluting investors’ holdings and potentially flooding the spot markets.

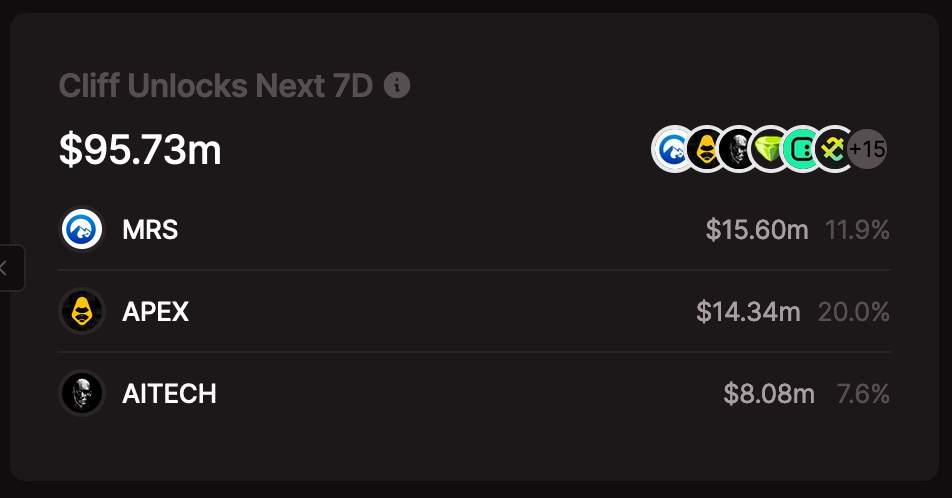

All things considered, Finbold retrieved data from Tokenomist on October 18, warning of three proportionally massive unlocks for small-cap cryptocurrencies. In the next seven days, 21 cryptocurrencies will unlock nearly $100 million of tokens, but three projects stood out.

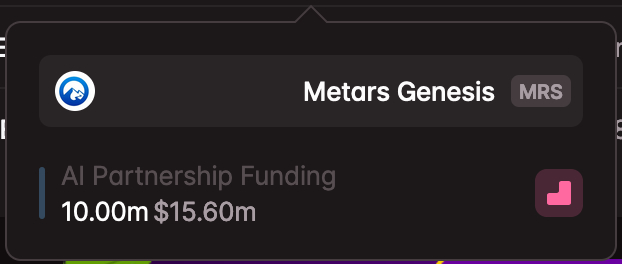

Avoid trading Metars Genesis (MRS) next week

First, Metars Genesis (MRS) will unlock $15.60 million of 10 million MRS next week, destined to AI Partnership Funding.

Metars Genesis is a low-cap cryptocurrency with less than $150 million in capitalization, increasing the relevancy of such an unlock. The 10 million MRS these partnerships could soon sell represents a nearly 12% supply inflation for the token.

ApeX (APEX)

ApeX (APEX) is another cryptocurrency that will face a massive supply dilution next week and should be avoided.

Notably, the protocol will unlock 9.62 million APEX, worth $14.34 million, in the next seven days. This event represents an even higher supply inflation than MRS, adding 20% new tokens to the circulating supply.

On the tokens’ distribution, early investors will receive over one-third of the unlocks, while the team will get the majority.

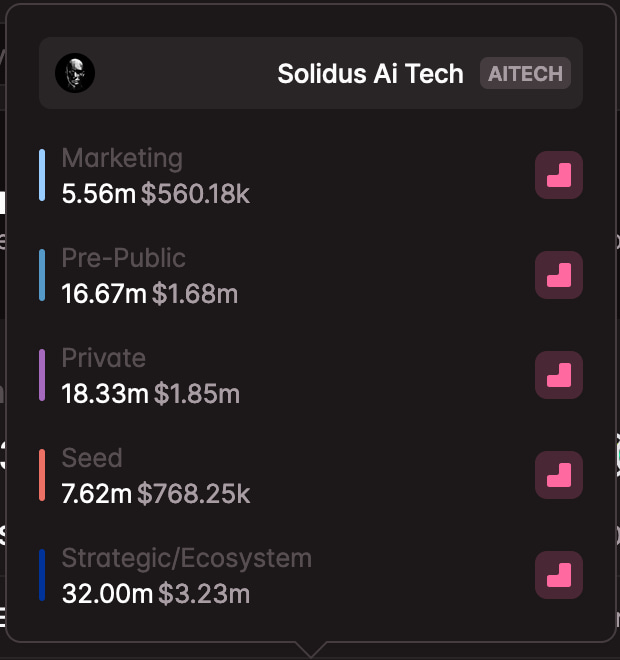

Cryptocurrencies to avoid: Solidus Ai Tech (AITECH)

Finally, the last of the three cryptocurrencies to avoid trading next week is Solidus Ai Tech (AITECH). This project tries to navigate the artificial intelligence (AI) boom dominating all finance markets. For example, Finbold reported how uranium can shine in the commodity market while AI-related stocks are among the most popular investments for 2024.

AITECH will add 7.6% more circulating supply to its ecosystem, unlocking 80.18 million tokens worth $8.08 million.

However, token unlocks and supply inflation do not necessarily mean a poor future price performance. According to basic economics, an asset’s value—translated into price—is determined by the relation between supply and demand.

Yet, avoiding trading cryptocurrencies with potential upcoming selling pressures is a valid risk management strategy, often overlooked in the market. On that note, Finbold consistently reports about token unlocks and other relevant fundamentals.

Moreover, the list above is made primarily of cryptocurrencies with low market capitalization, which often present more risks. Despite that, some low-caps can offer interesting opportunities, like the two promising cryptos for yield farming we listed earlier today.

finbold.com

finbold.com