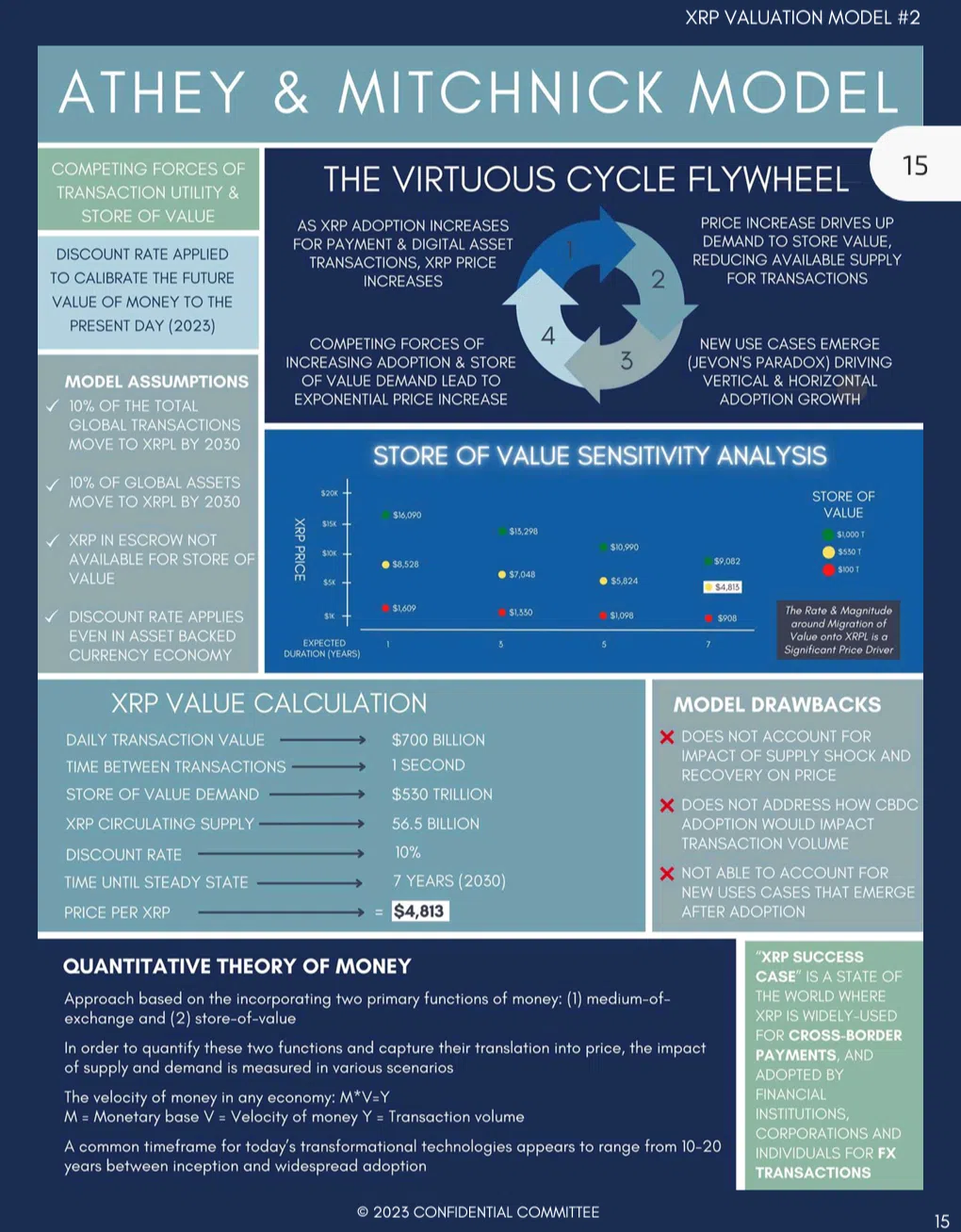

A valuation model by Susan Athey and Robert Mitchnick reveals a potential fair market value for XRP, positioning it at an impressive five-figure price.

XRP, currently trading for $0.5281, has underperformed across multiple market cycles. However, some suggest this underperformance is due to price suppression from several factors, including the just concluded Ripple lawsuit.

As a result, several individuals have introduced multiple models to evaluate XRP’s fair market value if this suppression never occurred. Developed in 2018, the Athey and Mitchnick model is one of the first publicly shared attempts to determine XRP’s true worth. It factors in XRP’s role as a transactional asset and a store of value.

XRP Fair Market Value at $4,813

The Athey-Mitchnick model builds its projections on two major drivers: XRP’s use in cross-border payments and the demand for it as a store of value. The model assumes that by 2030, 10% of global transactions would be processed using the XRP Ledger (XRPL).

Additionally, the 10% target also applies to global assets moving to XRP, contributing to the price surge. The model takes into account XRP’s utility for fast, borderless transactions, along with its ability to be stored, which limits supply in circulation for payments.

According to the valuation technique, XRP’s fair market value sits at a massive $4,813. A key aspect of this projection revolves around XRP’s unique virtuous cycle, where an increase in adoption for payments results in a higher price.

This, in turn, spurs more users to hold the asset for its long-term value, effectively reducing its availability for transactions. This is central to the forecasted exponential price increase, as both demand for transactions and store of value push prices upwards.

Further Considerations and Limitations

In addition, the model also estimates that escrowed XRP would not be available for use in transactions, further limiting supply and adding upward pressure on the price.

To compute this fair market value, Athey and Mitchnick assume that daily transaction volume could reach $700 billion, while demand for storing XRP could amount to $53 trillion by 2030. The circulating supply of XRP is set at 56 billion tokens, with a discount rate of 10% applied to adjust for the future value of money.

Interestingly, they suggest that the model is conservative in that it excludes some potential markets like real estate and derivatives, meaning the fair value could be even higher if those factors were included. Despite this, it discusses the price potential of XRP as adoption scales across various sectors.

However, it’s worth noting that the model does not factor in supply shocks, central bank digital currencies (CBDCs), or new use cases that may emerge post-2030. This presents certain limitations to its accuracy, yet its influence remains substantial in the ongoing debate about XRP’s suppressed price due to past regulatory challenges, including the SEC lawsuit.

thecryptobasic.com

thecryptobasic.com