Meme coin enthusiasts are caught in a battle between two leading platforms: SunPump and Pump.fun. SunPump operates on the Tron blockchain, while Pump.fun runs on Solana, with each platform offering unique models for token generation.

These meme coin launchpads have both emerged as market leaders, inadvertently competing for dominance in the space. Traders are watching closely to see which platform will gain the upper hand as the rivalry continues.

Solana and Tron Meme Coin Launchpads

DWF Ventures conducted an in-depth analysis comparing Tron’s SunPump and Solana’s Pump.fun. The report highlights key differences in their ecosystems, bonding curve mechanisms, token deployment, and revenue generation.

Ecosystems

Pump.fun, operating on the Solana blockchain with a fully diluted valuation (FDV) of $81.4 billion and a total value locked (TVL) of $5 billion, leads in token deployment and revenue. The platform has successfully launched 193,000 tokens, generating $105 million in revenue.

On the other hand, SunPump, despite being newer, is quickly gaining traction on the Tron blockchain, boasting a higher daily active user (DAU) count and total value locked (TVL) of $8.21 billion.

Read more: What Is TRON (TRX) and How Does It Work?

Bonding Curve Mechanism

Both platforms use bonding curve models. This means that as more users buy into the curve and the market capitalization reaches $69,000, $12,000 of the liquidity is deposited into the Raydium Protocol for Solana’s Pump.fun and SunSwap for SunPump.

Raydium Protocol serves as an on-chain order book automated market maker (AMM), driving the growth of decentralized finance (DeFi) on Solana. In contrast, SunSwap Finance, part of the Binance Smart Chain (BSC) network, is focused on yield farming, offering returns to participants based on their investments.

Decentralized Exchange Conversion Rate

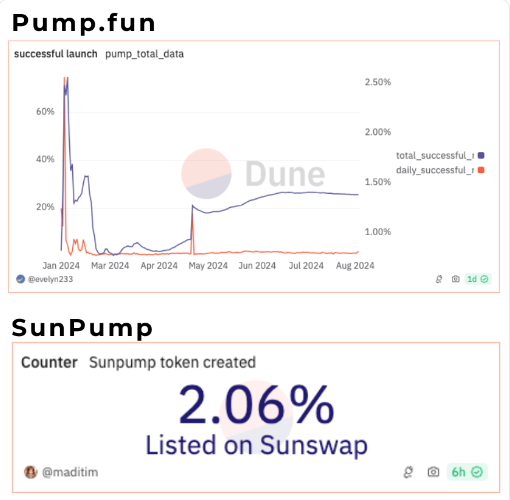

Despite the initial excitement surrounding SunPump and Pump.fun, the decentralized exchange (DEX) conversion rates for both launchpads have remained quite low, with SunPump at 2.1% and Pump.fun at 1.4%.

DWF Ventures’ analysis points out that while these platforms have made it easier for users to launch tokens, successfully building a meme coin community and securing a DEX listing is much more challenging.

Tokens Deployed, Revenue, and Fees

In terms of tokens deployed, Solana’s Pump.fun is leading, having launched nearly eight months ago. The platform has deployed around 1.9 million tokens, generating $105 million in revenue.

Initially, Pump.fun charged creators approximately $2.6 (0.02 SOL) for token creation, similar to SunPump. However, when SunPump launched on the Tron blockchain, Pump.fun eliminated creation fees, shifting the cost to the token’s first buyer.

SunPump, although just a month old, is quickly gaining traction. Justin Sun is focused on expanding market share and increasing profits, envisioning over 20 million daily transactions within three months.

“While touted as a pump.fun competitor, SunPump still falls well short of Pump.fun’s activity. Since launching on August 9, SunPump has facilitated the launch of over 46,000 tokens, 77% less than Pump.fun’s 193,000 launches in the same time frame,” a Solana Floor report explained.

Read More: How to Buy Solana Meme Coins: A Step-By-Step Guide

The meme coin launchpad space is becoming increasingly competitive, with platforms like Jupiter’s LFG entering the fray, boasting over $1.032 billion in total value locked, according to DefiLlama data.

While Solana’s Pump.fun has the advantage of being a first mover, Tron’s SunPump is emerging as a strong competitor, driven by Justin Sun’s bullish outlook. The SunPump hype could boost Tron transactions beyond the 29% growth recorded in Q2.

However, both platforms face risks due to the prevalence of meme coin rug pulls, leading to investor uncertainty. Amidst such concerns, SushiSwap deployed a launchpad to prevent pump and dump challenges.

beincrypto.com

beincrypto.com