Three cryptocurrencies will unlock nearly $150 million worth of tokens, potentially flooding the market with increased supply pressure. Speculations on the outcome of such massive inflation could bring uncertainty and increase the risks of trading these tokens.

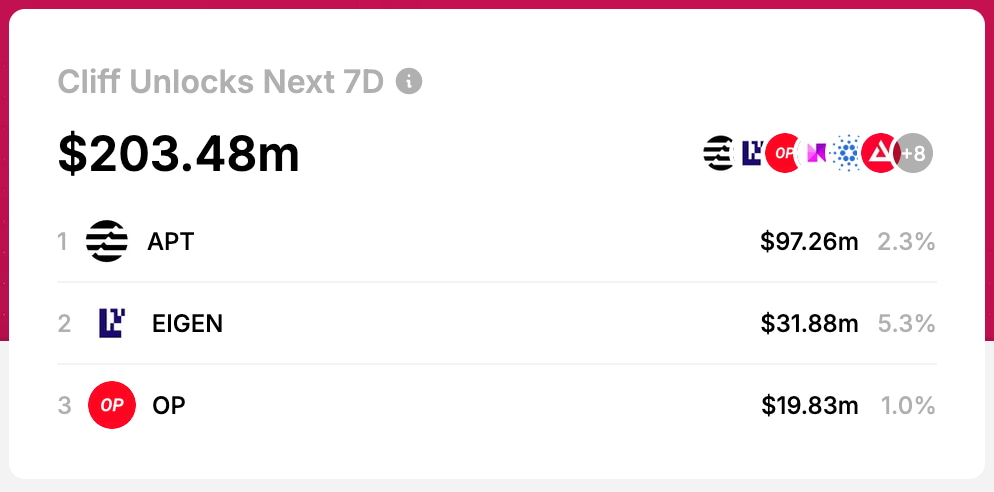

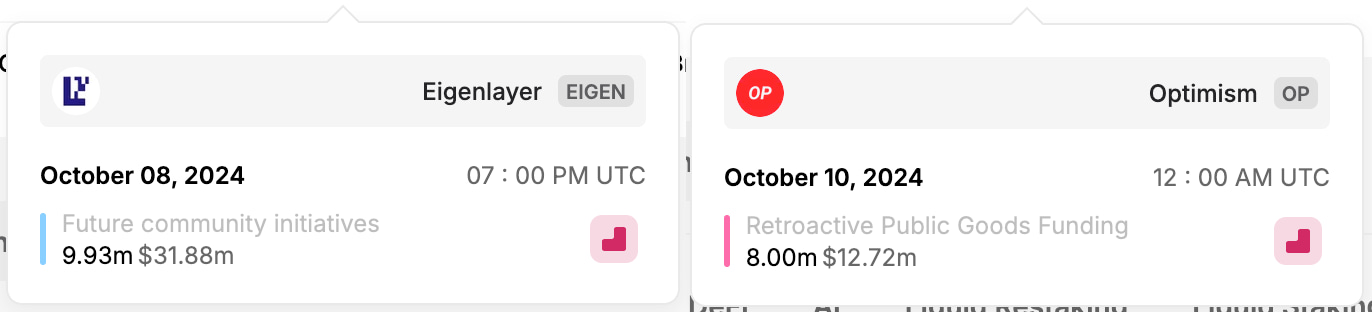

Indeed, on October 6, Finbold accessed data from TokenUnlocksApp, showing that 14 cryptocurrencies will unlock $203.48 million this week. Aptos (APT), Eigen Layer (EIGEN), and Optimism (OP) will be responsible for 72.8% of these unlocks, totaling $148.97 million.

Usually, token unlocks come from vesting contracts that originate from a project’s private funding rounds or public launch. They represent the opportunity for early investors and contributors to realize their profit, with new buyers being the exit liquidity.

Aptos (APT) to unlock nearly $100 million

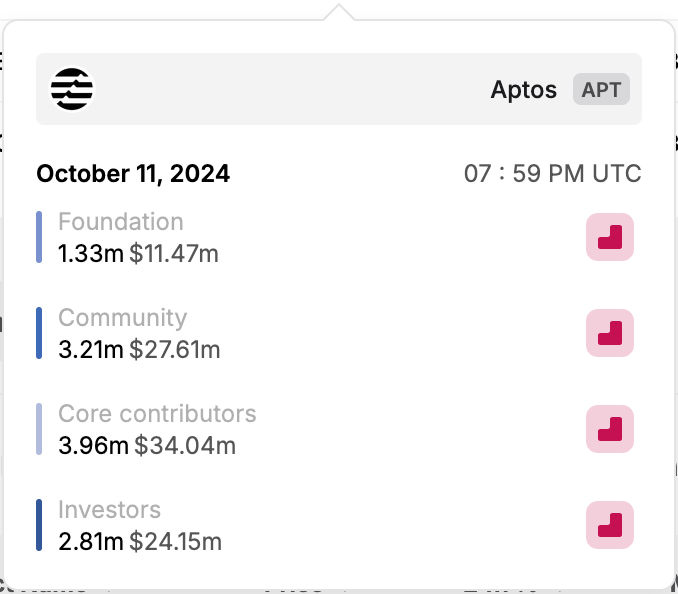

In particular, Aptos dominates this week’s unlocks by a large margin, unlocking $97.26 million worth of tokens. This represents nearly 50% of the over $200 million in assets that will become liquid and soon reach the market.

Precisely, the blockchain protocol created by former Meta (NASDAQ: META) engineers will release 11.31 million APT on October 11. The tokens will be distributed between the Foundation, Community, Core Contributors, and Investors.

This unlock warning comes exactly one week after Apto’s direct competitor, Sui (SUI), unlocked over $100 million in tokens. Finbold reported the event that raised concerns among known market participants who highlighted the exit liquidity dynamics.

Overall, cryptocurrency tokens have been used to fundraise startups and give early investors easy exit liquidity. The Eigen recent airdrop, for example, illustrates what can happen when the community does not keep the momentum going.

Notably, Justin Bons believes the crypto market is “dominated by predatory VCs,” as Finbold reported in June. The founder and CIO of Europe’s oldest cryptocurrency fund explained how it completely changed the game of investing in cryptocurrencies.

“Fundraising in crypto used to be democratized; anyone could participate on equal terms Now, the market is dominated by predatory VCs instead!”

– Justin Bons

So, while the exit liquidity is welcomed by highly capitalized institutional players who can participate in private rounds, retail investors are mostly punished by entering projects with plenty of incoming unlocks as they become the exit liquidity.

finbold.com

finbold.com