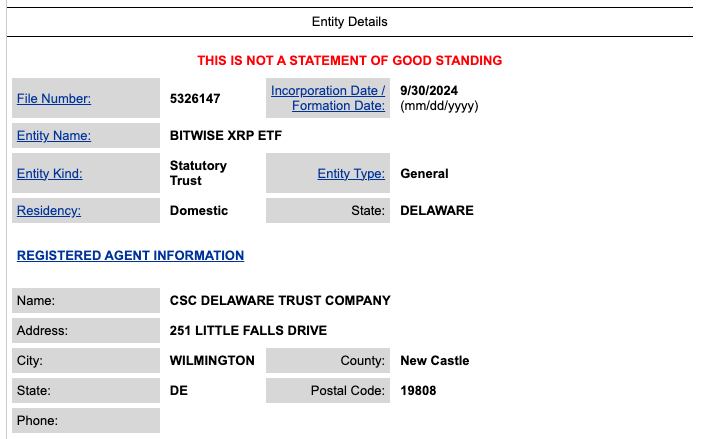

Bitwise Investments has taken its first steps toward a potential XRP exchange-traded fund (ETF), with a filing on 30 September 2024 in Delaware. Listed under the State of Delaware’s Division of Corporations, the filing was confirmed by a Bitwise spokesperson to Cointelegraph. However, this move appears to be part of preliminary preparations, and it could be months before a formal application is submitted to the U.S. Securities and Exchange Commission (SEC), if at all.

According to a report by Ana Paula Pereira for Cointelegraph, this development aligns with previous comments from Ripple CEO Brad Garlinghouse, who predicted in May during an interview at the Consensus 2024 conference that an XRP ETF was only a matter of time, especially after the successful introduction of spot Bitcoin and Ether ETFs in the United States. If approved, an XRP ETF would provide institutional investors with a secure, regulated avenue to invest in the cryptocurrency, potentially increasing trading volume and adoption.

The Cointelegraph report pointed out that although the Delaware filing is a significant early step, it doesn’t indicate an imminent SEC application. According to the report, the process could still be in the preparatory stages, and a formal filing could take months if it happens at all.

This news also stirs memories of the fake filing in November 2023 when an application for a “BlackRock iShares XRP Trust” briefly fueled XRP price gains of 12% before being debunked. Delaware authorities are still investigating that incident.

Meanwhile, Ripple continues to grapple with its legal battle against the SEC. Though the July 2023 ruling deemed XRP not a security in public exchanges, a recent September 2024 appeal has put the final decision on hold, delaying the ultimate outcome of the case.

Featured Image via Pixabay

cryptoglobe.com

cryptoglobe.com