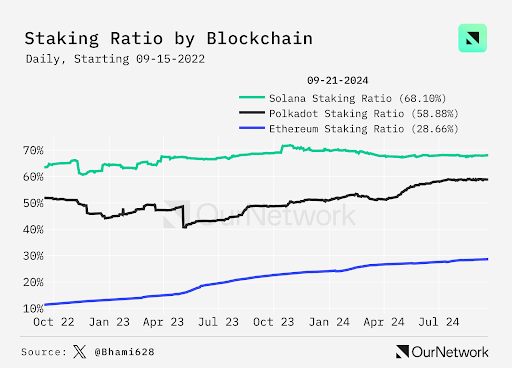

In a notable shift in blockchain staking trends, Solana has overtaken Ethereum in staking ratio, with 68% of its total supply staked as of September 2024. By comparison, only 28% of Ethereum’s supply is staked. This demonstrates a significant difference in user participation across the two leading blockchain networks.

When you stake, you lock up tokens to help secure a blockchain network in exchange for rewards. This staking ratio is an important metric to assess how much of a blockchain’s supply is being used for validation and security.

The data on staking ratios includes both native staking, where tokens are locked directly within the network, and liquid staking, which allows users to stake tokens while maintaining liquidity through derivative tokens.

Solana Has $50B More Locked in Staking Pools Than a Year Ago

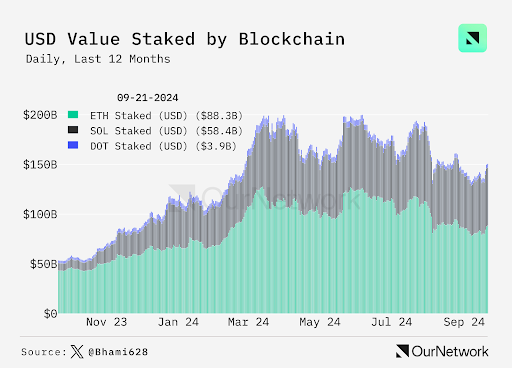

Though Solana has a higher staking ratio, Ethereum remains the largest proof-of-stake (PoS) blockchain by total value staked. As of September, Ethereum had over $88 billion in tokens staked, compared to Solana’s $58 billion.

Meanwhile, Solana’s current staked value reflects a dramatic growth from $7.5 billion in September 2023, which implies fresh capital of over $50 in one year. This sharp increase highlights Solana’s rising network engagement and adoption. But Ethereum’s larger total value staked shows its strength as the leading PoS blockchain by asset value.

Notably, the Polkadot (DOT) network has seen a lot more staked tokens over the past year. Polkadot is just behind Solana in terms of staked ratio, with 58.88% of its supply locked. While Solana and Ethereum have several billion dollars in locked value, Polkadot is far behind with just $3.9 billion.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com