FractureLabs, a game developer, has filed a lawsuit against Jump Trading, accusing the firm of manipulating the price of the DIO token in late 2021.

Jump Trading, a US-based financial trading company specializing in algorithmic trading, is well-known for its investments in the crypto market.

Jump Trading Allegedly Breached its Market-Making Contract.

According to a Bloomberg report, FractureLabs planned to raise capital through an initial token offering for Decimated (DIO) on the Huobi exchange in 2021. The game developer hired Jump Trading as its market maker.

In its complaint, FractureLabs claims that Jump committed to maintaining DIO’s price within a specific range. However, in practice, the token’s price surged to nearly $1 before steadily dropping to $0.006 over the following year. As a result, FractureLabs accuses Jump Trading of manipulation of DIO’s price for profit through pump-and-dump tactics.

The price chart of DIO shows a continuous decline since the beginning of 2022, with no recovery period.

“Jump then systematically liquidated its DIO holdings, generating millions of dollars in revenue for itself.” the lawsuit states.

FractureLabs also revealed that it had lent Jump Trading 10 million DIO tokens and sent 6 million tokens to the Huobi exchange as part of the agreement. At the time, the 10 million tokens were valued at $9.8 million. However, when Jump Trading returned the tokens, their value had dropped to just $53,000.

In addition to FractureLabs, the US Commodity Futures Trading Commission (CFTC) is also investigating Jump Trading’s involvement in cryptocurrency trading and investment activities.

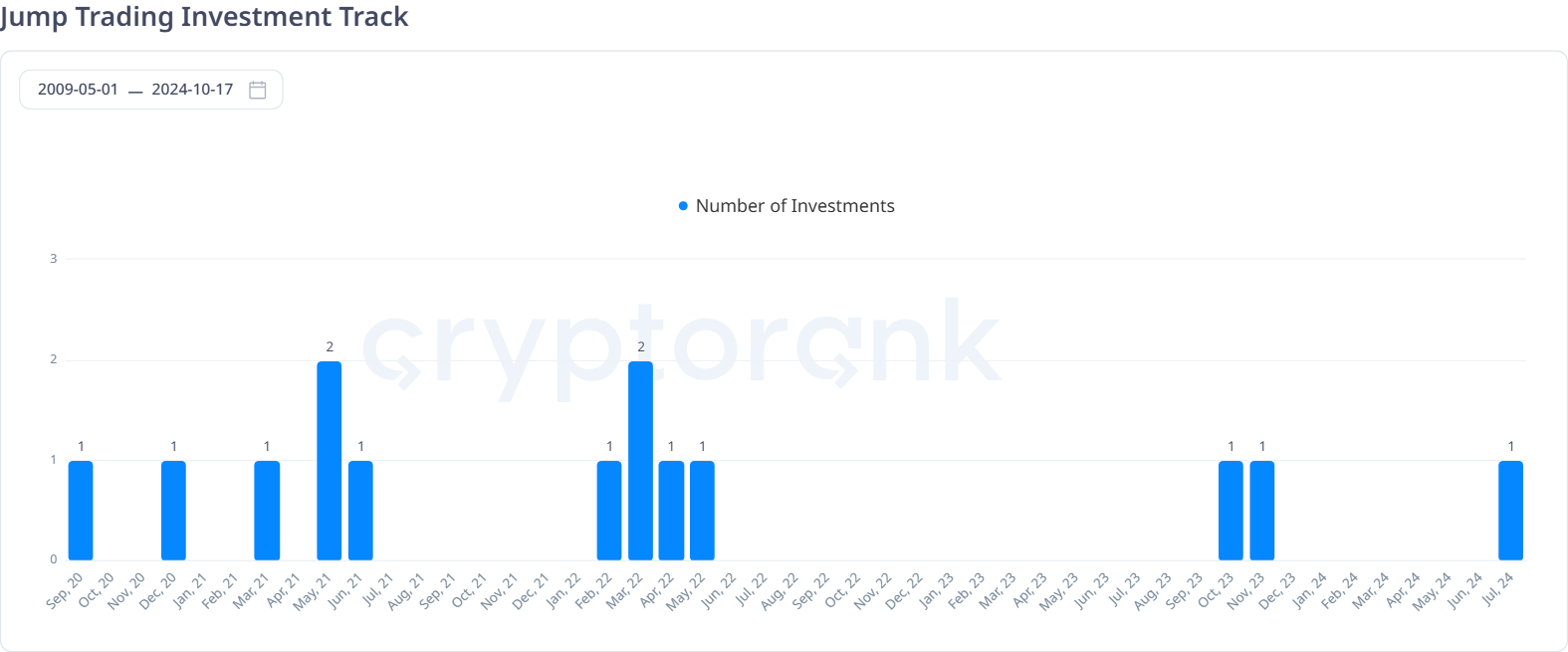

Jump Trading’s subsidiary, Jump Crypto, is focused on investments in the cryptocurrency market. Data from CryptoRank shows that the company’s investment activities have been sparse over the past two years.

Although Jump Trading had early success with investments in projects like Solana and Lido, it has also faced challenges, notably with investments in TerraUSD and Wormhole.

beincrypto.com

beincrypto.com