Bitwise filed for the XRP ETF after some recent comments from Ripple CEO Brad Garlinghouse about the inevitability of an XRP ETF. Meanwhile, Ripple received in-principle approval for a license in Dubai, taking the project a step closer to expanding its cross-border payment services in the UAE. Other ETF issuers, including Hashdex and Franklin Templeton, are also moving forward with their crypto index ETFs, while Binance achieved regulatory registration in Argentina.

Bitwise Takes Big Step in Launching XRP ETF

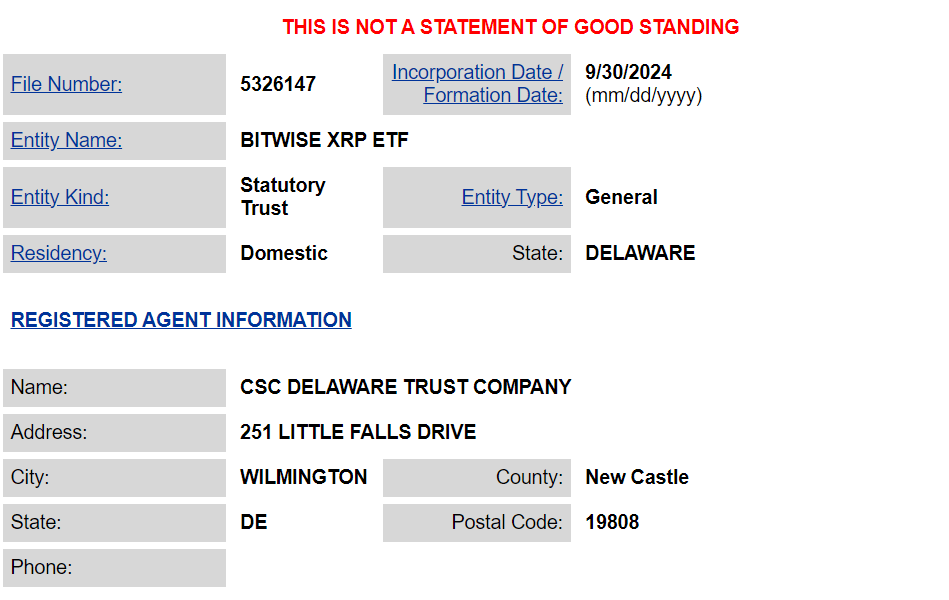

Bitwise has filed for an XRP exchange-traded fund (ETF) in Delaware, according to a listing on the State of Delaware’s Division of Corporations website. The Bitwise XRP ETF was officially incorporated on Sept. 30, 2024. The registered agent for the filing is CSC Delaware Trust Company, which is based in Wilmington, Delaware.

While this incorporation is a big step, it does not necessarily mean that Bitwise will immediately submit a registration application to the US Securities and Exchange Commission (SEC). The move could be part of an early preparation phase, and it could take months before a formal application is filed.

Bitwise’s XRP ETF filing (Source: State of Delaware)

Bitwise’s filing was made after some comments made by Ripple CEO Brad Garlinghouse. He hinted that an XRP ETF is inevitable after the success of Bitcoin (BTC) and Ethereum (ETH) ETFs in the United States.

The approval of an XRP ETF will allow institutional investors to get exposure to the cryptocurrency through a regulated investment vehicle, which could boost both liquidity and adoption of XRP. Over the past few months, rumors about an XRP ETF have circulated widely in the crypto community. In November of 2023, the price of XRP even surged by 12% after a fake filing for a “BlackRock iShares XRP Trust” in Delaware caused speculation about an ETF launch. BlackRock later denied any involvement, and Delaware prosecutors are now investigating the false filing.

This latest filing in Delaware comes after years of legal disputes between the SEC and Ripple Labs. In 2020, the SEC sued Ripple, and accused the company of conducting an unregistered securities offering through the sale of XRP. After almost three years, Judge Analisa Torres ruled in July of 2023 that XRP is not considered a security when sold on public exchanges, which offered Ripple at least a partial victory.

However, the ruling also left the door open for institutional sales of XRP to be treated as securities offerings. In September 2024, both Ripple and the SEC requested a stay on the case’s final judgment.

Ripple Receives Key License Approval to Enter UAE Market

Not only has XRP attracted the attention of the ETF industry, but Ripple also received in-principle license approval from the Dubai Financial Services Authority (DFSA). This allows the company to establish a presence in the United Arab Emirates (UAE).

This approval was announced on Oct. 1, and is a key step forward in obtaining a full license in Dubai, which will allow Ripple to offer cross-border payment services for fiat and digital assets in the Dubai International Financial Center (DIFC), a special economic zone.

In its official statement, Ripple shared that this milestone strengthens its position as a regulated global entity and facilitates the introduction of Ripple Payments Direct (RPD) in the UAE. The company now has to meet specific obligations, like securing office space in the DIFC, before receiving a full license. Ripple plans to become the first blockchain-enabled payment services provider licensed by the DFSA, and also plans to introduce its enterprise-grade digital asset infrastructure in the region.

Ripple CEO Brad Garlinghouse praised the UAE's more forward-thinking regulatory environment, as it provides clear guidance for innovative businesses who are looking to expand. Ripple sees Dubai as a strategic hub to access fast-growing crypto markets in the Middle East, Africa, and South Asia.

Salmaan Jaffery, the chief business development officer of the DIFC Authority, pointed out that Dubai’s strategic location and strong regulatory framework make it an ideal global hub for international businesses.

At the same time, Dubai's Virtual Asset Regulatory Authority (VARA) recently implemented stricter guidelines for companies marketing crypto investments. As of Sept. 26, VARA requires companies promoting digital assets to include a disclaimer in their marketing material. VARA CEO Matthew White stated that providing clear guidance helps virtual asset service providers deliver their services much more responsibly.

Hashdex Amends Filing for Crypto Index ETF

Biwise is not the only company moving forward with its ETF plans. Asset manager Hashdex submitted an amended registration filing for its proposed ETF that is designed to offer a diversified cryptocurrency portfolio. According to an Oct. 1 filing, the SEC is continuing its review after requesting more time in August to decide on the fund’s authorization.

The Hashdex Nasdaq Crypto Index US ETF will initially consist of Bitcoin and Ethereum, the only assets currently included in the Nasdaq Crypto US Index. There is, however, the potential to expand to other digital currencies.

Nasdaq Crypto US Index (Source: Nasdaq)

Some industry analysts believe that crypto index ETFs are the next major focus for issuers after the listing of Bitcoin and Ethereum ETFs earlier in 2024. Katalin Tischhauser, the head of investment research at Sygnum, stated that index ETFs offer efficient exposure to a range of assets, very similar to how investors buy the S&P 500 through ETFs.

In addition to Hashdex, asset manager Franklin Templeton is also awaiting approval for a crypto index ETF, according to a filing in August. The Franklin Crypto Index ETF will track the CF Institutional Digital Asset Index, which also currently includes only Bitcoin and Ethereum. Tischhauser explained that these are the only cryptocurrencies that are authorized by the SEC for inclusion in ETFs so far.

Demand for crypto ETFs is still growing, and total assets in US ETFs surpassed $10 trillion for the first time in September of 2024. Crypto ETFs contributed a lot to this growth, and even accounted for 13 of the 25 largest ETF launches by inflows through the end of August. Nate Geraci, the president of The ETF Store, shared that more than $20 billion has flowed into crypto ETFs in 2024.

Binance Registers as Crypto Service Provider in Argentina

Meanwhile, Binance announced that its mobile and web applications are now fully accessible to users in Argentina after being officially registered as a crypto service provider in the country. The exchange has been incorporated into Argentina’s virtual asset service provider (VASP) registry under the National Securities Commission (CNV).

This is the exchange’s its 20th registration with global regulators, and follows Binance’s recent approvals in Kazakhstan, India, and Indonesia. Its subsidiary Tokocrypto also received a license from Indonesia’s Commodity Futures Trading Regulatory Agency on Sept. 9.

The registration in Argentina allows Binance to offer its complete range of services to users. Guilherme Nazar, Binance’s head of Latin America, stated that Argentina is a key market for the company, and they will continue working closely with authorities to ensure the sustainable and secure development of the crypto industry. Nazar also stated that compliance is central to Binance’s strategy as it plans to contribute to local and global standards for user protection.

Binance’s founder and former CEO, Changpeng Zhao, was also recently released from a US prison after serving four months for violations related to Anti-Money Laundering laws. Zhao was freed on Sept. 27.